IPO Wrap: Guzman y Gomez preps possible IPO, recent fintech lister CAB Payments craters 72pc in one day

Aussie food chain Guzman Y Gomez preps for possible IPO. Picture Getty

- Recent London lister, CAB Payments crashed by 72pc on Tuesday

- Aussie food chain Guzman Y Gomez preps for possible IPO

- We look at upcoming IPOs on the ASX

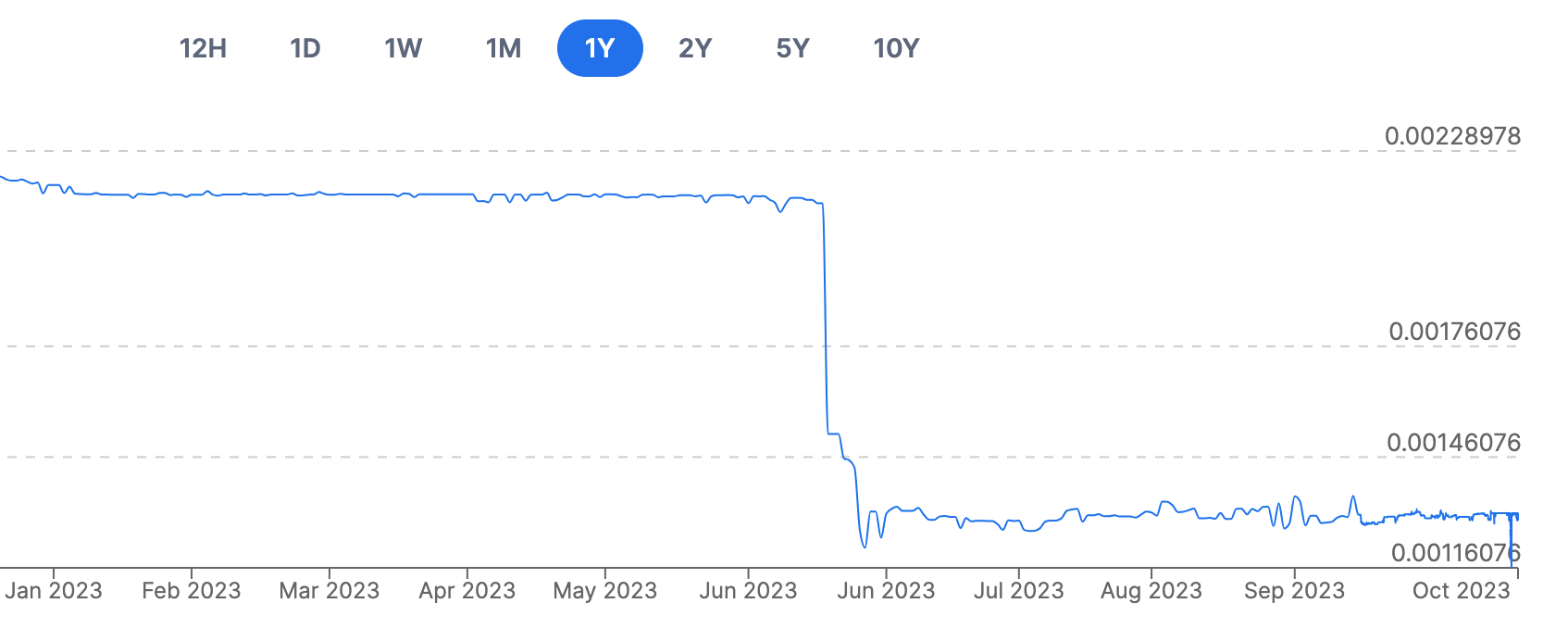

CAB Payments, the payments processing company that went public on the London Stock Exchange a few months ago, cratered by 72% on Tuesday.

Investors in the fintech stock scrambled for the exit after the company issued a dire warning on revenues.

CAB Payments provides foreign currency and cross-border payment services for businesses, and has attributed the weaker forecast to “changes to the market conditions”.

The company cited the Nigerian naira, Central African franc, and West African franc as some of the currencies that are compressing its margins.

The Nigerian naira has indeed plunged by 90% since June, as the country grappled with US dollar shortages that worsened under suspended central bank governor, Godwin Emefiele.

CAB Payments warned that its business will continue facing headwinds in the coming months, and the situation could even worsen as the US dollar continued its bullish trend.

Guzman y Gomez preps for possible IPO

Back home, yet another IPO hopeful, Guzman y Gomez, has fronted fund managers in the past week.

Word is that the Mexican food chain is eyeing a valuation of around $1.5bn.

The chain was founded in Sydney in 2006 by New Yorkers and childhood best friends, Steven Marks and Robert Hazan.

Marks was a former hedge fund manager, while Hazan had a background in fashion.

There is no definitive timeline on the IPO, but it’s likely to be some time in 2024.

Here’s how the 2023 ASX IPOs are performing

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | IPO Price | Current Price | Return | Market cap | Listing date |

|---|---|---|---|---|---|---|

| GDM | Great Divide Mining | 0.2 | 0.305 | 53% | $7,630,000 | 25/8/2023 |

| PLN | Pioneer Lithium | 0.2 | 0.3 | 50% | $9,900,000 | 28/9/2023 |

| ACM | Aus Critical Mineral | 0.2 | 0.28 | 40% | $11,297,875 | 3/7/2023 |

| JBY | James Bay Minerals | 0.2 | 0.27 | 35% | $13,140,225 | 12/9/2023 |

| LM1 | Leeuwin Metals Ltd | 0.25 | 0.305 | 22% | $12,091,950 | 29/3/2023 |

| NVO | Novo Resources Corp | 0.2 | 0.195 | -3% | $8,062,500 | 11/9/2023 |

| NDO | Nido Education | 1 | 0.96 | -4% | $215,000,000 | 16/10/2023 |

| CGR | CGN Resources | 0.2 | 0.19 | -5% | $17,200,000 | 18/10/2023 |

| NGX | NGX | 0.2 | 0.185 | -8% | $18,122,368 | 16/6/2023 |

| RDX | Redox Limited | 2.55 | 2.31 | -9% | $1,239,192,170 | 3/7/2023 |

| CHW | Chilwaminerals | 0.2 | 0.18 | -10% | $7,798,750 | 5/7/2023 |

| AUG | Augustus Minerals | 0.2 | 0.17 | -15% | $19,588,800 | 25/5/2023 |

| HTM | High-Tech Metals | 0.2 | 0.17 | -15% | $4,685,683 | 23/1/2023 |

| EG1 | Evergreen Lithium | 0.25 | 0.21 | -16% | $15,463,250 | 11/4/2023 |

| COV | Cleo Diagnostics | 0.2 | 0.165 | -18% | $14,191,125 | 22/8/2023 |

| DYM | Dynamic Metals | 0.2 | 0.16 | -20% | $8,050,000 | 16/1/2023 |

| ASK | Abacus Storage King | 1.41 | 1.025 | -27% | $1,484,936,347 | 1/8/2023 |

| ILT | Iltani Resources | 0.2 | 0.14 | -30% | $7,939,644 | 30/6/2023 |

| PL3 | Patagonia Lithium | 0.2 | 0.14 | -30% | $5,880,420 | 31/3/2023 |

| CVB | Curvebeam Ai Limited | 0.48 | 0.315 | -34% | $80,460,158 | 23/8/2023 |

| SQX | SQX Resources Ltd | 0.2 | 0.13 | -35% | $3,250,000 | 20/2/2023 |

| DY6 | Dy6 Metals | 0.2 | 0.1 | -50% | $6,169,999 | 29/6/2023 |

| GHY | Gold Hydrogen | 0.5 | 0.235 | -53% | $12,523,065 | 13/1/2023 |

| ADC | Acdc Metals Ltd | 0.2 | 0.075 | -63% | $3,389,220 | 17/1/2023 |

| VHM | VHM | 1.35 | 0.48 | -64% | $78,389,800 | 9/1/2023 |

| ACE | Acusensus Limited | 4 | 0.72 | -82% | $109,750,478 | 12/1/2023 |

There were a couple of listings on the ASX over the last couple of weeks – CGN Resources (ASX:CGN) and Nido Education (ASX:NDO).

CGN’s stock closed its debut day at 18.5c, down from the 20c listing price.

CGN is chasing IOCG, rare earths and nickel targets in the hot West Arunta region on WA’s border with the NT.

Its flagship Webb Project is a substantial 948km2 package of tenements in West Arunta, which has been recognised as a rare opportunity to target copper, nickel and specialty metals in a highly prospective terrain with very limited previous exploration.

Meanwhile, Nido Education closed its first day of trading at $0.96, down from the $1 listing price.

The early childhood education and care (ECEC) venture was created by founder of former ASX-listed Think Childcare, Mathew Edwards.

Think Childcare was sold in 2021 to the Ontario Teachers’ Pension Plan-backed Busy Bees Early Learning in 2021 for $3.20/share, valuing the company at ~$195 million.

Edwards and his team at Nido presently manage 28 ECEC centres. However, they reportedly plan to use a significant portion of the IPO funds to purchase an additional 24 centres.

Upcoming ASX IPO listings

All dates are sourced from the ASX website. They could change without notice.

Chariot Corporation (ASX:CC9)

Expected listing: October 27

IPO: $15.5m at $0.45

This lithium explorer is currently focused on selected projects located in the United States.

Assets include the flagship Black Mountain Project in Nevada, which contains outcropping pegmatites with grades of up to 6.68% Li2O from rock chip samples.

The Resurgent Project, also in Nevada, holds the second largest land position in the McDermitt Caldera, an area that hosts the largest lithium resource in the US at >40Mt of lithium carbonate equivalent (LCE).

Chariot says assay results and initial geological work suggest that these two projects compare favourably with respect to grade and scale with similar early-stage hard rock lithium and claystone lithium projects in the US.

Newmont Corporation (ASX:NEM)

Expected listing: October 27

IPO: This is not an IPO round, but a Chess depository interests (CDI) listing

Newmont is a global mining company with operations in Africa, Australia, North and South America. It is the world’s leading gold producer, but is also engaged in the production of copper, silver, lead and zinc.

Newmont, which is primary listed on the NYSE, created a dual listing on the ASX to help Newcrest Mining (ASX:NCM) investors receive Newmont stock after the it was acquired by Newmont.

Under the agreement, Newcrest shareholders were issued 0.4 Newmont shares for each NCM share they hold, plus a franked special pre-completion dividend of up to $US1.10 per share.

Newmont’s market cap on the NYSE stands at US$30.5 billion.

Western Australia Energy Resources (ASX:WER)

Expected listing: November 1

IPO: $5m at $0.20

WER’s flagship Jimberlana project in WA hosts an existing nickel resource along with lithium, gold and rare earths potential.

The company has an existing 9.25Mt at 0.81% nickel and 0.051% cobalt resource at Bronzite Ridge prospect, part of its flagship Jimberlana project west of Norseman.

This resource is based on historical drilling, which leaves the door wide open for the company to potentially boost those numbers.

WER says it’s planning a three-pronged exploration strategy, including infill drilling to increase the nickel laterite resource at Bronzite Ridge and obtain metallurgical samples for ore characterisation and processing studies.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.