Nasdaq Wrap: Market hits speed bump, but is Nvidia’s huge drop a prime buying opportunity?

Nasdaq Wrap

Nasdaq Wrap

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

The once unstoppable stock market rally is now facing some bumps as it hits a bunch of obstacles threatening its record-breaking streak.

August’s selloff showed just how fast things can go south, as US recession worries hit hard and rattled investors who were used to seeing nothing but gains. Even though the S&P 500 bounced back later in the month, it hasn’t managed to recover all the losses.

Last week, September also kicked off on a rough note, with major indices falling sharply in the holiday-shortened week.

Stocks had their worst week since March 2023, and bonds were also volatile, as another weak US jobs report sparked concerns the economy is slowing down and the Federal Reserve isn’t acting fast enough to fix it.

On Friday, the much anticipated US non-farm payrolls climbed by just 142,000 in August, versus 160,000 forecasted, despite unemployment falling to 4.2%.

“Whether this inflection turns into recession, or something less negative, depends upon how aggressive the Fed counters current negative momentum,” said Steven Blitz at TS Lombard.

“Does the Fed go 25 or 50?”, he pondered.

We will get an answer to that question on September 17 and 18 when Fed members convene to make the decision.

Of course, the market’s been through rough patches like this before, from US and Swiss bank failures in 2023 to perpetual Middle East conflicts, but it always bounced back to hit new highs.

What’s different about this year’s rally, though, is that it’s been fuelled primarily by a handful of big tech stocks, with Nvidia leading the way.

This heavy reliance on tech and the AI boom carries risks, especially if Nvidia or these other major players in the space fall short of expectations.

Nvidia’s massive drop last week, which erased $280 billion from its market value in one day, is particularly making investors nervous.

“There’s an old saying – if the troops can’t follow the generals, it’s a warning sign,” said Jason Teh at Vertium Asset Management.

Nvidia Corp (NASDAQ:NVDA)

Nvidia took a massive hit on Tuesday, plunging 9.5% in its biggest one-day drop ever.

This wiped out $280 billion in its market value, sparking concern among investors about AI’s future.

Despite strong earnings in the second quarter, Nvidia’s forecast didn’t meet high expectations, leading to concerns that the AI hype might be cooling.

What’s more worrying is that CEO Jensen Huang has sold more than 5 million of his shares in Nvidia in recent months.

According to SEC filings, from June 13 to September 4, Huang sold nearly 5.3 million shares in batches of 120,000 for a total value of around US$633 million.

But analysts say that all this is normal and Huang isn’t the only tech CEO cashing in.

Top execs like Micron’s Sanjay Mehrotra and Qualcomm’s Cristiano Amon have also been selling off their shares after their companies’ stocks surged to lock in personal profits.

Bank of America, meanwhile, sees Nvidia’s downturn as a great chance to buy the stock.

“We continue to believe in NVDA’s unique growth opportunity, execution and dominant 80%+ share as generative AI deployments are still in their first 1 – 1.5yr of what is at least a 3 – 4 year upfront investment cycle,” wrote Bank of America analyst, Vivek Arya.

Tesla (NASDAQ:TSLA)

Tesla’s stock price was volatile last week, adding 10% in two sessions before paring the gains to finish just 1% higher.

The big announcement was its plans to introduce the Full Self Driving (FSD) tech in Europe and China.

Tesla admitted rolling out this technology won’t be straightforward, given the tough regulations in these regions, but still hopes to launch it by early 2025.

FSD was first promised back in 2016 with claims of fully autonomous driving, but those claims haven’t panned out perfectly, leading to Tesla requiring drivers to stay alert.

Despite this big announcement, not everyone is confident about Tesla.

Longtime investor Ross Gerber has sold about US$60 million worth of Tesla stock in recent weeks, citing concerns over sluggish sales and dissatisfaction with the company’s direction.

Gerber argues that Tesla’s focus on robotics and self-driving tech is a distraction from the real issue: the need to boost car sales.

Broadcom (NASDAQ:AVGO)

Broadcom’s stock price plunged 10% on Friday and 15% for the week after its worst post-earnings drop on record.

You may not have heard of Broadcom but the US$600 billion behemoth is a major player in the semiconductor and infrastructure software industry.

The company is a significant supplier to Apple, Dell, Cisco, Qualcomm and many other companies in the tech space.

Broadcom posted a hefty net loss of US$1.875 billion in Q3, a sharp turnaround from the US$3.3 billion profit it made the same time last year.

While Broadcom’s long-term prospects might be promising, these immediate results have left investors a bit on edge.

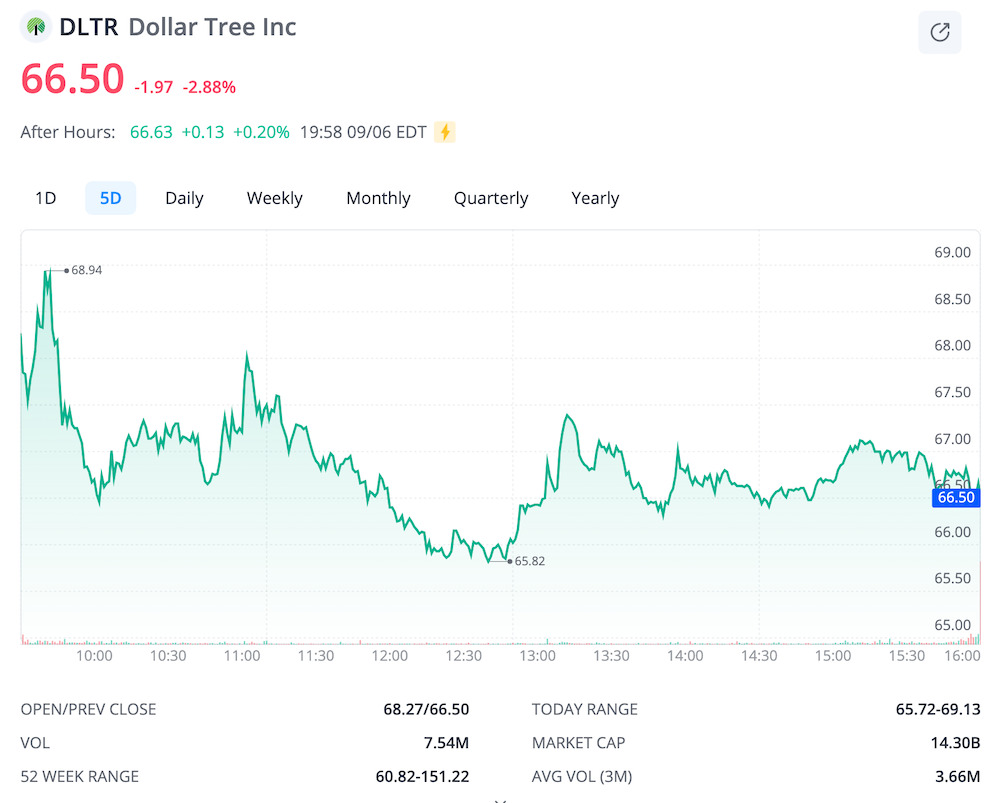

Dollar Tree (NASDAQ:DLTR)

Dollar Tree’s stock took a nosedive last Wednesday, with shares plummeting 22%.

The discount store revealed its poor performance for Q2, which fell far short of expectations.

To make matters worse, Dollar Tree has slashed its full-year sales and earnings forecasts, now predicting revenue between US$30.6 billion and US$30.9 billion, down from earlier expectations of $31 billion to $32 billion.

Discount stores such as Dollar Tree and NYSE-listed Dollar General (which dropped over 30% two weeks ago) are having a tough time.

Once the go-to for bargain hunters, they’re now losing traction to the bigger players as retailers like Walmart and Target slash their prices.

We’ll see big names such as Oracle, Kroger, and Adobe report their quarterly results later this week.

Apple also held its big iPhone event on Monday, where it unveiled the iPhone 16 series, including the Pro and Pro Max models, the Apple Watch Series 10 and Ultra 2, and updated AirPods with USB-C charging.

The week’s economic updates include reports on consumer price inflation and wholesale inflation, plus the University of Michigan’s consumer survey.

Here’s a rundown of the key economic events:

* September 9, the consumer credit report for August

* September 10, the NFIB optimism index for August

* September 11, the Consumer Price Index (CPI) for August

* September 12, the Producer Price Index (PPI) data for August

* September 13, we’ll see the preliminary report on consumer sentiment for this month

Join a community of dedicated traders who demand an advanced investing app – and get it. Sign up today and claim your welcome rewards, start investing in the US market with $0 brokerage*, tap into the convenience of 24-hour trading, harness the power of real-time data, and test your strategies risk-free with our Paper Trading.

*Trade US and Australian ETFs with $0 brokerage. Additional brokerage discounts may apply during promotional campaigns. Regulatory and FX fees may apply.