2022 a devastating game of two halves for Aussie IPOs, as new metal small caps come to the fore

Initially in 2022 local public offers looked strong... Via Getty

The blame for a wildly unbalanced year of Aussie initial public offerings (IPOs) can be lain, twitching, at the feet of the Reserve Bank of Australia.

This is the conclusion – though he’s far too nice to say it – of Marcus Ohm, partner at HLB Mann Judd over in sunny Perth and author of the latest HLB Mann Judd IPO Watch Australia Report.

According to Ohm, we were doing pretty well in ’22 on the IPO front until the wheels fell off almost every global market – including ours – as the second half of 2022 descended on us like a pall of uncertainty.

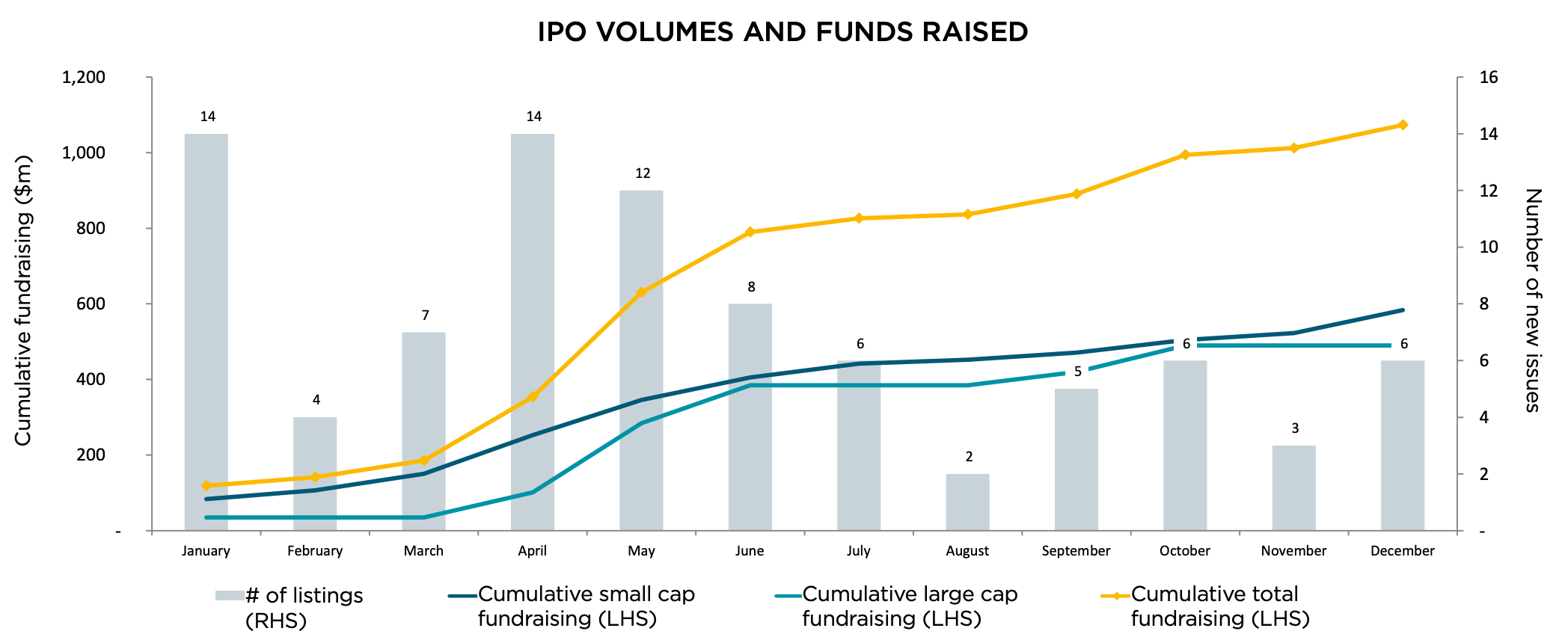

The HLB Mann Judd IPO report shows just how quickly the IPO flow dried up after June, with just 28 listings between July and December compared to 59 in the first half of the year.

The IPO Watch Australia report goes back through the calendar year IPO activity on a swag of key metrics, like listing volumes, share price performance, industry spread and overall trends, as well as a review of the pipeline for 2023.

The only person who does it better is our Emma Davies. And her IPO Watch only includes successful ones (Ed: Untrue).

Marcus Ohm, meanwhile, says the volatility felt across the broader market had a direct and significant impact on IPOs.

And once that came through, around the six month mark, the enthusiasm to list just evaporated.

The total number of IPOs in 2022 was down well over half (54%) on the previous year (87 in 2022 compared to 191 in 2021).

The bank did it

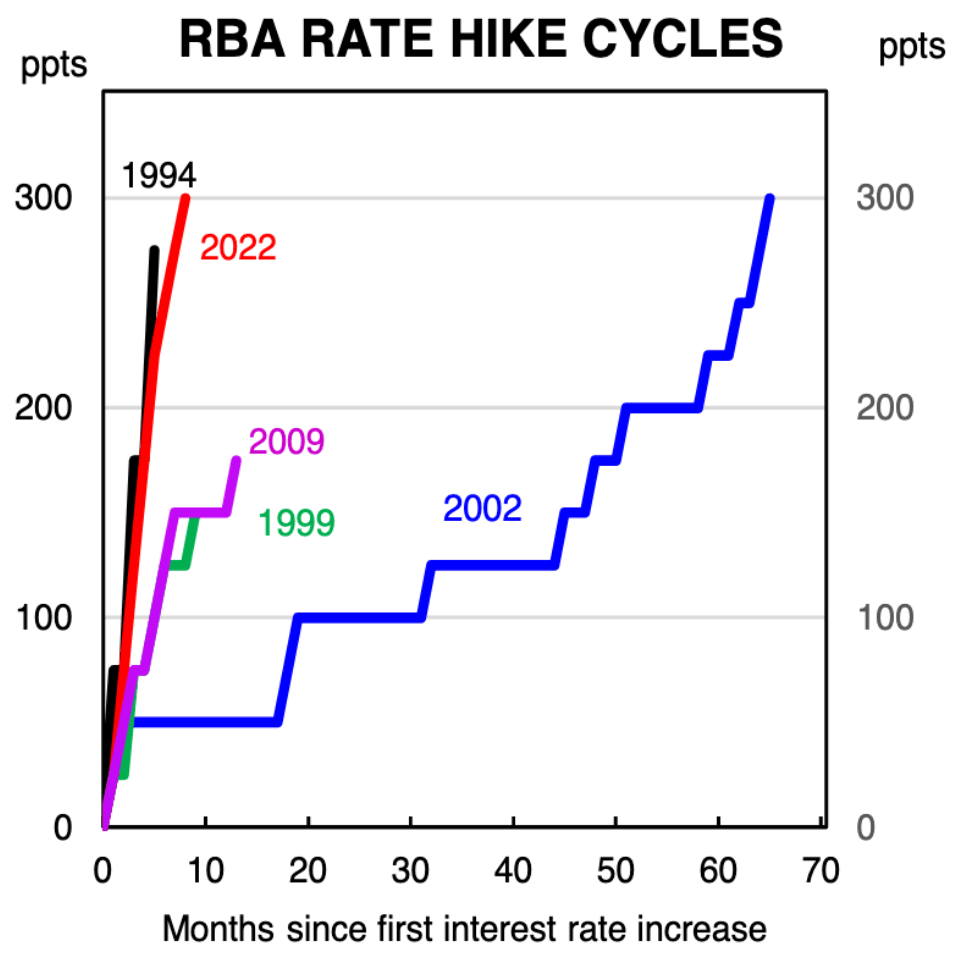

“Macroeconomic and geopolitical issues, coupled with rising inflation, resulted in the RBA lifting interest rates for the first time in twelve years,” Ohm says, “significantly impacting the stock market and subsequently IPOs.”

The RBA has been coming down hard this tightening cycle, breaking records in its attempt to get on top of bubbling inflation, a mission which is proving a stubborn one to achieve.

The fact that the central bank had been effectively cheering on flagrant spending – particularly in the housing sector – by assuring everyone there’d be no ned to lift rates until sometime around the next century has played a significant role.

As CBA’s chief economist Gareth Aird said last week, there was a lot to like about the performance of the Aussie economy in 2022.

“Output per capita grew solidly and the jobless rate hit a 50-year low of 3½% mid-year where it remained over H2 22.”

“Business investment lifted… company profits grew solidly. Workers shared in the spoils and wages growth, as measured by the wage price index (WPI) which increased to a near 10-year high in the September quarter…

However, the news was not all positive, was it Gareth.

Economies running at capacity will almost always experience a lift in inflation. And in 2022 Australia joined most other developed economies in experiencing very high inflation, much, much stronger than anyone wanted or expected.

“The RBA responded to the bout of high inflation and embarked on an incredibly aggressive tightening cycle.

“More specifically, the RBA delivered a whopping 300bps of rate hikes between May and December,” Aird said.

But that’s how 2022’s cookie crumbled

Ohm says that almost more than any other year, 2022 was a year of two halves.

“The first half of the year looked relatively healthy, with 59 new listings which was comparable to the 61 at the same stage in 2021. However, the second half of the year saw the IPO market all but dry up.”

“As a result, the amounts raised through IPOs fell 91 per cent in 2022, with just $1.07 billion raised compared to the record-breaking amount raised in 2021 of $12.33 billion. The amounts raised were also significantly below 2020 ($4.98 billion) and 2019 ($6.91 billion).

“Notably, there were fewer listings in 2020 (74) and 2019 (62) than in 2022, reflecting the contributions from large cap listings in these prior years,” he said.

It’s still a small cap world

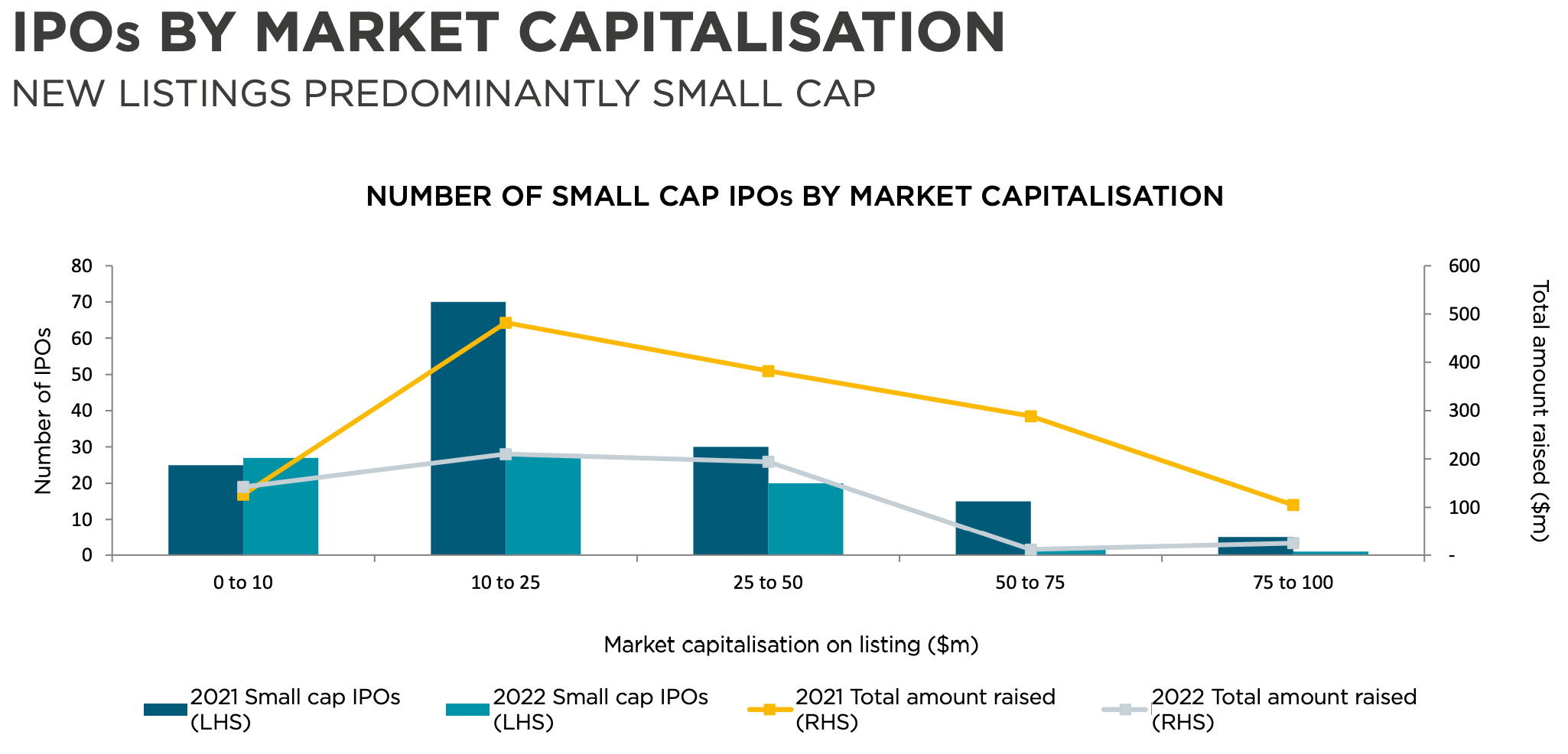

Consistent with the trend seen in previous years, weaker market conditions resulted in the IPO market being dominated by small cap companies.

“During periods of market volatility or downturn, large cap companies avoid a public listing while small cap companies continue to come to market. This was certainly the case in 2022,” Mr Ohm said.

According to the study released around Australia Day, of the 87 listings during the year, 78 were small cap companies (those companies with a market capitalisation less than $100 million), representing 90 per cent of the total number of listings. In contrast, small caps made up 76 per cent of 2021 listings and 58 per cent of 2020 listings.

Small caps raised 54 per cent of total funds in the year, a considerably higher portion of total funds than the 11 per cent contributed by small caps in 2021.

It’s not quite yet an IPO world

Ohm said the subdued conditions look set to continue in the first half of 2023.

“Market uncertainty is continuing to inhibit any significant new listings coming to market, with only ten small cap entrants in the pipeline looking to raise an average of $8 million.

“However, it is interesting to see that Bain Capital has recently announced it is seeking advice on relisting Virgin Airlines on the ASX. If the company goes public in 2023, it will be one of the market’s biggest IPOs for some time, and perhaps hints at greater confidence in the IPO market than the formal pipeline suggests.

“Nonetheless, the extent of any improvement in the IPO market for 2023 will depend on the reduction in the macroeconomic and geopolitical factors currently impacting markets,” he said.

The market factors and weaker investor sentiment also impacted company subscription targets in 2022. In total, 70 per cent of listings achieved their target amount, a notable fall from 87 per cent in 2021 and below the five-year average of 81 per cent.

“New listings have struggled to meet subscription targets during the year, and also found it difficult to maintain and grow their share price in the period.

“Despite average first day gains of 16 per cent, gains for many new entrants were down at year-end and, on average, listings posted a loss of two per cent against IPO price.

“Notably, small cap entrants managed a marginal gain of one per cent at the end of the year, contrasting with an average year-end loss for large cap listings of 33 per cent. Only two of the nine large cap listings recorded a year-end gain.

“Despite this, the share price performance of new market entrants bettered that of the ASX All Ordinaries Index which finished the year down seven per cent year-on-year. The All Ordinaries rallied from a low of 6663 in June 2022 to finish the year at 7222. Investors will hope the rebound continues into 2023,” Mr Ohm said.

Vanadium, Paladium and any battery metals nearby

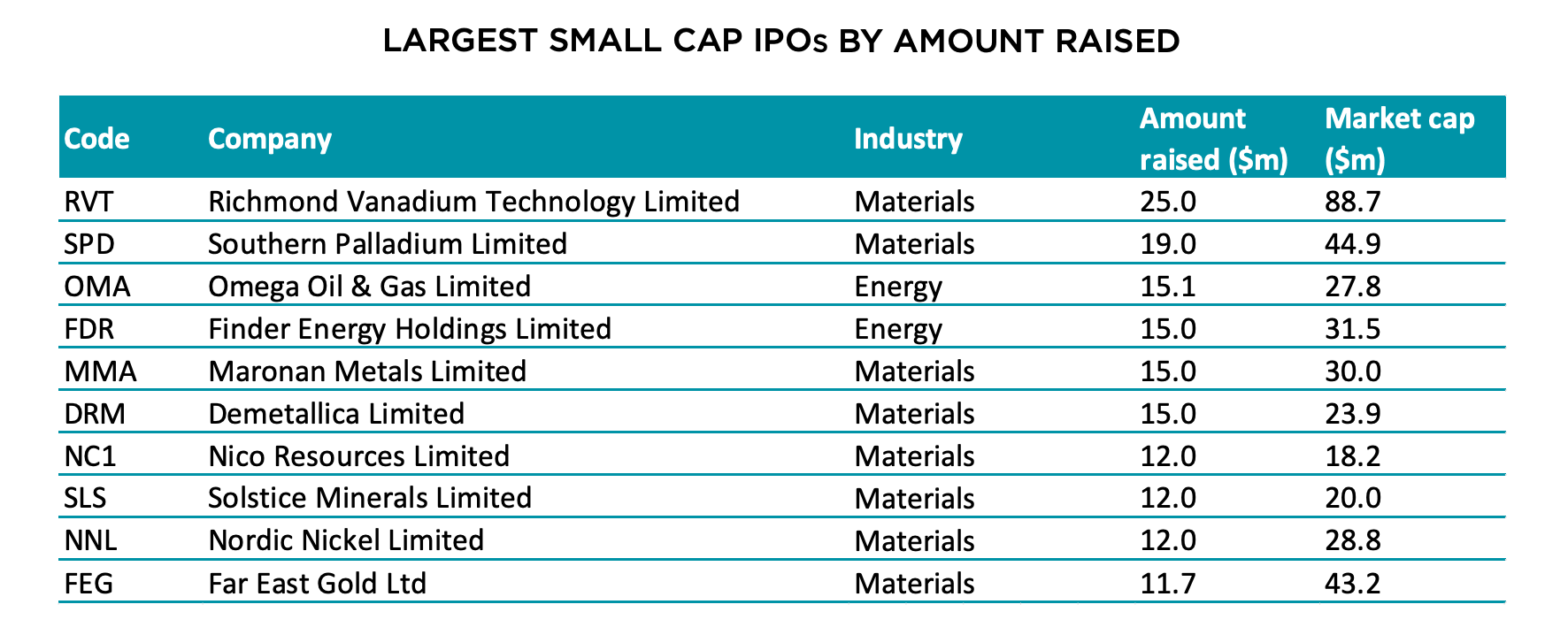

Materials listings dominated the market again, with 63 new market entrants in the year compared to 107 in 2021. This represents 72% of all listings, an increase from 56% in 2021.

A total of 61 of the Materials listings were small cap companies, Ohm says.

Gold and battery metals, in particular lithium, have been popular commodities for exploration listings this year. The two large cap Materials listings in the year were Leo Lithium Limited (ASX: LLL) and Atlantic Lithium Limited (ASX: A11) which raised a combined $113.3 million.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.