Airbnb breaks into top 10 US stocks for Australian investors

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

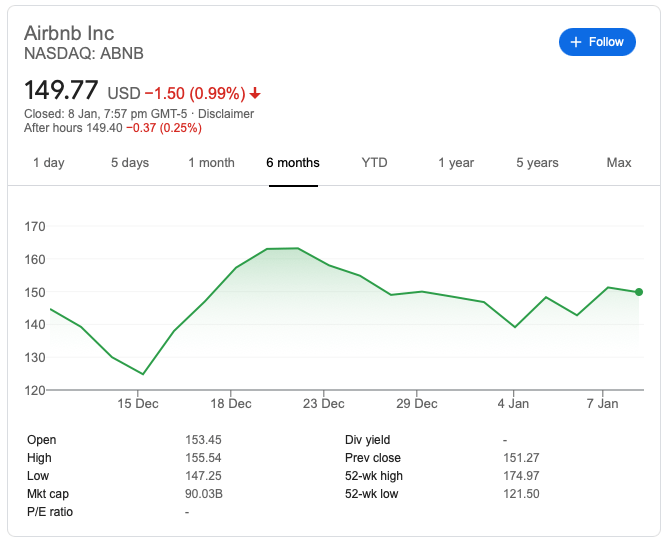

- Airbnb officially arrives into top 10 most sought-after US stocks after December IPO

- ‘Australian investors were keen to buy Airbnb from the outset’

- EV makers Tesla and Nio led the top share buys in December

Australian share buyers flooded into guest accommodation provider platform Airbnb in December as it traded for more than twice its list price on its IPO debut.

Airbnb (NASDAQ:ABNB) became the eighth most traded US stock for Australian investors last month, according to data from investment trading platform eToro.

“The vacation rental marketplace more than doubled its IPO price on the first day of trading on December 10, reaching $US140 from its IPO price of $US68,” said eToro market analyst, Josh Gilbert.

The US company’s IPO was one of the most keenly anticipated last year, and Airbnb has profited at a time when many travel-related businesses have fared poorly.

“As a profitable business and with strong resilience through the pandemic, it is clear to see why so many investors were keen to invest,” said Gilbert.

DNA mapping stock BioNano Genomics leaps into top 10

BioNano Genomics (NASDAQ:BNGO), a company that provides optical mapping of DNA through its proprietary technology, was another top-traded stock for Australian investors.

The penny stock made impressive gains in December, jumping 500 per cent from 50c per share to $US3 per share, and catching the attention of investors worldwide.

“The pharmaceutical company’s listing on the Nasdaq soared after announcing a comprehensive analysis of a single genome of a high-functioning individual with Autism Spectrum symptoms, which would help improve health options from individuals with Autism,” said Gilbert.

However, he went on to stress, its strong gains had raised eyebrows among investors and they needed to exercise caution over its future prospects.

Top-traded US stocks for Australian investors in December: eToro data

| December rank | COMPANY | % CHANGE - MONTHLY | November rank |

|---|---|---|---|

| 1 | Nio | -31 | 1 |

| 2 | Tesla | 17 | 2 |

| 3 | Palantir Technologies | 5 | 3 |

| 4 | Alibaba | -15 | 4 |

| 5 | Apple | 27 | 6 |

| 6 | Moderna | 71 | 10 |

| 7 | Pfizer | -13 | 8 |

| 8 | Airbnb | 0 | 157 |

| 9 | Amazon | -27 | 5 |

| 10 | Bionano Genomics | 0 | 157 |

Tesla and Nio hold on to top spots

Holding on to the top spots in the table of most-traded US stocks in December were electric vehicle companies Tesla (NASDAQ:TSLA) and Nio (NYSE:NIO).

Tesla’s share price has been on another tear this week, climbing 7.8 per cent Friday to a new high of $US880 per share, and a market value of $US834bn.

“Tesla saw an increase in trading activity as it was added into the S&P 500 index,” said Gilbert. Trading in its shares rose 17 per cent month-on-month in December.

China-based EV maker Nio’s share price shed nearly one-quarter of its value from late November to mid-December, its largest pullback in 2020.

“Many investors would have seen this as a great opportunity to buy Nio shares at a more attractive price after continuous monthly gains,” he said.

Jack Ma helmed Alibaba, Apple and COVID-19 pharma companies round out table

Big data processing software company Palantir Technologies (NYSE:PLTR) traded more volume among investors and stayed as the number three US stock.

Co-founded by Pay Pal entrepreneur Peter Thiel, the tech company has contracts with several US government agencies.

Alibaba Group (NYSE:BABA) is led by its founder Jack Ma, possibly the richest man in China, whose lack of public appearances has sparked speculation.

It was fourth placed in terms of popularly-traded US stocks among investors in Australia.

Fifth placed was Apple (NASDAQ:APPL) that had a 27 per cent increase in its stock volume in December, while Amazon (NASDAQ:AMZN) was ninth placed.

Two pharmaceutical companies that are leading the race for COVID-19 vaccines moved higher in the table of top 10 stocks for Australian investors in December.

They are Moderna (NASDAQ:MRNA) and Pfizer (NYSE:PFE), although both of their share prices have softened recently.

Trading volumes for Moderna’s shares soared 71 per cent after the US Food and Drug Administration issued emergency authorisation for Moderna’s COVID-19 vaccine in mid-December.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.