China’s controlling a pretty awful IPO market so far this year

IPOs. All you can eat. Via Getty

- EY Global IPO Trends Q2 2023 shows YTD, global IPO volumes fell 5%, proceeds down 36% YOY

- China accounted for lion’s share after Beijing reforms

- Asia-Pacific continues to dominate with circa 60% share

The global IPO market has been stagnating ever since the start of last year as economic conditions soured and then Russia up and invaded Ukraine contributing a to a general sense of madness, uncertainty, a stack of inflation followed by what’s been a pretty relentless and intense string of interest rate rises.

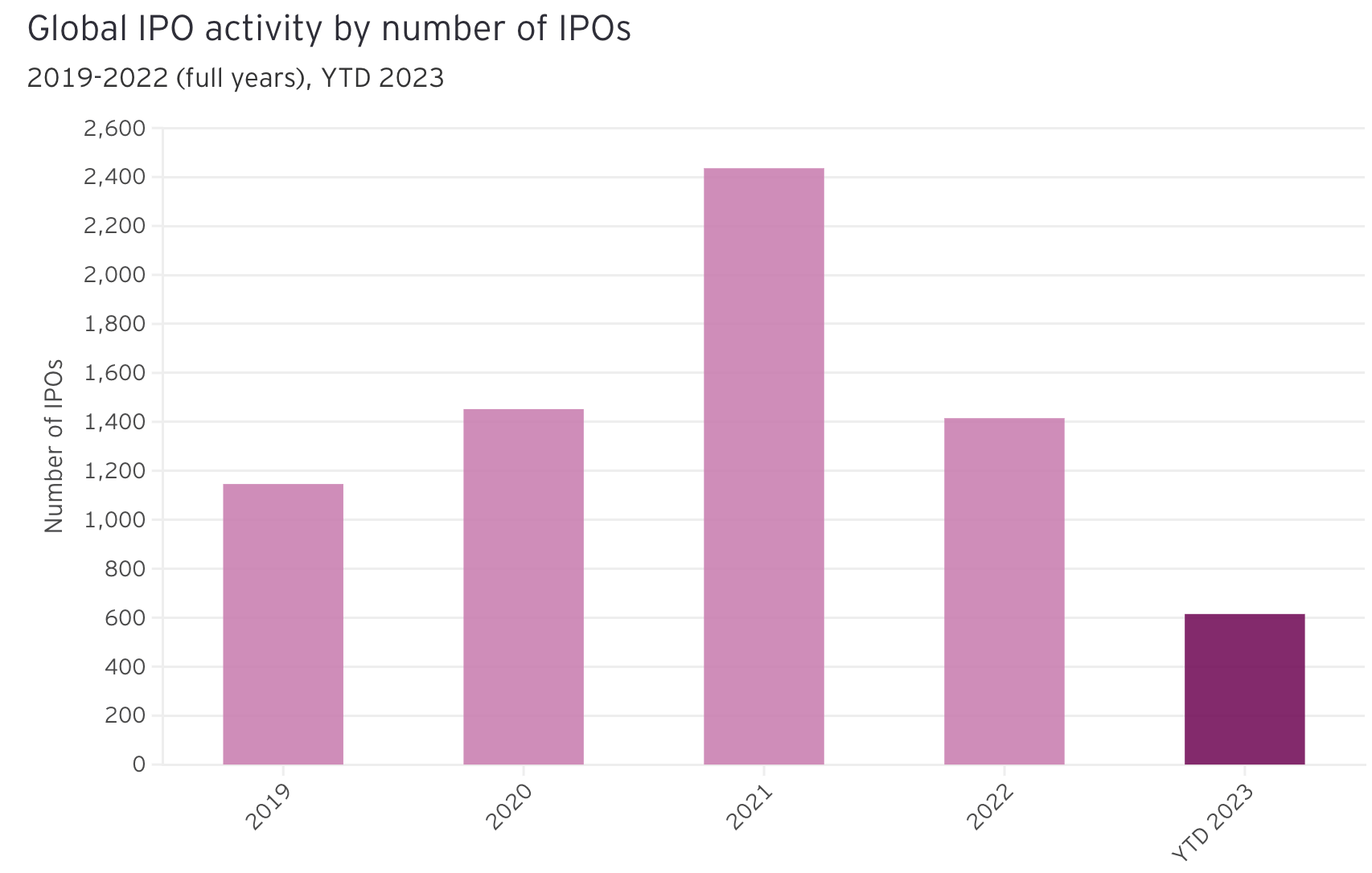

But the world’s kept turning and in a sense so have IPOs. Around the world in 2023 EY says there’s been some 615 Initial Public Offerings, raising about US$61 billion. It’s not a heap by any yardstick, but the engine’s still ticking over.

The question is what can herald in a long-awaited revival in a once thriving IPO market after what’s been the longest downturn since the internet tech crash.

In terms of volume YTD action’s about -5% on last year and well over one-third lower (-36%) on raised capital, year-on-year (YOY).

The EY data, released overnight, suggests some decently larger deals came to market in Q2 compared to Q1, but the recovery is slow and as difficult to watch as Michael Schumacher putting on dancing shoes.

“These modest results reflect slower global economic growth, tight monetary policies and heightened geopolitical tensions,” EY notes.

China floats

According to Bloomberg, China was the world’s go-getter on the IPO front over the first half of 2023. The increasingly cranky #2 global economy accounted for almost half of global fundraising, with Beijing testing out some overdue capital market reforms which opened the floodgates for some shonkier state-related companies to get public and flog some new shares.

The Chinese Communist Party has shown a willingness to reopen the flow of cash with recent capital market reforms which fast-track public floats.

IPOs across Shanghai, Shenzhen and Beijing exchanges in the six months to June, came to reap a roundUS$31 billion from in a global total of US$67.9 billion.

“The launch of the new registration system has left the door open for more high-quality offerings on China’s capital market,” Lin Jin, an analyst at Shenwan Hongyuan told the SCMP.

“That is an effective push for connecting the real economy with the capital market.”

Mainland China’s three stock exchanges handled 172 IPOs in the first six months of the year, compared with 166 in the same period last year, according to Bloomberg data showed.

By sector, industrials led with 75 billion yuan (US$10.5 billion) of funds raised, followed by tech which raised 51.8 (US$7.6 bn) billion yuan as China ramped up its tech self-reliance campaign as US export sanctions loomed.

On the plus side

Digging about for the good news – EY says some emerging markets are cracking along with some surprising IPO action.

In good news for ASX possibles and probables, the global demand for rich mineral resources, vast populations, growing unicorns and entrepreneurial small- and medium-sized enterprises (SMEs) have seen particular emerging markets benefit.

While the technology sector continues to be the leading sector in IPO activities to date in 2023, IPO proceeds raised by companies of the energy sector have dwindled on the back of softer global energy prices.

Also of some note – ross-border activity has experienced a significant surge in both volume and proceeds, the firm says – that’s primarily attributed to the growing influx from China into the US and a steady flow into the Swiss Stock Exchange (no thanks to Credit Suisse).

Unspactacular

The special purpose acquisition company (SPAC) market continued to be challenged with negotiations becoming increasingly complex. There is still an exorbitant number of SPACs yet to announce or complete a de-SPAC, which are facing liquidation by the expiration period in the next six months. However, we do expect SPAC IPO activities to return to a more sensible and sustainable level that were seen pre-2021.

Regions: Q2 beats Q1

China was the world’s most active market for initial public offerings (IPOs) in the first half of the year, accounting for almost half of global fundraising, as Beijing unleashed capital market reforms which made it easier for companies to sell new shares.

Chinese companies raised a combined US$31.3 billion from IPO flotations on the Shanghai, Shenzhen and Beijing exchanges in the six months to June, in a global total of US$67.9 billion, Bloomberg data showed.

Chinese markets have had a pretty dire run of it in 2023 thus far has. Goldman Sachs has led a raft of forecast downgrades while a faltering tech sector and manufacturing, property growth outlook has made the Middle Kingdom look rather middling.

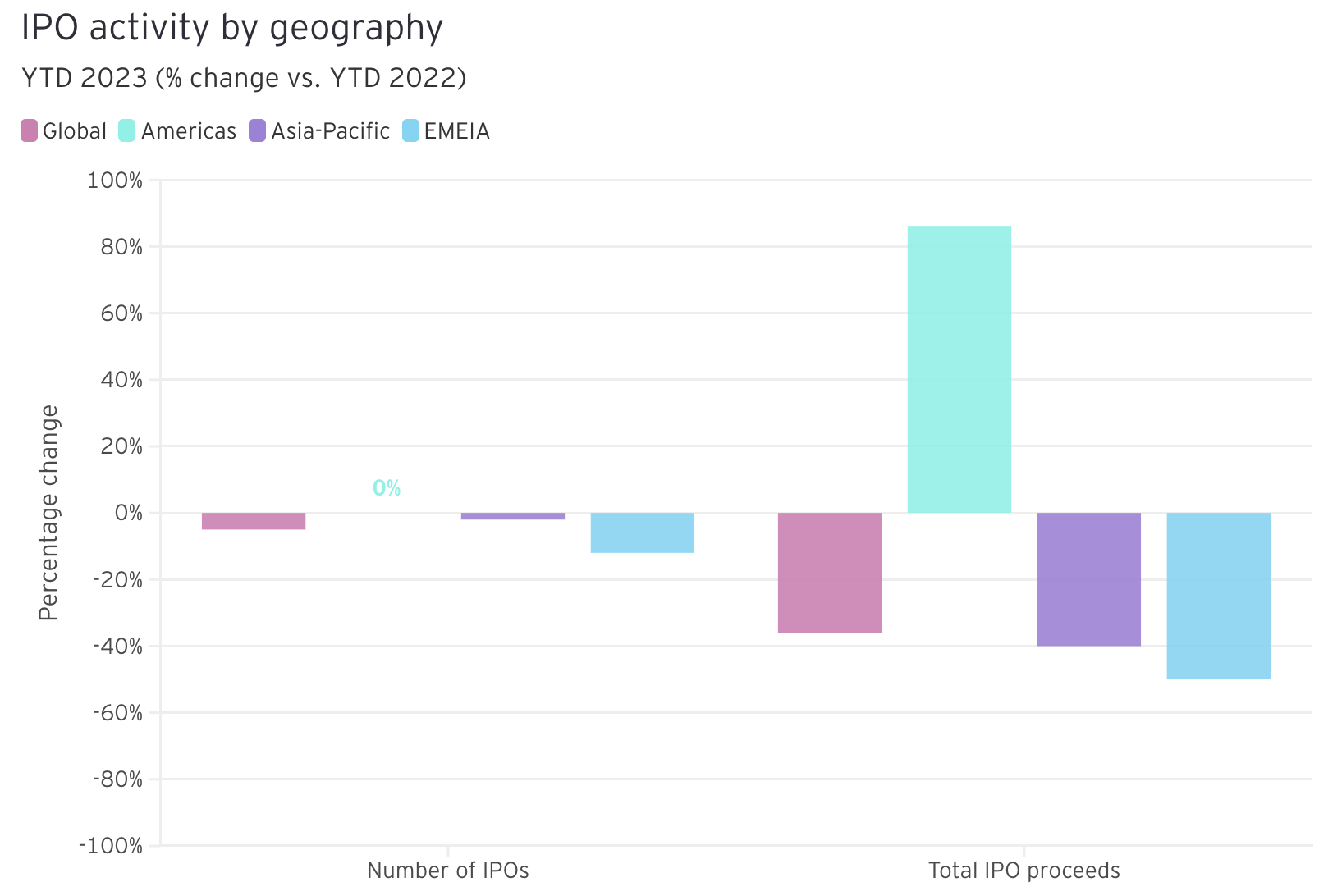

While the number of IPOs remained flat, the Americas region saw an increase in proceeds of 86%, raising US$9.1b, YOY. This growth was primarily attributed to a single mega spin-off IPO, which happened to be the largest US IPO since November 2021.

The US experienced an uptick driven primarily by a few large deals and recent improvements in market sentiment could be a sign for more US IPO activity later in 2023 or 2024.

However, despite the positive developments, it may take the overall Americas IPO market longer to recover than many market participants forecasted at the beginning of the year due to the unforeseen banking crisis in 2023.

Asia-Pacific: IPO capital du monde

YTD, the Asia-Pacific IPO market has maintained its position as the global leader in IPO volume and value, with an approximate 60% share.

Of the top 10 global IPOs, half were from Mainland China and one was from Japan. The region saw 371 IPOs raising US$39.4b in this period, a YOY fall of 2% and 40% respectively – proceeds were down significantly due to a cooler-than-expected Mainland China IPO market, with many large IPOs waiting on the side-line.

For the first time in more than 20 years, Indonesia has surpassed Hong Kong in the global stock exchange rankings by deal number.

EMEIA IPO activity has continued to shrink, with 167 listings raising US$12.4b YTD, a 12% and 50% fall YOY, respectively.

Several Middle Eastern companies are planning initial public offerings (IPOs) in 2024 instead of this year, a senior Bank of America (BoA) exec told Reuters this week, amid worries of a global recession.

Despite this, the region kept its position as the second largest IPO market with 27% of all IPOs deals, and saw the second biggest IPO at US$2.5b. India exchanges also broke a two-decade streak, jumping to the top spot in deal count.

However, Paul Go, EY global IPO boss, says inflation in most EU nations ‘remains challenging, and the lack of liquidity continues to hold back IPO activity.’

“Against the backdrop of a divergent global economy and unpredictable geopolitical landscape, some stock markets are reaching a long-time high and enjoying low volatility. Certain theme-centric sectors such as technology and clean energy are signaling an upswing in IPO activity.

“Large, well-established companies are demonstrating enduring resilience, while growth narratives with more realistic and acceptable valuation are becoming more receptive by the market. In this shifting environment, companies need to prepare now to be ‘IPO-ready’ for any forthcoming windows,” Paul said.

2H IPO pipeline

EY reckons a resurgence in global IPO activity is ripe for late 2023 ‘as economic conditions and market sentiment gradually improve’ assuming of course that the current tight, sticky monetary policy woes are in their final stages.

“After the one mega spin-off IPO debut in the US that outshone all other traditional IPOs, there are strong indications that this trend will persist. Large corporate spin-offs and carve-out listings will likely surface across major markets, as companies seek to create more shareholder values through divestiture while investors lean toward mature, profit-making businesses amid a yet-to-revive IPO market,” The firm noted.

They also said this:

“Understanding the different requirements of each IPO market that companies plan to enter is essential to meet investor expectations and avoid potential delays due to regulatory issues. Investors will continue to be more selective, orienting toward companies with solid fundamentals and proven track record. All options, from alternative IPO processes (direct listing or de-SPAC merger) to other financing methods (private capital, debt or trade sale), should be considered.”

According to the FT, venture capitalists, punters and investors are probably feeling a whole lot more upbeat than the tale EY is telling after June 30th proved to be the busiest day of new listings in the US since November 2021.

Three companies started trading on Thursday after each of them raised more than $100mn in IPOs, marking the busiest day for listings since November 2021 and the latest in a series of encouraging recent milestones.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.