The ASX is the fourth busiest stockmarket for floats so far this year

Pic: d3sign / Moment via Getty Images

The ASX is the fourth busiest stock market for IPOs so far this year, according to consultant Ernst & Young.

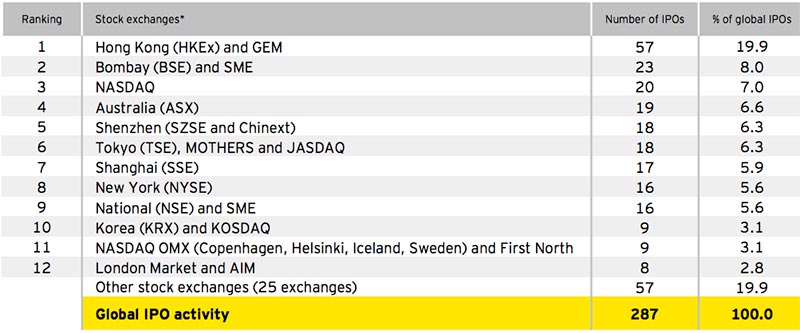

The ASX hosted 6.6 per cent of all IPOs (19) around the world in the March quarter, according to Ernst & Young’s Global IPO trends: Q1 2018 report.

Hong Kong was first with 57, followed by Bombay (23) and the US based tech-heavy NASDAQ (20).

However, the 19 ASX floats represented a 30 per cent drop on the same quarter last year.

The March quarter is traditionally the ASX’s quietest period for IPOs — especially with this year’s early Easter.

The ASX has about 34 registered IPOs listed on its upcoming floats page.

However, Australia did not crack the top 12 stockmarkets when it came to adding up the amount of IPO cash raised last quarter.

The ASX raised around $US110 million while the New York Stock Exchange topped the list with $US10.2 billion (almost a quarter of all global IPO cash).

Despite the mid-February market wobble, global IPO fund-raising has been relatively strong this year — raising $US42.8 billion in the March quarter — 28 per cent more than the same quarter last year, according to Ernst & Young’s Global IPO trends: Q1 2018 report.

While the amount of cash raised was significantly higher, the actual number of global IPOs was 27 per cent lower at 287. However the 2017 March quarter had the highest number of listings in ten years.

The ASX was the fourth busiest stockmarket for IPOs in the March quarter. Here’s the top 12 IPO stockmarkets from Ernst & Young:

Despite lower activity, the Asia-Pacific remained the world’s busiest region for new listings in the quarter.

The region accounted 157 IPOs — a 39 per cent drop when compared with the same quarter last year. Total proceeds in the region were $US11.4 billion.

“Market volatility in February did slightly dampen investor confidence, slowing momentum gained from calendar year 2017,” said EY’s Global and EMEIA IPO lead, Dr Martin Steinbach.

The most popular sector for IPOs was industrials with 45 floats, followed by technology (38) and consumer products (35).

Positive IPO outlook despite headwinds

Strong equity markets and sound corporate earnings were contributing to a positive global IPO outlook for the rest of 2018.

In Australia, the outlook for micro, small and mid-cap listings up to about $500 million market cap was “very, very healthy”, the ASX’s general manager of listings Max Cunningham told Stockhead.

Demand for $1 billion-plus listings was “yet to be tested”. However the ASX was expecting at least one billion-dollar IPO in the financial services sector in the short-term — and possibly more.

The ASX has IPO visibility of about three months.

Ernst & Young expected “to continue to see IPOs from a range of sources including large tech, high growth, cross-border listings, carve-outs and state-owned enterprises”, Dr Steinbach said.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

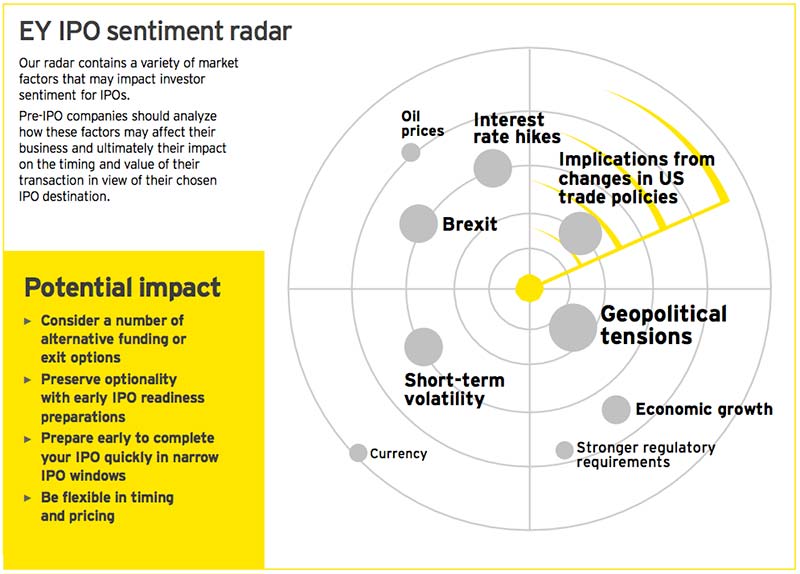

However, the report noted a number of headwinds on its “IPO sentiment radar” (see below) — especially uncertainty around US trade policies, geopoliticial tensions and post-Brexit negotiations.

“Despite expected interest rate hikes also later this year and uncertainty around potential trade policies, steady investor confidence is encouraging a healthy pipeline across sectors and markets this year,” Dr Steinbach said.

Here is Ernst & Young’s “IPO Sentiment Radar”:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.