IPO Watch: Copper-zinc play Tartana boasts near term production and blue sky potential

Pic: Getty

Tartana Resources (ASX:TNA) wants to bring its brownfields copper and zinc projects into production quickly.

Tartana was formerly Riverside Energy, a UK-based coal explorer. But following a $40.4m cash injection from private equity firm EMR Capital, Tartana de-merged the coal project into private British company West Cumbria Mining.

Now it’s looking to tap Australian investors to pursue its new goal of becoming a “significant copper-zinc company”.

The first step is an IPO this month, ahead of a potential August listing. Tartana is looking to raise between $4m and $6m selling 20m to 30m shares at 20c each.

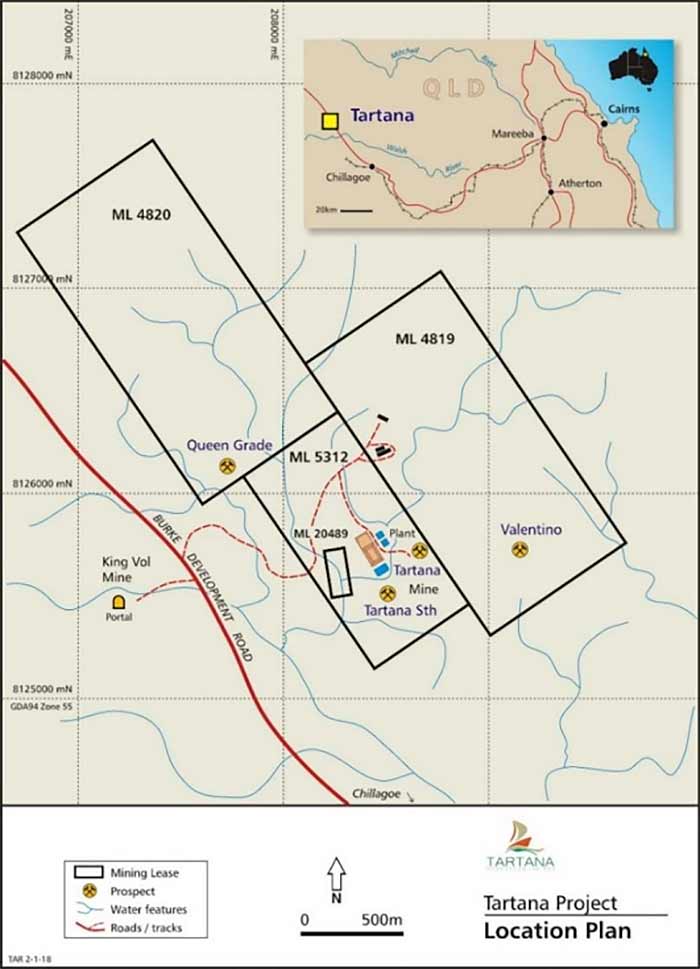

Tartana owns a previously mined copper and zinc project in northern Queensland (also called Tartana) and a zinc slag project in western Tasmania called Zeehan.

The flagship Queensland copper-zinc project comes with existing mine infrastructure and neighbours Auctus Minerals’ privately owned King Vol zinc mine.

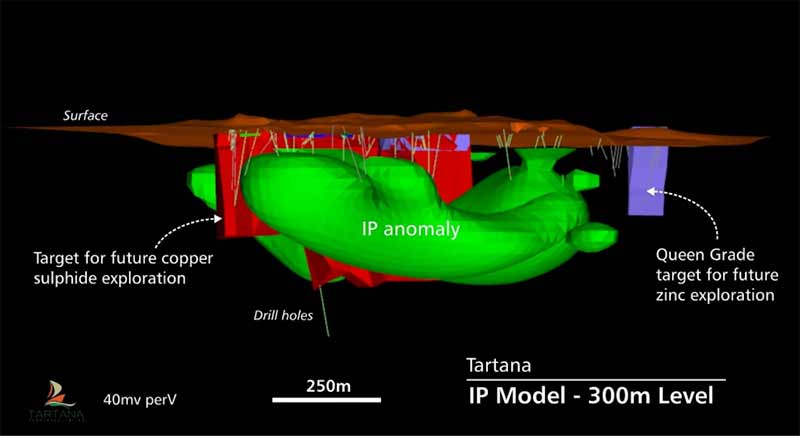

Tartana executive chairman Stephen Bartrop says the company’s Queen Grade zinc project has a similar mineralisation style to the King Vol orebody.

“Both Auctus and Tartana remain in discussions on various opportunities which may benefit all stakeholders,” he says.

“[It] requires drilling to upgrade the current open pit exploration target, which ranges between 0.3 to 3Mt at a grade range of 4 per cent to 10 per cent zinc for 11,000 to 290,000 tonnes of contained zinc,” he says.

But he says Tartana was initially attracted to the project by copper porphyry mineralisation along strike and below the open pit mine.

The company has used historical drilling and a significant geophysical IP anomaly to define a (also very broad) exploration target ranging between 11.2 Mt and 47 Mt at a grade range of 0.6 per cent to 0.8 per cent copper for 64,000 to 376,000 tonnes.

But the company wants quick cashflow, which is why the initial focus will be identifying copper oxide mineralisation and restarting sulphate production — which sells at a ~25 per cent premium to the LME copper price.

With existing infrastructure in place, Tartana reckons this can be achieved very quickly and cheaply.

Bartrop also says the Zeehan zinc slag project in Tasmania is an “exciting project in the current high zinc price regime and has, in my view, the potential to generate cash flows as well as providing an opportunity to later restore an old smelter site”.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Any documents linked or referred to in this article were not selected, modified or otherwise controlled by Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in the documents linked or referred to in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.