Investor appetite for Africa-focused ASX gold contenders remains strong

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Africa-focused gold plays are still very much on investors’ radars, with new ASX hopeful Megado Gold already witnessing strong demand for its upcoming IPO.

Exploration success has seen players like Predictive Discovery (ASX:PDI), which has a gold project in Guinea, go from sub-$5m battler to $60m market cap butterfly.

Chesser Resources (ASX:CHZ) and Oklo Resources (ASX:OKU) have also been rewarded following exploration success at their respective projects in Senegal and Mali.

Ethiopia-focused Megado Gold is next in line to light up the ASX boards and has already closed its bookbuild oversubscribed, raising the maximum $6m at 20c per share.

“The bookbuild was multiple times oversubscribed,” executive director Dr Chris Bowden told Stockhead.

“The response has been great from institutions, high net worth investors and some strategic capital as well.

“Clearly gold equities domestically have seen a rerating. A lot of exploration companies have had their exploration results rewarded by the market.

“Specifically, the Africa-focused names, Predictive Discovery, Chesser and even Oklo, have all had really good share price re-ratings on exploration success.

“So the broader market is very bullish on gold, but specifically I think African exploration names are really on investors’ radars at the moment.”

Fertile, underexplored region

Megado has six exploration projects covering 738sqkm in Ethiopia, which has seen little modern exploration.

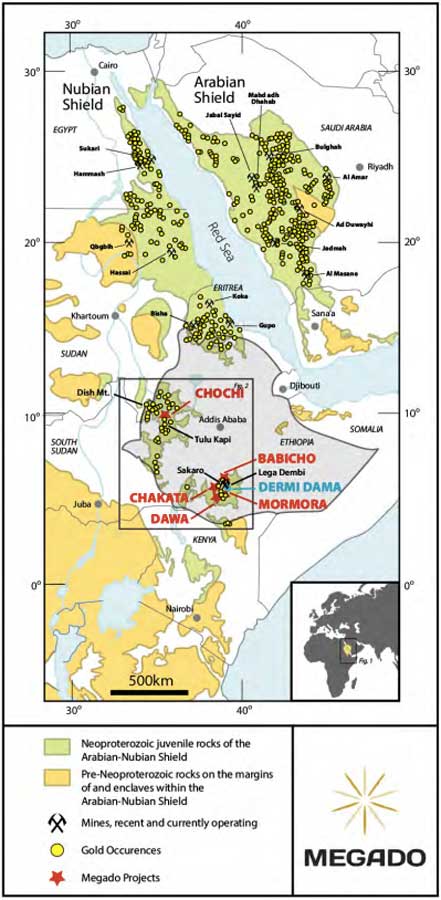

It is part of the prolific Arabian-Nubian Shield, which is host to at least six deposits with over 1 million ounces delineated despite the lack of modern exploration.

Megado’s landholding sits immediately along strike from Ethiopia’s only modern gold mines, Lega Dembi and Sakaro (+3 million ounces), and the country’s next gold mine, the +1.5-million-ounce Tulu Kapi deposit.

Ethiopia’s geological setting is similar to West Africa and Western Australia’s goldfields.

“It’s a very geologically prospective part of the world,” Dr Bowden said.

“It’s part of the Arabian-Nubian Shield, and it’s been underexplored, so there’s significant potential there to make a discovery.

“It’s also a very stable mining jurisdiction with a pro mining government and ministry looking to push forward the mining industry, and with good commercial royalties, taxes and free-carry.

“So it ticks all the boxes when you’re looking at a long-term commercial project and success of discovery.”

Ethiopia exploration experience

Dr Bowden is well-versed in exploration and making big discoveries in Ethiopia, having lived there for five years working as the only expat in a workforce of +200 employees when he discovered and drilled out the +1.5-million-ounce Dish Mountain Gold deposit in western Ethiopia.

Other members of the Megado team also have specific experience in Ethiopia, having been a part of the discovery and mining operations at the Sakaro and Lega Dembi mines, as well as the discovery and initial feasibility drill-out of Dish Mountain.

“There’s already a significant amount of manpower and resources in country that we are utilising now, and we’re putting in place some expat staff to help oversee the project as well,” Dr Bowden said.

“There’s numerous service providers in country, earthworks and drilling companies and sample prep labs, so we can fast track programs quite quickly given my previous history there and being able to tap into those networks that are already in place.”

Megado is aiming to list around October 26 under the ticker MEG.

The company will use the cash raised from the IPO to undertake exploration to pinpoint high-priority targets.

The 80 per cent-owned, 132sqkm Babicho project will be the site for maiden drilling, likely followed by the 100 per cent-owned, 62sqkm Chakata project.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.