A month on Wall St: Banks crash, stocks March higher

Via Getty

IG Markets’ relentless senior market analyst and intrepid technical fiend, Tony Sycamore drops in for a wrap of all the implausible, yet entirely undeniable nonsense over the last four weeks which Wall Street is calling March, 2023.

The Idles of March

Despite a frantic month where regulators and bank watchers in general were caught dozing, and which saw apocalyptic reports around the demise of three Regional US Banks and a systematically important European bank, all three key US stock indices are on track to lock in gains for March.

With one and a half full trading sessions left to go, the S&P500 is up 1.45% for March and 4.9% for the quarter. The Nasdaq is up 6.68% in March and 17.4% for the quarter, on track for its best quarterly performance since 2020. Even the laggard, the Dow Jones, is back to flat on the month and down just 1.3% for the year.

The astounding performance of the tech-heavy Nasdaq further proves the point we made in last week’s note, “How U.S. stock indices have gained despite banking crisis” here. As interest rate markets flipped from expecting rate hikes to expecting rate cuts, there has been a tailwind supporting tech giants, including Apple, Microsoft, Google, Meta, Amazon and Nvidia.

As the conversation shifts from “which bank goes next?” to “what comes next?” it’s worth keeping in mind investor money has been flowing away from equities into money markets, including $238bn in the past fortnight alone, which could come back into stocks if no new banking dramas emerge.

The second supportive consideration is the month of April is seasonally the fourth best month of the year for US stock markets, with an average return of 1.78% for the S&P500 over the past 10 years.

The final consideration could prove to see a tailwind switch to a headwind for tech stocks. If the economy proves more resilient than expected, inflation stays sticky, and there is little evidence of a credit crunch, it won’t be long before expectations of rate cuts swing back towards tightening.

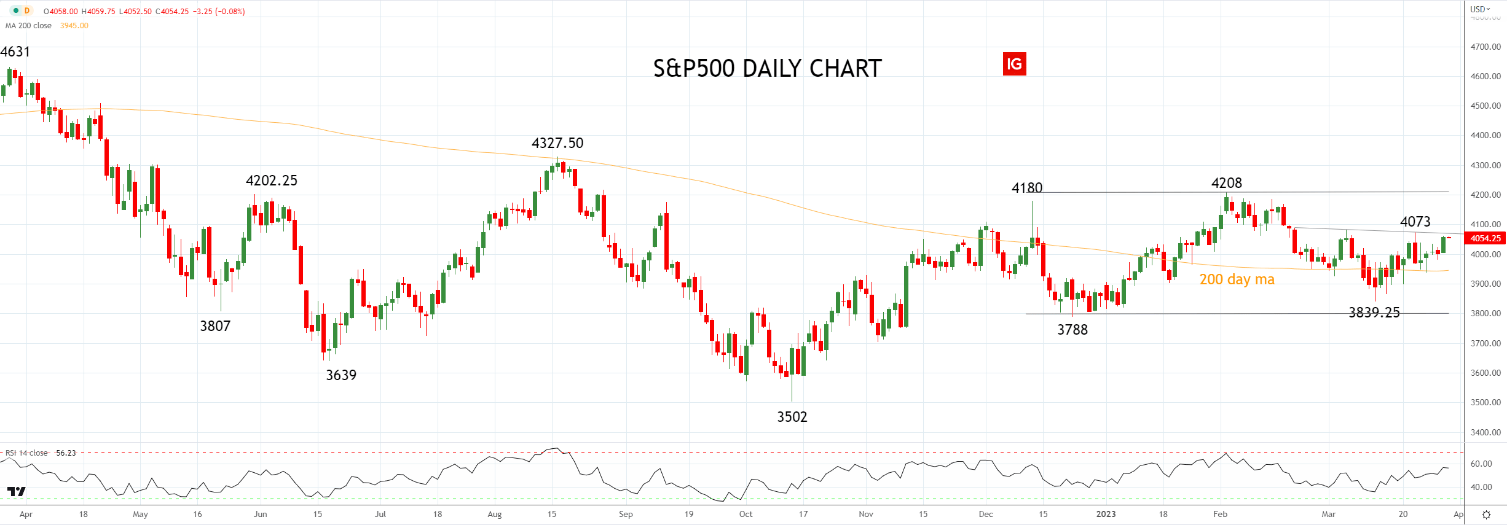

S&P500 Technical Analysis

The S&P 500 is eyeing the neckline/resistance at 4070ish of a wonky inverted head and shoulders.

Should the S&P500 see a sustained break above 4070/80, we think it would likely trigger a more robust recovery towards 4200 – the top of its 15-week 4200/3800 range.

Conversely, if the S&P500 fails to break above resistance at 4070/80, allow for a retest of the support coming from the 200-day moving average at 3945.

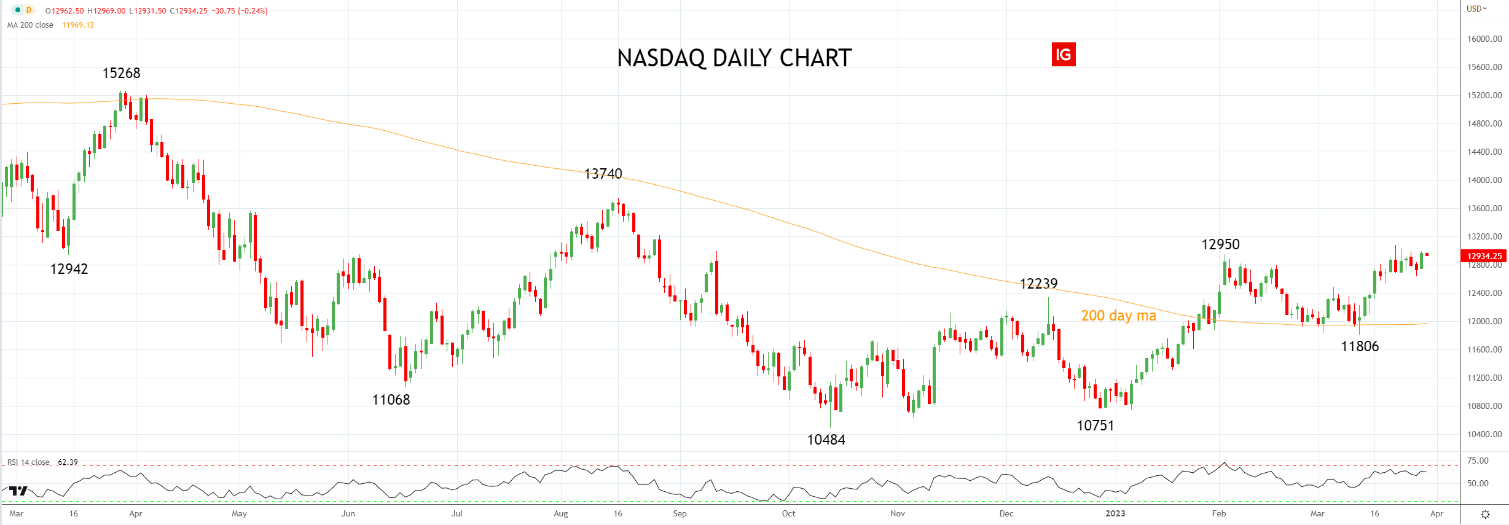

Nasdaq Technical Analysis

As outlined above, expectations of interest rate cuts have supported tech stocks and helped the Nasdaq extend its rally away from the support coming from the 200-day MA at 11,970.

Providing that the Nasdaq holds above support 11970/11,800, we continue to expect the rally from the October lows to continue higher towards the August 13,740 high.

A sustained close back below support 11970/11800 would negate the positive bias.

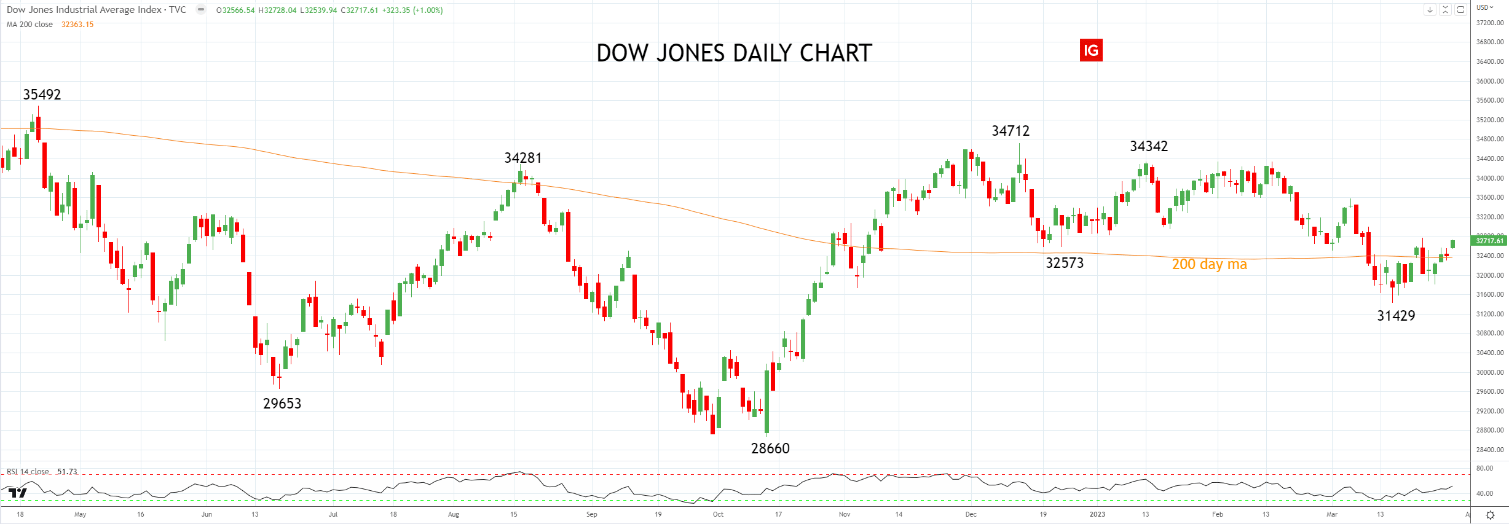

Dow Jones Technical Analysis

The Dow Jones break back above the 200-day M.A. this week at 32,363 negates the previous bearish bias and allows a more constructive view to emerge.

Providing the Dow Jones above the 200-day MA at 32,363 and above the recent 31,429 low, a weak positive bias is in place, looking for a push towards the March high at 33,383.

At the Close

A footnote from Christian:

It’s a little unnerving but stocks closed higher again on Wall Street, overnight, as traders assume the crazy-brave position.

The S&P 500 added 0.6% Thursday, its fifth gain in the last six days.

The benchmark index is locking that gain in for March despite the earlier weeks when the banking system was kaput.

Tough regulators were always a hit on US telly. In this case, confidence or the closest thing to it looks restored for the next 5 mins.

IG’s Tony Sycamore has been working in financial markets for the entire millennium – as well as 10 years at Goldman Sachs doing time in Sydney as part of Goldman’s crack Macro Proprietary Trading team.

The views, information, or opinions expressed in this article are solely those of the guests and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.