How local knowledge makes WA gold IPO Mt Malcolm Mines unique

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

It’s one thing to have a vision when looking to list a mining exploration play on the ASX, and another entirely to have the contact book to make said vision happen.

When aspiring listee Mt Malcolm Mines gets on the boards in mid-September, it will do so with a unique story around four decades in the making.

It was the 1980s when managing director Trevor Dixon – the former boss of Kin Mining and a founding vendor of Jubilee Mines – first made his way to the Leonora area where gold explorer Mt Malcolm will focus its attention.

Learning the ropes under the tutelage of industry names such as Raymond Lovi Smith, the principal prospector who discovered Gold Fields’ Granny Smith project, Dixon got to know the ground, and the people, pretty well.

That geological knowledge was a great help in his past role at Kin (ASX:KIN), whose flagship Cardinia gold project has a mineral resource of 28.2 million tonnes at 1.27 grams per tonne for around 1.15 million ounces of gold, and no doubt that knowledge will be just as valuable at Mt Malcolm.

But were it not for the contact book, there’s no way Mt Malcolm Mines would be listing on the ASX.

A grand total of 15 (!) transactions covering nine target areas and 120 prospecting licences were required to pull together the company’s premium land position in the heart of the Eastern Goldfields – an area covering 30km of strike on the world-class Keith Kilkenny Tectonic Zone.

It was a process which took around 18 months, countless calls and a little bit of convincing, but its result is something to admire.

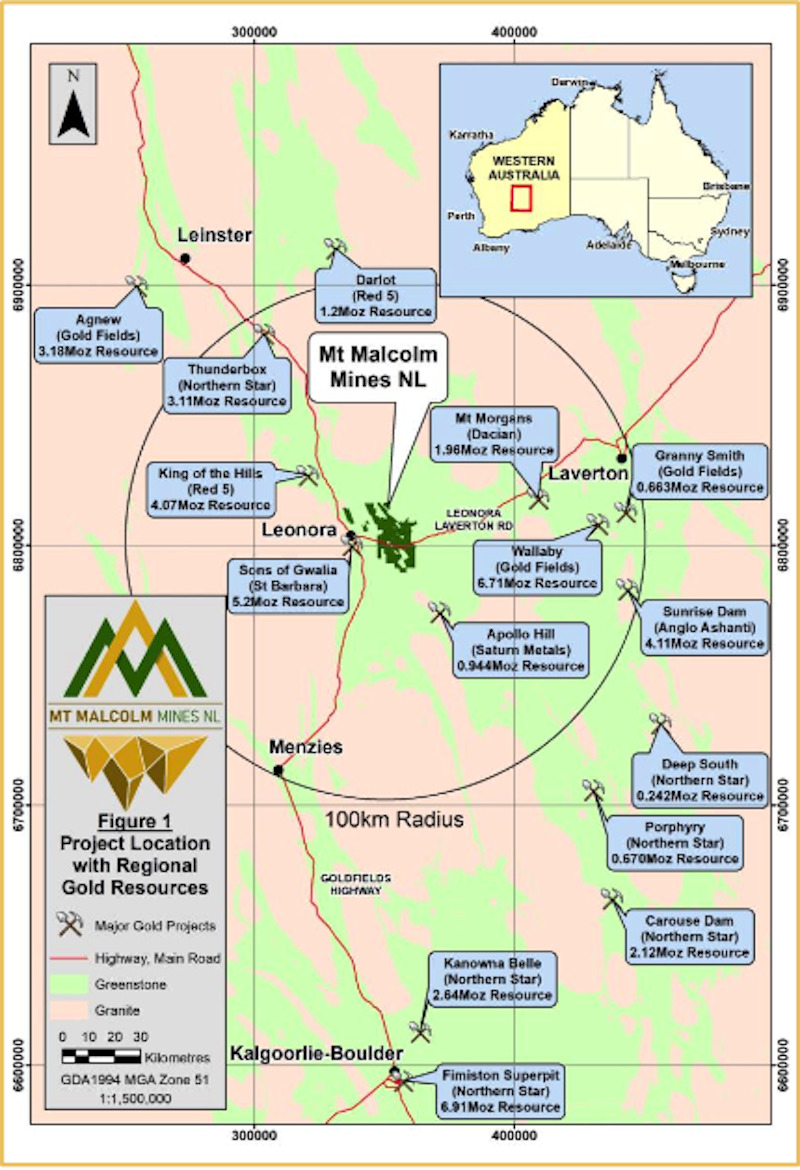

The term ‘world-class’ gets thrown around a lot when it comes to exploration IPOs, but it doesn’t appear to be used lightly here. Have a look at the names and ounces in the vicinity.

The 274km2 package sits 10-25km east of Leonora, includes some gold producers of historical significance, and lies central to eight producing gold mines and mills within a 100km radius. Some of those mills are hungry for local feed.

Mt Malcolm says limited modern exploration techniques have been applied across its tenement portfolio.

“I am extremely excited to be able to consolidate this premier tenement package,” Dixon told Stockhead in conversation recently.

“It’s well situated in a tier-one mining and exploration district, and we’ve brought together a really significant package which revolves around being one of the region’s great controlling structures.

“The Keith Kilkenny Tectonic Zone is a structure that businesses like Saracen Mineral Holdings had built their operations on – we’ve recently seen that business consolidate with Northern Star Resources.

“We have pulled together a significant package in the right area, and we’re looking to really get in there and build some resource ounces.”

Potential lies in wait

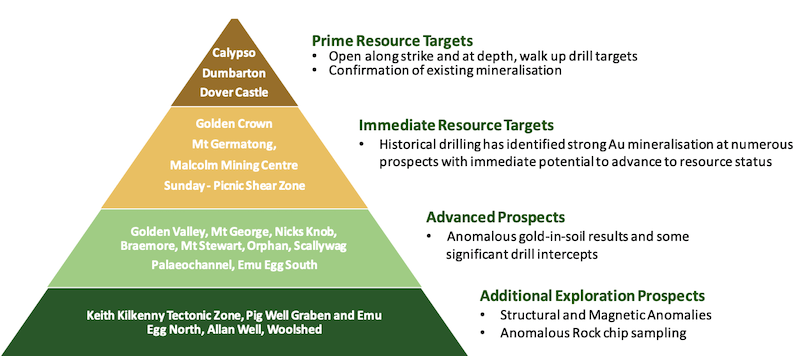

The plan of attack for the nine prospects on the Mt Malcolm books is designed to allow the company to build resource ounces quickly.

There are three prime targets – Calypso, Dumbarton’s and Dover Castle – though all nine of the prospect areas have had some level of drilling over the journey and the latter two were mined in the early 1900s.

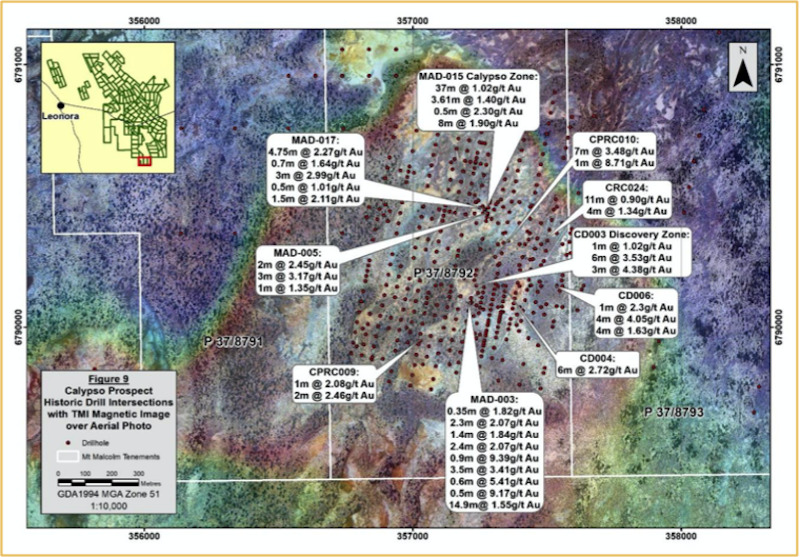

At Calypso, a large magnetic signature has already been established, and Mt Malcolm has set a conceptual exploration target of between 2.9 and 3.9 million tonnes at grades ranging from 1.6 grams per tonne gold to 2.2g/t.

The prospect was originally discovered by BHP in the 1980s, with shallow dipping gold deposit mineralisation noted. It then traded hands a number of times, and its multiple owners explored with inconsistent strategy for its ore style.

Historical drill hits from Calypso include 5m at 4.78g/t from 10m, 14.9m at 1.55g/t from 190.5m to near end-of-hole, 37m at 1.02g/t from 8m, and 5m at 4.56 g/t from 102m1.

The company is planning two-phase diamond drill program and RC programs to delineate a JORC compliant mineral resource.

At Dover Castle, mineralisation sits within steeply dipping quartz veined shears, with strike extensions mineralised over two kilometres despite the corridor having only been tested with shallow percussion drilling.

Historical intersections here have hit 16m at 2.34g/t from 4m, and 24m at 2.48g/t from 10m including 5m at 7.37g/t from 18m.

Mineralisation at Dumbarton’s sits within steeply dipping quartz vein shears, with the deposit open along strike and down dip of current drillholes.

Past hits include 4m at 5.73g/t from 35m, and 4m at 7g/t from 44m. Compelling numbers.

A target zone of more than 700m by 50m will be drill tested by Mt Malcolm.

Mt Malcolm also has a number of immediate resource targets, where multiple intercepts provide the opportunity for the company to convert to mineral resources, as well as advanced prospects and additional exploration prospects as well.

It’s a substantial base from which to build a company.

M&A activity a factor to watch

With so many large deposits and mills in the area to feed, it makes sense that the region has seen an uptick in M&A activity of recent times.

Dacian Gold (ASX:DCN) and NTM Gold announced plans to merge in November last year, in a deal worth $84.6 million, or $125.60 per resource ounce when factoring in NTM’s mineral resource base of 679,000 ounces.

NTM’s Redcliffe gold project sits within 100km of Dacian’s Mt Morgans gold operations.

In July, St Barbara (ASX:SBM) acquired a 19.8% stake in Kin – their first major acquisition in the region and a move designed to keep the 1.4 million tonne per annum Gwalia mill fed under its regional strategy.

Mt Malcolm’s tenements sit around 25km from Gwalia, and Dixon said that presented a real opportunity for the IPO once its projects were better understood.

“Our aim is to pull some ounces together into JORC compliance in our initial 9-12 months, and then look to do a little early feasibility work,” he said.

“That could give us the opportunity to get some cashflow into our business at an early point through the mills in our district.”

The Mt Malcolm IPO is currently open, with $8 million worth of anticipated proceeds at 20c which the prospectus forecasts would give it a post-raise market capitalisation of $16 million.

Management plans to put $5.5 million of that raise into the ground over the first two years – a move that will no doubt be watched by investors with interest.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.