IPO Wrap: Virgin Airlines and Molycop set to be two biggest ASX IPOs this year… and is Reddit finally listing?

Virgin Airlines and Molycop could be the two biggest ASX IPOs this year. Picture Getty

- Expert says we need big IPOs to jumpstart sluggish market

- Virgin Airlines and Molycop could be the two biggest ASX IPOs this year

- And who will be listing on the ASX in the coming weeks?

US IPO activity has remained at snail’s pace this year compared to prior bull markets.

Consultancy group Ernst & Young (E&Y) says that in order for the IPO market to begin normalising, there needs to be a couple of big names that come to market at reasonable valuations and trade well in the secondary market.

There are signs this may happen soon, according to E&Y, because sentiment is rising, evidenced by the rebound in growth stocks and the Nasdaq’s 35% climb YTD.

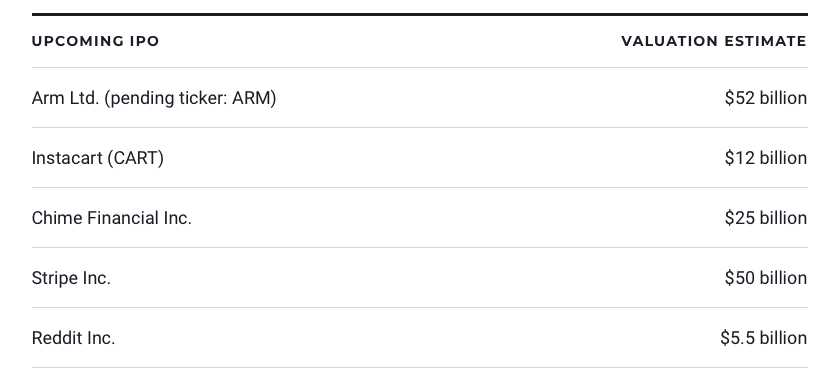

The market is now hopeful on the prospect of a handful of mouthwatering IPOs bubbling to the surface – some confirmed and others just rumours and speculation.

While Reddit has not confirmed that it’s pursuing an IPO, as far as social media platforms go, the name doesn’t get much bigger.

Valued at US$10 billion in 2021 when it raised US$700m, Reddit is unfortunately now worth just half that amount after Fidelity Investments slashed its valuation to US$5.5 billion in May.

Reddit had actually filed for IPO paperwork with the SEC in December 2021, but has held off on listing since.

In an interview with The Verge in June, co-founder and CEO Steve Huffman didn’t give a precise timeline for an IPO.

“You may notice there’s not a lot of companies going public right now,” he said.

“It’s something we’d like to do someday. I don’t know when the market will be more conducive to that, and there’s a few things I’d like to do with Reddit before we get there.”

A couple of big IPOs on the ASX before year end?

In Australia, we’re relying on a couple of potential billion-dollar listings to save the ASX from the worst year on record for IPOs.

Virgin Australia is set to return to the bourse some time in November with a market cap of around $1 billion.

Virgin owner Bain Capital has reportedly been watching the latest earnings season in Australia before rolling out more road shows for the IPO.

Steel business Molycop has begun a non-deal roadshow with prospective investors, with a target of listing before end of the year.

Owned by US private company American Industrial Partners (AIP), Molycop is also eyeing valuations north of $1 billion.

Molycop is one of the world’s largest suppliers of grinding media, the objects used to refine material and reduce particle size. It was the former crown jewel of giant steel making company Arrium before Arrium went bankrupt in 2016 and picked up by AIP.

How the 2023 ASX IPOs are performing

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | IPO Price | Current Price | Return | Market cap | Listing date |

|---|---|---|---|---|---|---|

| ACM | Aus Critical Mineral | 0.2 | 0.41 | 102.50% | $12,338,469 | 3/7/2023 |

| GDM | Great Divide Mining | 0.2 | 0.28 | 40.00% | $7,630,000 | 25/8/2023 |

| LM1 | Leeuwin Metals | 0.25 | 0.33 | 32.00% | $14,779,050 | 29/3/2023 |

| DYM | Dynamicmetals | 0.2 | 0.23 | 15.00% | $8,050,000 | 16/1/2023 |

| EG1 | Evergreenlithium | 0.25 | 0.27 | 8.00% | $15,182,100 | 11/4/2023 |

| COV | Cleo Diagnostics | 0.2 | 0.21 | 2.50% | $14,918,875 | 22/8/2023 |

| HTM | High-Tech Metals | 0.2 | 0.21 | 2.50% | $4,808,990 | 23/1/2023 |

| RDX | Redox | 2.55 | 2.55 | 0.00% | $1,359,960,899 | 3/7/2023 |

| AUG | Augustus Minerals | 0.2 | 0.20 | -2.50% | $15,317,800 | 25/5/2023 |

| ILT | Iltani Resources | 0.2 | 0.19 | -5.00% | $7,939,644 | 30/6/2023 |

| CVB | Curvebeam Ai | 0.48 | 0.45 | -6.25% | $80,460,158 | 23/8/2023 |

| DY6 | Dy6Metals | 0.2 | 0.18 | -10.00% | $6,941,249 | 29/6/2023 |

| CHW | Chilwaminerals | 0.2 | 0.18 | -12.50% | $8,028,125 | 5/7/2023 |

| ASK | Abacus Storage King | 1.41 | 1.22 | -13.48% | $1,642,628,703 | 1/8/2023 |

| NGX | NGX | 0.2 | 0.16 | -22.50% | $14,497,894 | 16/6/2023 |

| PL3 | Patagonia Lithium | 0.2 | 0.16 | -22.50% | $7,595,543 | 31/3/2023 |

| SQX | SQX Resources | 0.2 | 0.12 | -40.00% | $3,000,000 | 20/2/2023 |

| GHY | Gold Hydrogen | 0.5 | 0.27 | -46.00% | $14,230,756 | 13/1/2023 |

| ADC | Acdc Metals | 0.2 | 0.07 | -64.50% | $3,342,148 | 17/1/2023 |

| VHM | VHM | 1.35 | 0.47 | -65.19% | $72,241,580 | 9/1/2023 |

| ACE | Acusensus | 4 | 0.89 | -77.75% | $100,919,980 | 12/1/2023 |

There was one IPO on the ASX over the past week, that of Great Divide Mining (ASX:GDM).

Listed at 20c, the Queensland explorer is focusing on a high-potential portfolio of gold and critical metals assets with initial emphasis on its Yellow Jack gold project in Greenvale, Queensland.

The projects have close proximity to existing heap leach and Carbon-in-Pulp process plants, enabling project development with limited capital expenditure.

GDM says it has commenced engaging consultants to work on its maiden JORC 2012 compliant mineral resource estimate at Yellow Jack – which it expects to be completed within the coming weeks.

Meanwhile, the best IPO stock in 2023 so far is Australian Critical Minerals (ASX:ACM).

ACM announced earlier this week that its maiden exploration program has been successfully completed at the Cooletha lithium project in the Pilbara.

The company has only covered approximately 15% of the pegmatite prospective region, and the results from the first batch of 94 rock samples from Cooletha submitted to the laboratory are about 6-8 weeks away.

Upcoming ASX IPO listings

All dates are sourced from the ASX website. They could change without notice.

Novo Resources (ASX:NVO)

Expected listing: September 11

IPO: $7.5m at $0.20

Novo is a Canadian gold explorer currently listed on the TSX and OTCQX.

It owns one of the largest prospective gold and battery metals land packages in the Pilbara.

The Nullagine Gold Project is located approximately 185km north of Newman, and within the Mosquito Creek Basin.

The project includes the 1.8Mtpa CIL processing facility, an onsite laboratory, 10MW power station, and fully permitted TSF along with a facility to process mechanical sorter products.

Freightways Group (ASX:FRW)

Expected listing: September 14

IPO: $20m at indicative price range of between $1.55 and $1.90

Freightways is a leading provider of express package services throughout New Zealand, with complementary information management and business mail operations.

Its flagship brand, New Zealand Couriers, has operated in the express package industry for nearly 40 years, having been a pioneer of the industry in New Zealand.

Today, Freightways operates through its leading brands such as New Zealand Couriers, Post Haste Couriers, SUB60, DX Mail and Online Security Services.

Pioneer Lithium (ASX:PLN)

Expected listing: September 18th

IPO: $5m at $0.20

Pioneer’s main game is the Root Lake project, which covers 1927ha 100km of Sioux Lookout in northwest Ontatio, contiguous to GT1’s Root Bay and McCombe pegmatite projects. Together they host 12.6Mt at 1.21% Li2O.

PLN says drill permits are already in place, while it also owns the Lauri Lake project in Ontario and LaGrande project over 4687ha along trend from Corvette in Quebec.

The company says the Root Lake Project represents an exceptional opportunity, lying between two existing deposits, with compelling potential for future exploration to extend this known lithium mineralisation onto Pioneer’s ground.

Far Northern Resource (ASX:FNR)

Expected listing: September 21

IPO: $6m at $0.20

FNR is planning to drill down into the Empire Gold Project 34km west of Chillagoe inland from Cairns.

Explored privately by FNR since 2018, the project already has a resource of 820,000t at 0.85g/t for 22,500oz, 16,890oz of those in the indicated category.

It sits within a marathon run of Chillagoe and two mines in Mungana and Red Dome that have produced gold in recent times.

When it closed in 1997, Red Dome had delivered over 700,000oz of gold and 29,000t of copper over a decade at a grade of 2.1g/t.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.