IPO Watch: Moly Mines duo pair up again for new gold IPO

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

The former founding directors of unlisted Hibernia Gold, which was later renamed Moly Mines, have teamed up again to take new gold venture Kaiser Reef to the ASX.

Adrian Byass and Jonathan Downes have launched an IPO to raise $4.5m at 20c per share with the goal of lighting up the boards in late February.

It seems the pair are hoping to replicate the success of much bigger gold player Newcrest Mining (ASX:NCM) and fellow junior Alkane Resources (ASX:ALK).

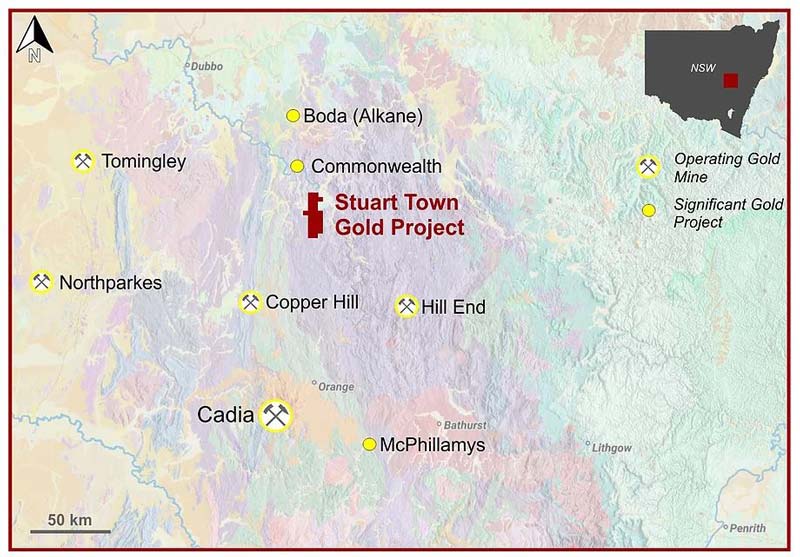

Kaiser Reef owns the rights to a gold project in New South Wales that sits between Newcrest’s Cadia mining operation and Alkane’s recent significant porphyry gold-copper drill intercept.

Back in September, Alkane discovered something very, very big at its Northern Molong porphyry project.

The company hit 502m at 0.48 grams per tonne (g/t) gold and 0.2 per cent copper, 211m from surface, at its Boda prospect.

And Kaiser Reef’s project sits not too far away:

Byass, who has taken on the role of chairman, says the company’s Stuart Town gold project covers a significant historic gold field that has had very limited exploration in a “premier district”.

“The board considers that one of the best indicators for a large-scale gold deposit is below a significant historic gold field that remains largely unexplored,” he said in the prospectus.

According to Kaiser Reef, its ground witnessed “significant historical production” exceeding 170,000 ounces of gold sourced from many relatively small lode and alluvial gold sources.

The Stuart Town project is also surrounding by several operating gold mines.

The proposed capital raising will give Kaiser Reef a roughly $6.7m market cap on listing.

Kaiser has only been around since September, when it was formed to acquire another unlisted company, Chase Metals.

Both Byass and Downes have more than two decades of experience in the mining industry.

They were founding directors of Hibernia Gold, which later became Moly Mines.

The company had been looking for potential opportunities in the mining sector since mid-2013, when it inked a mine gate sale deal for its Spinifex Ridge iron ore mine in Western Australia’s Pilbara.

It also owned the Spinifex Ridge molybdenum-copper project, but that had been on care and maintenance since the global financial crisis hit in 2008.

In early 2018, Moly Mines acquired ASX-listed Queensland Mining and added the White Range copper and gold project to its portfolio. The company rebranded as Young Australian Mines and is now working on bringing the White Range project into production.

READ: Moly Mines play for Queensland Mining just about wrapped up

Downes was also a founding director of Ironbark Zinc (ASX:IBG) and Siberia Mining and is currently a non-executive director of Galena Mining (ASX:G1A), Kingwest Resources (ASX:KWR) and Corazon Mining (ASX:CZN).

Meanwhile, Byass is currently a director of Infinity Lithium (ASX:INF), Galena Mining, Kingwest Resources and Fertoz.

He also did a short stint as chairman at troubled gold producer Orinoco Gold (ASX:OGX).

Byass told Stockhead in March that he was brought in to help Orinoco because of his past success in the mining industry, particularly with bringing gold mines into production.

READ: Orinoco Gold’s new chairman sets the record straight on what is going on at its Brazil mine

Kaiser Reef informed shareholders of that fact in its prospectus, stating that Byass served as non-executive chairman of Orinoco for 11 weeks until it was placed into voluntary administration on April 6.

“Mr Byass resigned as a director of Orinoco on 6 April 2019 prior to it appointing administrators, having been appointed on behalf of major shareholders of Orinoco as part of a proposed recapitalisation on 13 February 2019.”

The Kaiser Reef IPO closes on February 7, with listing slated for February 27 under the proposed ticker “KAU”.

Any documents linked or referred to in this article were not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in the documents linked or referred to in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.