Nasdaq Wrap: Nvidia overtakes Apple as world’s most valuable, as investors brace for election volatility

Picture via Getty Images

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

- Wall Street faced pullback last week after strong rally

- Nvidia surpasses Apple as most valuable company

- Investors brace for election volatility ahead of key earnings

The week that was

Last week, Wall Street faced selling pressure after a strong six-week rally.

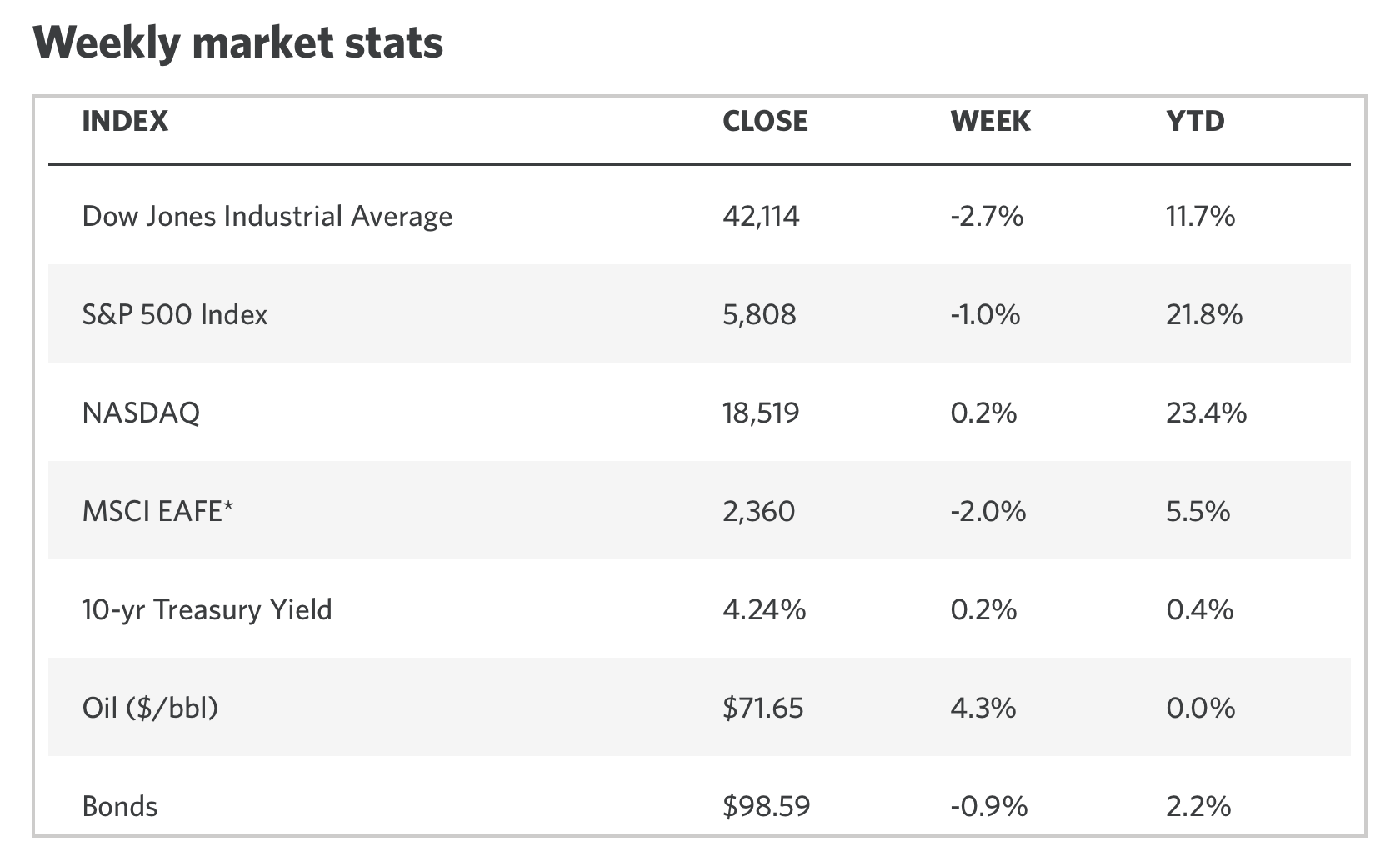

The S&P 500 closed 1% lower, the Nasdaq was up modestly, while the blue chips-focused Dow Jones saw a more significant decline of 2.7%.

The pullback in Dow was largely attributed to profit-taking as rising market interest rates weighed on investor sentiment.

The 10-year Treasury yield surged by 20 basis points to 4.24% as traders recalibrated their Fed rate expectations, contributing to the downward pressure on stocks.

Gold prices smashed the US$2,700 an ounce barrier, trading as high as US$2,757.80 as traders moved to safe assets amid ongoing uncertainty around the US elections and Middle East conflict.

The International Monetary Fund (IMF) issued a warning about potential economic challenges, further heightening caution among investors.

On Tuesday, McDonald’s and Starbucks – a couple of bellwether stocks for the economy – slumped amidst broader market uncertainty.

But the tech-heavy Nasdaq rallied late in the week, driven by strong results from Tesla and Taiwan Semiconductor Manufacturing (TSMC), which boosted interest in AI stocks.

Thursday saw Tesla rev up its stock price by 22% following strong Q3 earnings (see more below). Netflix exceeded earnings expectations, adding to the positive sentiment late in the week.

Analysts noted that investors will remain cautious ahead of this week’s crucial economic reports; and the resilience of mega-cap stocks, particularly in the face of rising interest rates, will be key to watch in the coming weeks.

How will the US election impact markets?

As the 2024 US election approaches, investors are bracing for potential market volatility. One critical area of focus is how the election results might impact technology companies.

Many tech firms have thrived under the current Biden administration. So if there is a shift towards a more conservative administration, we could see a tightening of regulations that could stifle growth in the tech sector.

On the other hand, a more progressive agenda could lead to increased investments in green technology and infrastructure, potentially benefiting Nasdaq-listed companies.

“When the incumbent party retained the presidency, volatility declined, on average, before the election and ticked up modestly afterward,” said fund manager, T. Rowe. Price.

“And in presidential elections where the incumbent party lost, volatility increased significantly in the periods before the vote and then receded afterward.”

Experts say the stocks that could win under Harris include: clean energy and renewables; infrastructure, healthcare and pharmaceuticals.

Stocks that could win under Trump include: fossil fuel, financials, defence and aerospace.

And finally, the election’s timing, falling just before a critical holiday shopping season, adds another layer of complexity.

Consumer sentiment can be swayed by political developments, which in turn affects retail performance – an important component of the Nasdaq’s broader index.

”However, the market is more focused on third-quarter corporate earnings. It isn’t likely to price in any election factors unless there’s a meaningful change to expectations,” said a recent note from US Bank Wealth Management.

Last week’s Nasdaq stock highlights

Tesla (NASDAQ:TSLA)

Tesla’s stock soared 22% on Thursday after its mixed third-quarter earnings showed positive signs.

Investors were encouraged by better-than-expected earnings per share and higher gross margins, along with the announcement that Tesla’s more affordable electric vehicle is on track for production next year.

CEO Elon Musk projected a potential growth of 20%-30% in vehicle deliveries for 2024.

While Tesla reported revenue of US$25.18 billion, slightly below expectations, it still marked growth from the previous quarter and last year. The company’s gross margin came in at 19.8%, exceeding forecasts.

Tesla delivered 462,890 vehicles in Q3, a 6.4% increase from the previous quarter, though slightly below Wall Street’s expectations.

Musk also mentioned ongoing testing for its robotaxi project and said that production for the cheaper EV will begin in the first half of 2025.

Overall, strong results and positive outlook for the stock.

Alphabet (NASDAQ:GOOG)

Waymo, Alphabet’s autonomous driving division, successfully closed a US$5.6 billion funding round last week, the largest in its history.

The investment, led by Alphabet and supported by firms like Andreessen Horowitz and Fidelity Investments, aims to support Waymo’s self-driving technology and expand its robotaxi services, which currently operates in cities like San Francisco, Phoenix, and Los Angeles.

Analysts say the funding positions Waymo for a potential public listing in the future, as it continues to compete in the growing autonomous vehicle market against rivals like Tesla.

But looking at the the bigger picture, some believe that Alphabet is facing challenges as it approaches its Q3 earnings report on October 29.

The company is under scrutiny due to an ongoing antitrust trial that questions its search engine practices, potentially forcing it to alter its business model.

Analysts from Wedbush are predicting limited upside for Alphabet’s stock, with expected growth in Google Search and YouTube Ads slightly below consensus estimates.

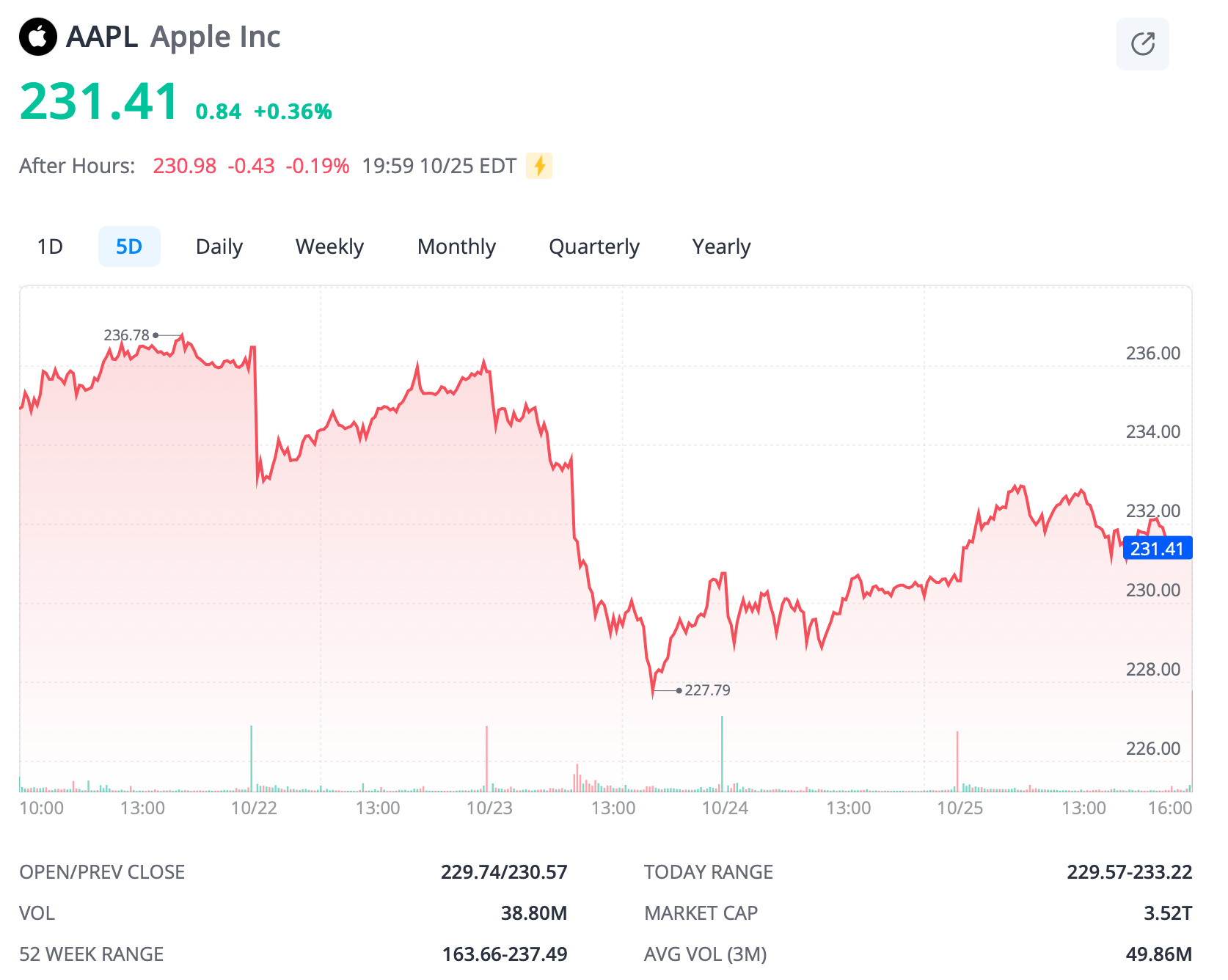

Apple Inc (NASDAQ:AAPL)

The most actively treaded mega tech stock last week was Apple.

On Friday, Nvidia surpassed Apple as the world’s most valuable company, reaching a market value of US$3.53 trillion.

Apple is set to release its Q4 FY’24 results on October 31, following the launch of the iPhone 16, with consensus expected revenue of US$94.5 billion – up 13% year-over-year – and earnings of US$1.56 per share.

Although iPhone shipments increased by 3.5% to 56 million in Q3, competition from Huawei is impacting Apple’s market share in China, where revenue fell nearly 10% this fiscal year.

Iterum Therapeutics (NASDAQ:ITRM)

Here’s one Nasdaq stock you probably have never heard of.

Iterum Therapeutics’s shares surged last week following the US FDA’s approval of its urinary tract infection treatment, Orlynvah.

This marks the first approved indication for Orlynvah and the company’s first product to receive FDA approval.

The FDA’s decision was based on two pivotal Phase 3 trials that demonstrated Orlynvah’s effectiveness against resistant infections.

Despite this positive development, Iterum is facing financial challenges, including potential delisting from Nasdaq due to equity shortfalls.

However, analysts maintain a “Buy” rating on Iterum, but concerns about its cash burn remain crucial for potential investors.

What to expect this week

This week is pivotal for investors as several key economic reports and earnings from major companies are set to be released.

US economic highlights:

- GDP Data: On October 30, the Q3 Gross Domestic Product (GDP) figures will be revealed

- Inflation Reports: The Personal Consumption Expenditures (PCE) price index, a key measure of inflation, will be released on October 31, which the Federal Reserve closely monitors

- Jobs Report: Throughout the week, we’ll also see updates on consumer confidence and job openings, giving further context to the US employment landscape.

Analysts expect that while US inflation might see a slight increase, it won’t be substantial enough to alter the Fed Reserve’s cautious approach to monetary policy.

This could support a “soft landing” scenario for the economy, easing fears of drastic interest rate hikes.

Earnings Reports:

Investors will also be focused on the earnings results of high-profile companies, often referred to as the “Magnificent Seven”.

In addition to Tesla (see further above), these include: Apple, Microsoft, Alphabet (Google), Amazon, and Meta (Facebook), all scheduled to report their Q3 results.

*Trade US and Australian ETFs with $0 brokerage. Additional brokerage discounts may apply during promotional campaigns. Regulatory and FX fees may apply.

The views, information, or opinions expressed by the experts quoted in this article are solely those of the experts and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.