Airbnb crashes 13pc as short-stay pioneer books record profit, shoots self in foot

Via Getty

Airbnb Inc (NASDAQ: ABNB) confused full disclosure with over-sharing last night, an easy mistake to make on a first date, but hard to forgive during times of tremendous economic uncertainty.

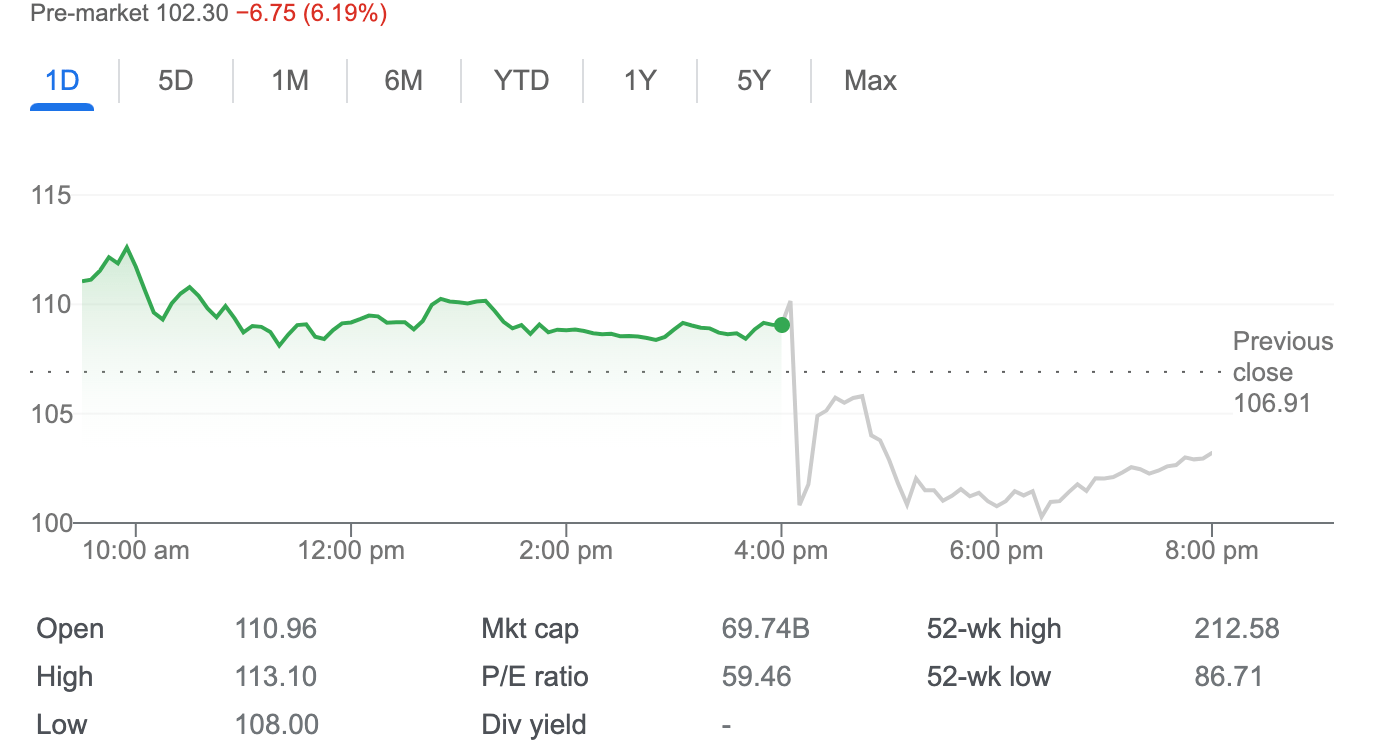

Shares fell more than 6% ahead of the market open, and continued down to shed more than 13% by the close, despite the short-stay juggernaut reporting a record $1.21 billion profit for the third quarter.

In fact a pretty terrific report was soundly muffed up by a warning that bookings could ‘moderate slightly’ heading into the next quarter,.

That throwaway sent up smoke signals which investors took for fire, regardless of the fact Airbnb still offered forward looking guidance that beat analysts’ estimates.

The short-stay trailblazer saw bookings and average daily rates jump nicely, and the company said that demand for short-term rentals remains strong despite the Economy of Damocles hanging over the sector’s various heads.

Still. The handsome-enough profit was less than Wall Street expected, however, and the company did flag – a little ominously, and thusly the market slide – that bookings growth will slow in the fourth quarter, while average daily rates will also be pressured.

A seemingly (always) very chuffed CEO Brian Chesky told an investor call on Tuesday that the company had nearly 100 million ‘Nights and Experiences’ booked, up 25% year over year:

“Gross booking value was US$15.6 billion, this is up 31% year over year; revenue grew 29% year over year to US$2.9 billion, our highest ever; and when you exclude foreign exchange, our revenue increased 36% year over year. Now we also had our most profitable quarter ever. Net income was US$1.2 billion. And this is up US$400 million from a year ago.”

The numbers also represent a luscious 42% net income margin.

“Adjusted EBITDA was US$1.5 billion, also our highest ever. And we generated US$960 million of free cash flow. In fact, over the last 12 months, we generated US$3.3 billion in free cash flow,” Chesky said.

“What our Q3 results demonstrate is that Airbnb continues to drive growth and profitability at scale. And even with the macroeconomic uncertainties, we believe that we’re well-positioned for the road ahead.

“Now why is this?” he said (rhetorically, I guess.)

“Well, new use cases such as long-term stays and non-urban travel are here to stay. And this is because millions of people now have the flexibility that they didn’t have before the pandemic.”

Here to stay

“After two years of lockdowns, demand has surged for travel and Airbnb’s unique business within the industry has helped achieve a record profit, ahead of analysts’ estimates.

“Asia Pacific provided a big boost for Airbnb, where the recovery had lagged that of other areas given extended travel restrictions, with ‘Nights and Experiences Booked’ surging 65%,” Gilbert addded.

Q3 profit, which compared with US$834 million in the same quarter last year, came to about to US$1.22 per share. Analysts expected US$1.47 per share, according to a survey by FactSet.

Revenue surged 29% from a year earlier, to US$2.88 billion, slightly higher than analysts’ forecast of US$2.85 billion.

Gilbert noted that while the platform business is a popular choice for heaps of different traveler markets, as inflation continues to build, many investors are keenly anxious that travel will suffer as first seen during COVID and that Airbnb might falter again.

Airbnb shares have had a tough run, down nearly a full third in 2022, regradless of the recovery in travel, a big money first half, and an occasionally maddeningly upbeat running commentary from Chesky.

On this theme, Gilbert said Airbnb cited bookings will ‘moderate slightly’ heading into Q4, but Airbnb still offered guidance that beat analysts’ estimates.

“Whilst Airbnb looks to be one of the top names in the travel industry, with a strong product offering and a loyal customer base, travel will continue to be put under the microscope by investors.

“Even with the record quarter, this warning from Airbnb will be what the Street focuses on, and we’re likely to see the stock punished, especially given that uncertain macroeconomic backdrop.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.