Nasdaq Wrap: Starbucks, Nvidia shine in big week for stocks; spotlight now turns to Jackson Hole

Fed Chair Powell’s Jackson Hole speech this week may hint at interest rate cuts. Picrture Getty

- Wall Street surged last week; with the Nasdaq up 5pc

- Fed Chair Powell’s Jackson Hole speech may hint at interest rate cuts

- Nvidia rose 17pc, and key earnings reports are due this week

Nasdaq Wrap is our new weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s in store this week.

The week that was

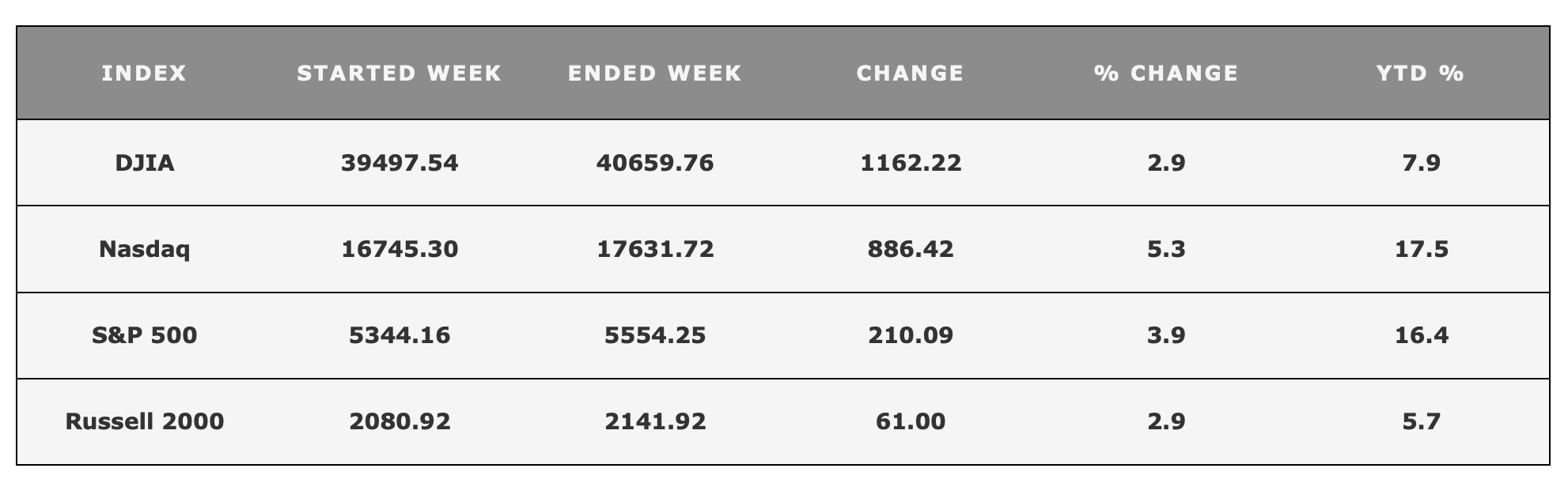

Last week, Wall Street recovered from its recent selloff, with the S&P 500 climbing 4% and the Nasdaq rising more than 5% – its first weekly gain in five weeks.

It was the best week of the year for all the major US indexes, and the best week for stocks since November.

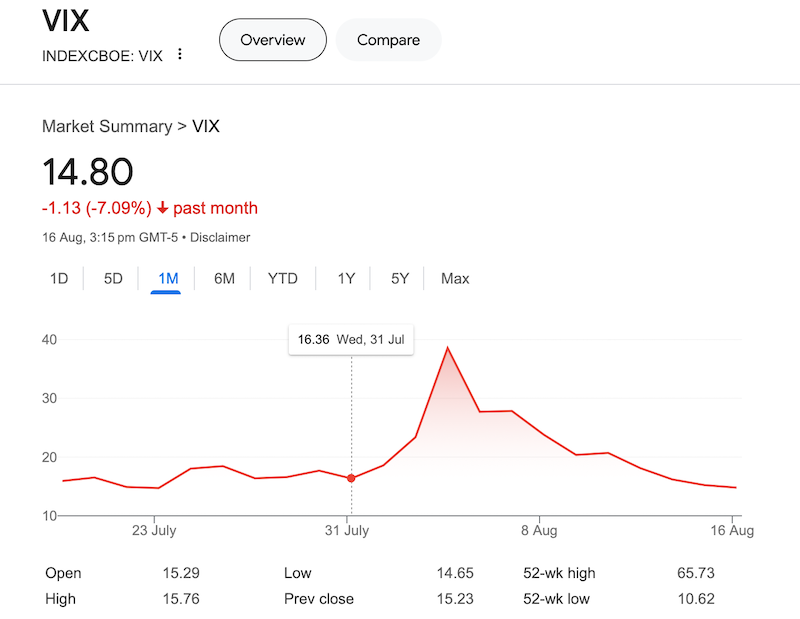

Additionally, the VIX Index, which measures market fear, fell sharply after spiking the previous week.

This swift turnaround is largely attributed to two key data releases.

First, signs of easing inflation emerged, with both the Consumer Price Index (CPI) and Producer Price Index (PPI) figures for July coming in lower than anticipated.

Second, economic data remained resilient, as retail sales and jobless claims exceeded forecasts, indicating that while the US economy is slowing, it is not on the brink of a major downturn.

“The cumulative evidence to date shows a solid job market and a consumer who continues to spend,” said Morgan Stanley chief global economist, Seth Carpenter.

Against this backdrop, it now appears likely that the Federal Reserve may begin cutting interest rates as soon as its next meeting on September 18.

Fed officials haven’t confirmed whether rates will actually be cut, and recent comments have been unclear.

But Fed Chair Powell is expected to provide more details on this in his speech at the Jackson Hole Economic Symposium – held from August 22-24 in Wyoming – on Friday (US time).

As with previous symposiums, Powell’s speech will primarily address central bankers, academics, and journalists. But he will be careful with his words, as Wall Street will meticulously dissect his remarks.

“The Fed will probably react to the gathering clouds by easing monetary policy by more and faster than we had expected,” said Kallum Pickering at Peel Hunt.

However, there are still other significant risks for the stock market apart from Fed’s policy.

Tensions in the Middle East, along with China’s slowing economy and weak consumer and business confidence, could pose serious threats to the market’s near-term performance.

This growing concern has pushed the price of gold, a safe haven asset, to over US$2,500 on Friday. Some analysts even suggest that gold could eventually reach US$2,900 an ounce.

Last week’s Nasdaq highlights

Starbucks (NASDAQ:SBUX)

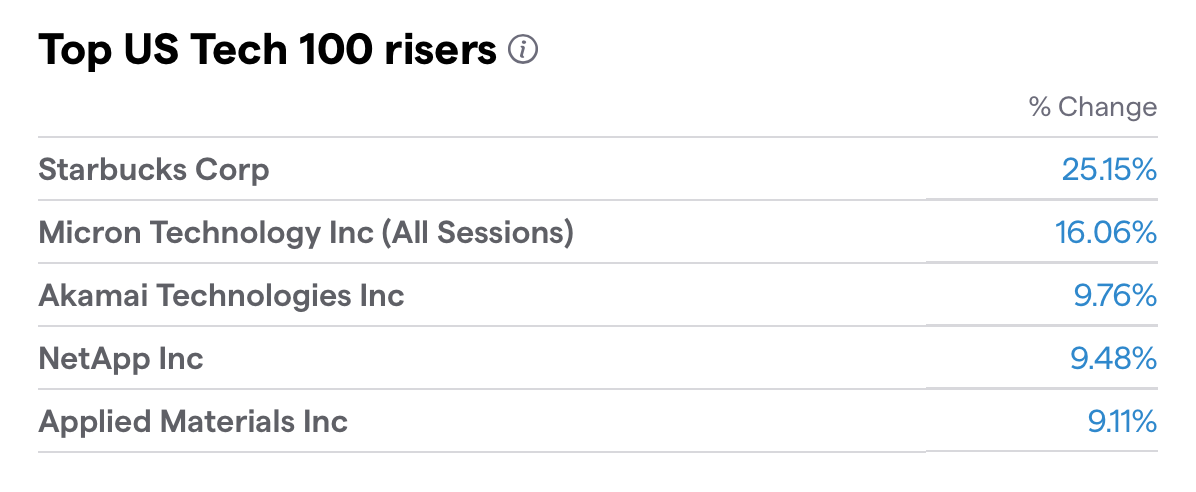

The biggest mover last week was Starbucks as the American coffee chain made headlines by hiring Brian Niccol, the CEO of Chipotle, as its new chief executive.

This unexpected move comes after just 17 months in the role for Laxman Narasimhan, who was replaced in a surprising management shake-up.

Niccol is set to receive a sign-on pay package worth up to US$113 million, which is four times larger than his predecessor’s and ranks among the biggest executive deals in corporate history.

Nvidia (NASDAQ:NVDA)

Nvidia climbed back 17% last week after the previous week’s selloff.

Investors came rushing back to the stock after Bank of America analyst, Vivek Arya, put Nvidia as his top pick for a rebound, predicting a recovery for the semiconductor industry by the end of 2024.

Nvidia dominates the market for powerful AI chips, holding 80% to 95% of it.

However, analysts expect that Nvidia’s Q3 earnings, set to be released on August 28, will show the company struggling to sustain the impressive revenue growth seen in Q2, where it reached US$13.5 billion—an increase of 101% from the previous year.

Read more: Semi-conducting yourself when the Nvidia chips are down

Micron Technology (NASDAQ:MU)

Micron was another big mover last week.

The stock has been quite unstable this year. It rose about 85% by mid-June but then dropped nearly 40%, leaving its year-to-date return at around 8%.

But the company benefits from a recovering memory market, with rising DRAM prices and strong demand from generative AI.

Analysts believe that Micron is well-positioned for growth as demand for memory, especially High Bandwidth Memory, continues to rise with AI advancements.

Apple Inc (NASDAQ:AAPL)

Meanwhile, Apple stirred up excitement among tech enthusiasts after saying that it was developing a new, expensive home device that features an iPad-like screen and a robotic arm.

This device, which has a team of hundreds working on it, will use the arm to move the screen around and perform tasks like tilting and spinning, and is designed to be a smart home hub.

The project, called J595, began to ramp up in recent months after being approved in 2022.

The move into robotics is part of Apple’s strategy to increase sales and expand its use of artificial intelligence, following the end of its self-driving car project.

Investors’ quick checklist for this week

It will be a relatively quiet week on the data front, but several events are worth a mention…

• The US will see several key economic events, including jobless claims, the release of FOMC meeting minutes, and new home sales data.

• Jerome Powell’s Jackson Hole speech will be a huge one, particularly for tech stocks.

• Globally, releases include the Eurozone CPI, Canada’s CPI, Australia’s Westpac Leading Index, and Japan’s trade balance.

• And on the Nasdaq, companies set to release their earnings reports include:

Palo Alto Networks (NASDAQ:PANW), Zoom (NASDAQ:ZM), Intuit (NASDAQ:INTU), and Dollar Tree (NASDAQ:DLTR).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.