IPO Watch: $3bn coal play Coronado fails to impress in first week on ASX

US-based Coronado Coal made its debut on the ASX last week but hasn’t yet traded above its Initial Public Offering price of $4.

Coronado — the biggest coal mining float since Yancoal Australia’s $1.5 billion listing in 2012 — claims to the fifth biggest metallurgical (or coking) coal producer globally in 2017.

Metallurgical coal is a low-ash, low-sulphur and low-phosphorus coal that can be used to produce high-grade coking coal – an essential part of the steelmaking process.

The World Steel Association forecasts global steel demand will reach 1.62 billion tonnes this year – an increase of 1.8 per cent over 2017.

Prices for coking (and thermal) coal have more than doubled since the market bottomed out in 2016.

The $3.2 billion Coronado lit up the boards last week after raising $774 million in its IPO.

Coronado traded between $3.49 and $3.84 on its first day before closing at $3.60:

Over the course of its first week, the metallurgical coal producer has dipped as low as $3.05 before recovering somewhat to trade at around $3.48 on Monday afternoon.

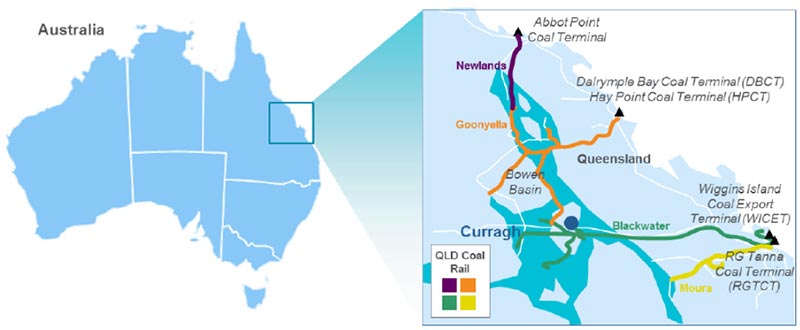

Coronado has eight producing mines in Queensland and the US.

It’s Australian operations are in Queensland’s Bowen Basin, Australia’s main source of coking coal:

Through acquisitions, Coronado has grown its coal sales from less than 500,000 tonnes in 2013 to more than 20 million tonnes in 2017 – making it one of the biggest metallurgical coal producers outside of the major diversified miners.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.