IPO Watch: $6m Mount Hope float puts focus back on copper-rich Cobar Basin

Mount Hope will put fresh eyes on a historic copper-producing region. Pic: Getty Images

- NSW’s Cobar region is one of the best mining districts in Australia, boasting numerous operations with historic production of 3Mt copper metal and 2Moz of gold over +140 years

- But the control of its largest mine by mining giant Glencore saw investment in exploration slip

- Renewed enthusiasm for drilling in Cobar basin a perfect opportunity for new IPO Mount Hope Mining

Over the past 20 years, the Cobar region of New South Wales has not seen the investment in new resources to match its enormous mineral potential.

The mills in the mining district are underutilised, a case in point is Glencore’s lackadaisical effort around the CSA copper mine – one of Australia’s highest-grade operations.

When American miner Metals Acquisition (ASX:MAC) – dual-listed on the NYSE and ASX – purchased the CSA mine for US$1.1 billion in June last year, it sent Cobar’s long-dormant exploration and development scene into a frenzy.

With the five existing mills still running below capacity and Polymetals Resources (ASX:POL) acquiring and restarting the Endeavor silver and base metals mine, Cobar is ripe for investment in new resources.

A new IPO which will see the New South Wales assets of Argentina-focused silver explorer Unico Silver (ASX:USL) spun out will test the appetite of investors for the recently reborn Cobar region.

With a ticker code of MHM, Mount Hope Mining’s IPO is seeking a minimum of $5m before costs via the issue of 25 million new shares at 20c, with the ability to accept oversubscriptions of up to a further 5 million shares to raise up to an additional $1 million.

And the latent capacity at CSA, along with its refreshed management and rising activity from other major players will put a premium on any discoveries made by nearby explorers like MHM.

“The CSA mine is the biggest in the region and has been operating semi-continuously for about 150 years, yet notoriously has excess milling capacity,” Mount Hope MD Fergus Kiley said.

“Glencore were never motivated to go and buy the other juniors in Cobar to keep the mill full because it would just be more administration of them and not accretive value.

“In terms of Glencore they’ve divested perhaps one out of 30 of their operations and you’ve put it into a company where it’s their sole asset and sole focus.

“Now they (MAC) are highly motivated to have that mill running at capacity, because they’re already running it.”

Kiley says having the biggest operation in the district in the hands of someone with the motivation to expand it will bode well for nearby explorers.

“The mill has the capacity to churn out 1.5-1.8Mtpa and Metals Acquisition has openly said they are in business for inorganic opportunities – meaning to acquire other projects that can add tonnes and run the mill at capacity.”

Ripe for investment

The Cobar Basin is one of the oldest mining centres in New South Wales, delivering 3Mt of copper metal and over 2Moz of gold across more than 140 years of continuous operations, along with significant quantities of lead, zinc and silver.

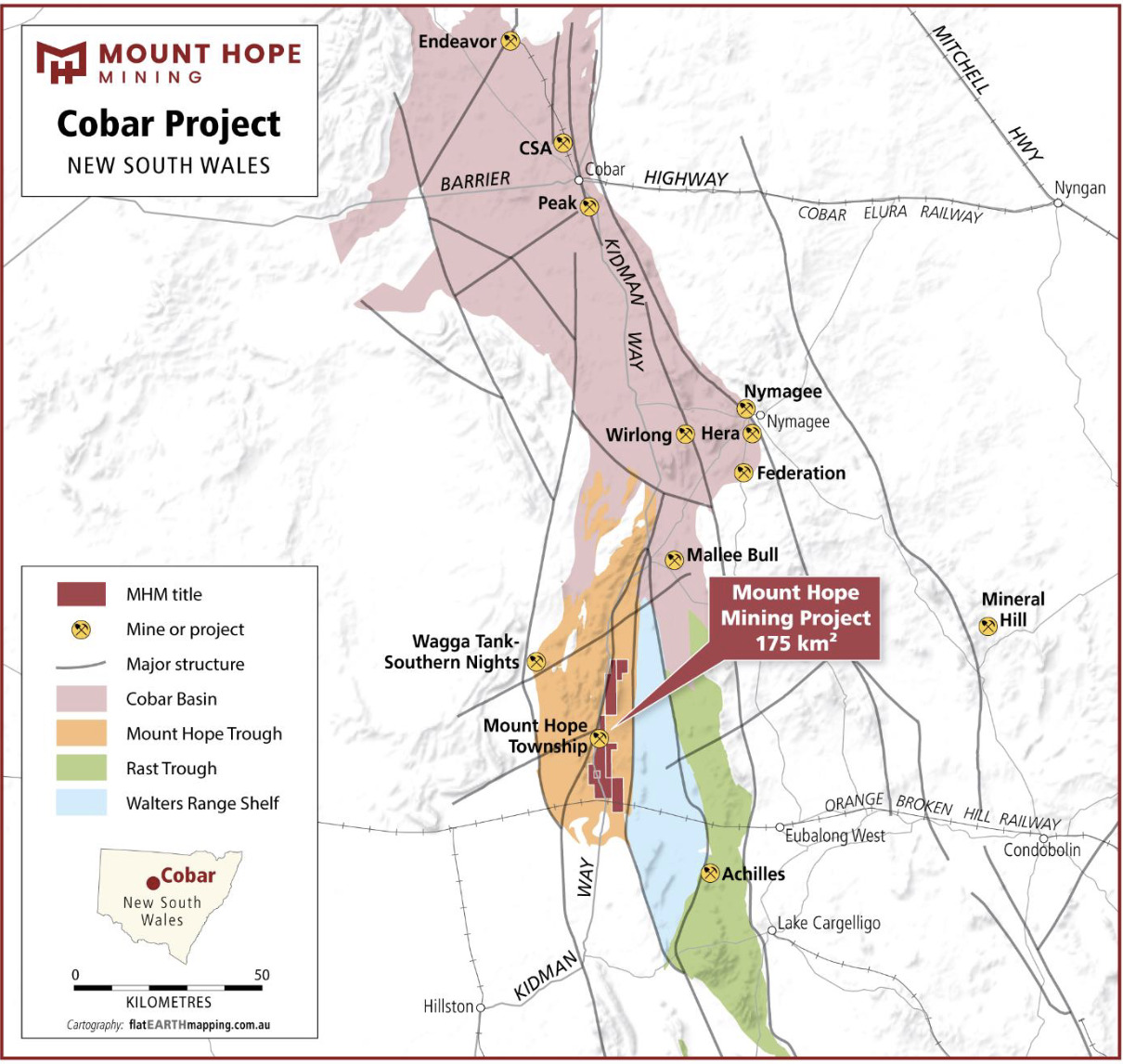

Alongside CSA, the Endeavor mine is also there along with Aurelia Metals’ Hera, Peak and Dargues operations, including the new zinc-rich Federation mine, as well as exciting recent discoveries like Peel Mining’s (ASX:PEX) Wagga Tank and Mallee Bull polymetallic deposits and Australian Gold and Copper’s (ASX:AGC) Achilles discovery near Lake Cargelligo.

Located just 148km south of CSA, Mount Hope contains a string of targets over 175km2 surrounding the historic Mount Hope township.

While there are no JORC compliant resources, Mount Hope is a shining example of the region’s mining legacy, delivering high-grade copper from 1878 until 1919 and then again during World War 2.

75,000t of ore was processed at a grade of 10.5% in its initial 41-year run, churning out 7891t of copper metal, with more than 4000t extracted in 1942 before mining ended at just 113m deep.

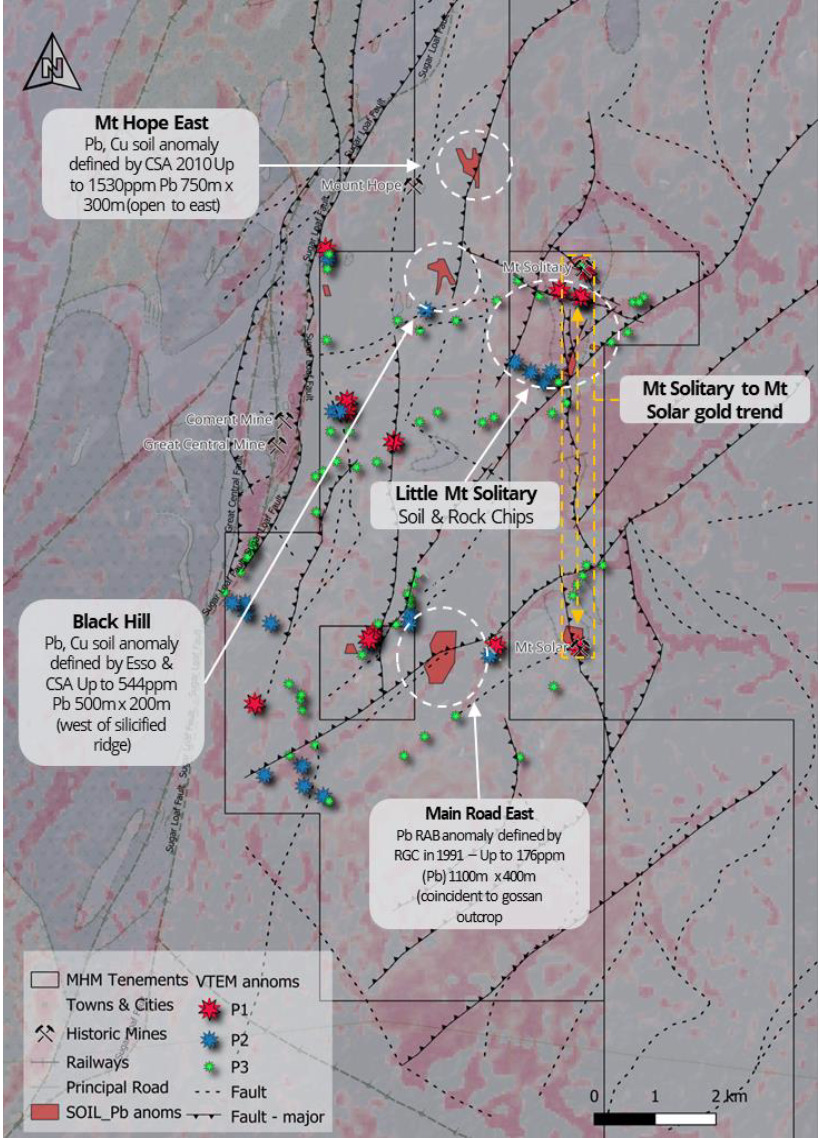

Today, MHM is looking to chase modern day discoveries at Mount Hope over five exploration prospects in a 15km long north-south corridor – Mt Hope East, Black Hill, Main Road East, Little Mt Solitary and the Mt Solitary to Mt Solar trend.

“Of those five, we have four very advanced exploration targets,” Kiley said.

“These are your classic Cobar-style VMS targets. They’re the type of exploration project that we’re looking for here that you see across the basin.”

VMS, or volcanogenic massive sulphides, are valuable because while those systems don’t have the tonnages of low-grade porphyries, their higher grades make them more profitable at a smaller scale with modest upfront capital.

“Those targets are defined by a soil geochemical anomaly at surface in the correct structural setting. So we’re in the right area, in the right rocks, with the right faults nearby,” Kiley added.

“We have access agreements in place with the three primary land holders, so we can get out and start working on the ground and we have, in fact, been out starting preliminary exploration work.”

Fresh eyes

Having come out of Unico Silver and previously been held by Glencore during its CSA days, Mount Hope already has runs on the board.

At Mt Hope East, a lead and copper soil anomaly was picked up by CSA in 2010 with up to 1530ppm lead over a 750m by 300m area that remains open to the east.

CSA in 2010 and Esso in 1977 also defined an anomaly at Black Hill with up to 544ppm Pb over 500m by 200m, while a RAB lead anomaly was also defined back in 1991 by RGC.

Previously as E2 Metals, Unico sunk seven RC holes into the Mount Solitary prospect, confirming high-grade gold that remains open at depth, showing it bears similarities to Aurelia’s Peak Gold Mines operations though no work was taken far enough to compile a resource.

Those datasets give Mount Hope a great head start for drill targeting, a major boon to stand out in what has been a weak IPO market.

“Mount Hope itself presents investors with an opportunity of coming into a company that has five shots at the dartboard with our exploration portfolio, which in its own right is high quality,” Kiley said.

“But also you have the tailwind of being in the right area at the right time.

“And generally, when you come out of these sort of bear markets, the companies that do the best, particularly in the early days, they’ve got the right rocks in the right area where all the activity is happening.

“We have multiple valuation levers that can be pulled and we’re not a one-trick pony, and that’s what really attracted me to the company and the opportunity.”

Who’s on board?

As with any IPO, an important aspect is who’s on board to lead the new explorer to discovery.

Unico, notably, will remain engaged with a 12% stake escrowed for 12 months.

Its boss Todd Williams will sit at MHM as a non-executive director, having previously recognised the need to give the Cobar basin prospects their own spotlight.

Having pushed the stock up almost 100% this year, USL’s investors are now in that company for its Argentine precious metals prospects, highlighted by a $22.5m placement last week to support a 50,000m drill program at Cerro Leon.

MD Kiley was previously a senior geologist and technical development lead for Wyloo, the private miner in Andrew and Nicola Forrest’s Tattarang investment group.

Experienced ASX director Ben Phillips, whose resources board roles include his position as chair at Norfolk Metals, will round out the team as non-executive chairman.

Whistler Wealth Management and Prenzler Group are jointly leading the IPO raise, which opened on October 30 and is scheduled to close on November 19.

According to the indicative prospectus timetable, MHM is targeting a December 9 date to list its shares on the ASX, with a post IPO market cap of $8.25-9.25m.

At Stockhead we tell it like it is. While Mount Hope Mining is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.