New lithium explorer GL1 wants to be the next Pilbara Minerals

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

After three years of exploration as a private company, Global Lithium Resources (ASX:GL1) says now is the time to list on the ASX as the lithium market builds momentum.

Lithium prices are up 100 per cent in 2021, but it could be just the beginning. Longer term, lithium demand is expected to increase between 8 and 11 times by 2030.

Where is it all coming from? No one knows for sure, but GL1 are hoping to be part of the solution.

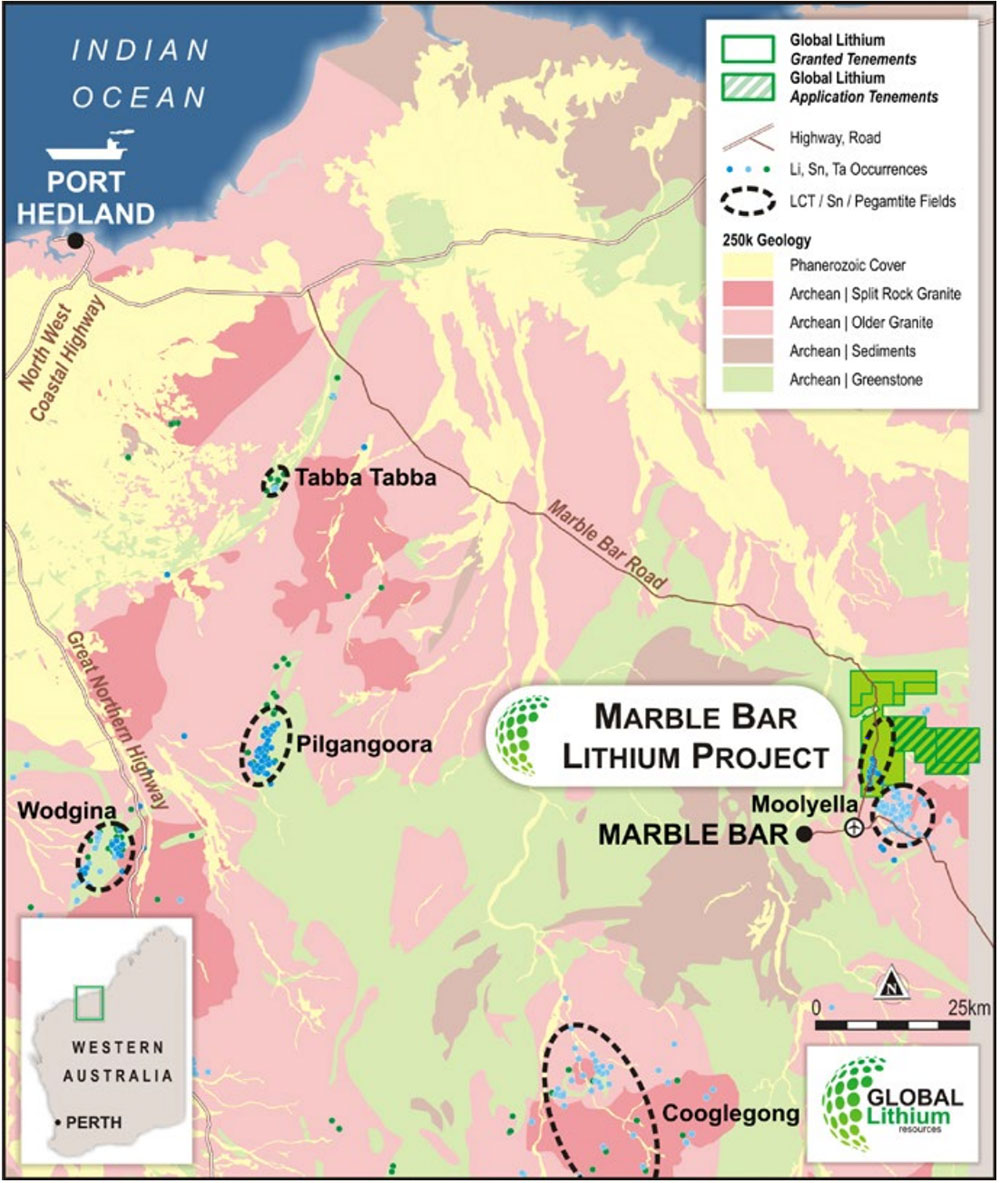

GL1’s main game is the ~240sqkm Marble Bar lithium project (MBLP) in WA’s Pilbara – the hard rock capital of the world – which it acquired in 2019.

This region hosts Pilbara Minerals’ (ASX:PLS) Pilgangoora operation and the Albemarle and Mineral Resources’ (ASX:MIN) Wodgina joint venture.

Global Lithium’s ground is in a very similar geological setting to Pilbara Minerals’ Pilgangoora deposit, it says.

A strong supportive group of private investors have funded the company to this point.

Early exploration success includes the discovery of the ‘Archer’ deposit, where the company – after three drilling campaigns – has already penned a maiden mineral resource of 10.5 million tonnes at 1% lithium.

On listing, the company will keep drilling to find the edges of the Archer deposit, a swarm of spodumene-bearing pegmatites over a 3km by 1km zone which remains ‘open’ in all directions.

“Archer is new discovery,” GL1 managing director Jamie Wright told Stockhead.

“It is not a recycled asset that has been picked over by past explorers – it is a genuine new discovery.”

Archer has potential to be a standalone development, but the parallel opportunity – perhaps the bigger opportunity – is what could be happening at depth.

“Archer dips back towards the east, back towards what we have interpreted to be the ‘source’ fluid,” Wright says.

“Fluids tend to accumulate in structural zones, so the real opportunity for us is to see what happens here at depth.

“The aim of the game on listing is to get onto Archer with some infill and extension drilling, and then track it back to see where it might go.”

The explorer, which plans to list in May, wants to raise a minimum of $9,000,000 and a maximum of $10,000,000 in its IPO at 20c per share.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.