IPO Watch: Here’s why African Gold was so hot on its grand entrance to the ASX

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Resources floats are not unlike betting on a horse race: there are favourites who are expected to win, but things often don’t go to plan.

But punters haven’t been afraid to take a gamble on West Africa-focused gold explorer African Gold and it’s paying off so far.

Just eight minutes after lighting up the boards on Thursday, the price of African Gold shares had doubled from their 20c issue price.

And though they didn’t stay at the price for long, shares were still ahead 50 per cent at 30c by the closing bell.

Over 1.8 million shares worth more than $600,000 changed hands in 228 trades.

So why was African Gold so loved up this Valentine’s Day?

One market commentator says its likely investors are piling in because the company has prospective projects in West Africa and a team that has had past success in the gold-rich region.

“It’s sometimes hard to say what it is about a new IPO that sets pulses racing,” Lion Selection Group director Hedley Widdup told Stockhead.

“IPO deals are very hard to time because of the preparation involved, and you never know if your concept overlaps with what the market is keen on.

“In the case of African Gold, the projects are early stage but pitched on what is known to be prospective geology in West Africa and with enough indications that are worth pursuing.

“But also, in this case, the key people have been successful in West Africa and also have broad relationships in the market. So I’d be guessing that element is what has attracted punters.”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

CEO Glen Edwards is a geologist with more than 25 years of experience in the mining industry, working for some of the biggest gold miners with operations in Africa such as Gold Fields, Newmont Mining and IAMGold.

Some more well-known personalities that make up African Gold’s board are Tolga Kumova, Evan Cranston and Steve Parsons.

Mr Kumova is best known as the former managing director and founding shareholder of Mozambique-focused Syrah Resources (ASX:SYR).

He took the graphite producer from a tiny explorer through to a top 200 ASX-listed mining company.

Both Mr Kumova and Mr Cranston have witnessed success with New Century Resources (ASX:NCZ), which recently restarted zinc production from the former MMG-owned Century mine in Queensland.

Mr Parsons, meanwhile, was the founding managing director of Perth gold explorer Gryphon Minerals, which he took from initial listing through to an ASX200 company.

He is also the managing director of Bellevue Gold (ASX:BGL), which just bolstered its gold resource in Western Australia by 43 per cent to over 1.5 million ounces.

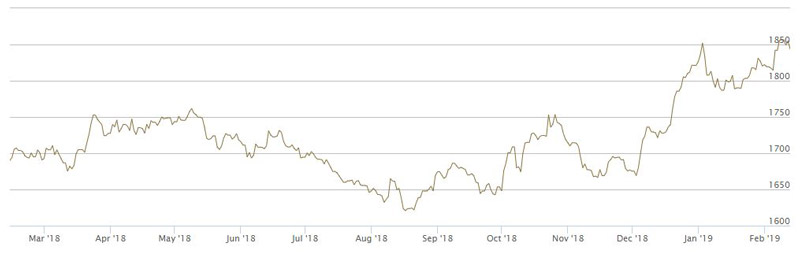

Gold is a pretty hot commodity right now, as the precious metal continues to fetch well over $1800 an ounce in Aussie dollars.

African Gold is exploring for gold in Ivory Coast at a project called “Agboville”.

The West African country is home to five major producing gold mines and a number of near-term development projects including Newcrest Mining’s (ASX:NCM) Bonikro mine and Perseus Mining’s (ASX:PRU) Yaoure and Sissingue projects.

The Ivory Coast has often lagged behind its West African neighbours for mining investment, after being plagued by a civil war in the early 2000s.

But improved transport infrastructure, along with the establishment of clear mining regulations, has given rise to an increase in foreign investment in the last five years.

Much of that investment has gone towards exploration, as the Ivory Coast holds the biggest share of the mineral-rich Birimian rocks that extend across West Africa.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.