2024 IPO Performers: Which fresh listings stole the stage this year?

Resources IPOs outperformed this year. Pic: via Getty Images.

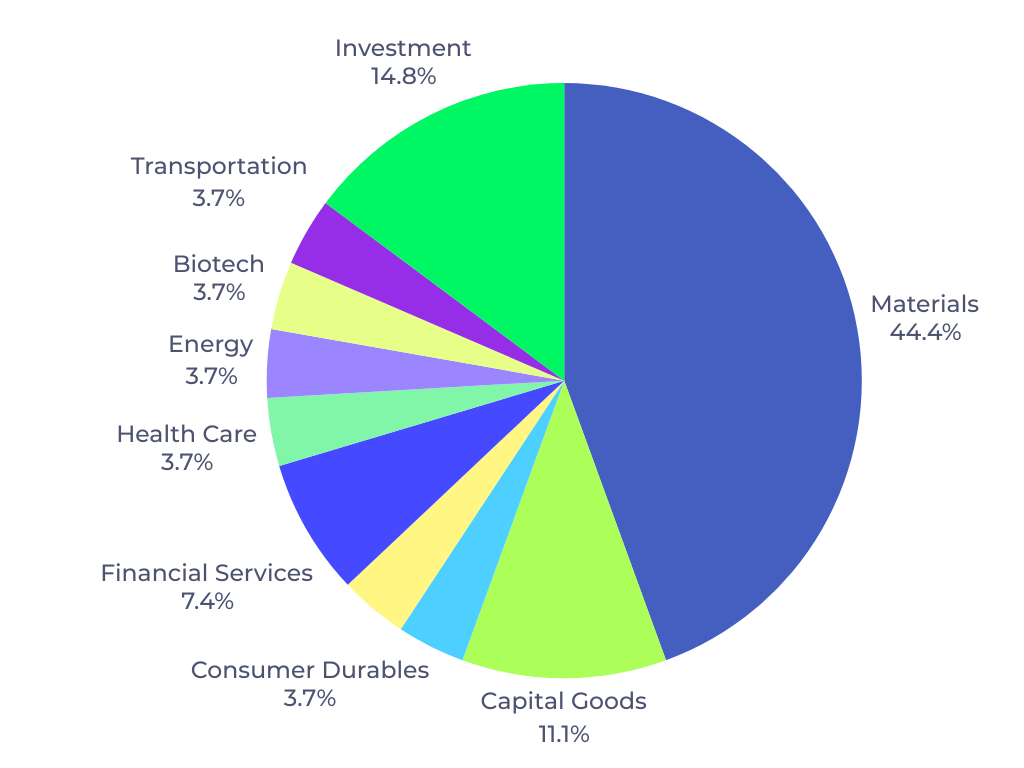

- 27 companies joined the ASX this year

- Only 12 finished in the green with resources stocks the top performers

- Sun Silver and Infini Resources top the charts

Out of the 27 listings this year, less than half managed to finish the year in the green.

Of course some have been listed for longer, so have had the opportunity to go up, down and then up again just in time to ring in the new year.

A total of 12 IPOs managed to stay green, with half of those enjoying a 50%+ boost to their share price at the time of writing.

A sad 14 stocks finished the year in the red, with 9 of those in the mining and energy sectors.

Here’s the breakdown by sector:

Top 5 performing IPOs this year

Here’s how ASX stocks that have IPOed this year are performing>>>

Code Company Listed Issue Price Price Today % Return Market Cap SS1 Sun Silver Limited 15/5/2024 $0.20 0.615 212.50% $57,394,336 I88 Infini Resources Ltd 15/1/2024 $0.20 0.585 195.00% $26,869,328 TEA Tasmea Limited 29/4/2024 $1.56 3.07 97.40% $698,309,405 GYG Guzman Y Gomez Ltd 20/6/2024 $22.00 41.53 89.80% $4,145,805,311 MNC Merino and Co 30/10/2024 $0.20 0.35 80.00% $20,169,097 AAL Alfabs Australia 28/6/2024 $0.25 0.385 54.00% $45,220,487 ORD Ordell Minerals Ltd 18/7/2024 $0.20 0.31 45.00% $10,746,801 WAG Theaustralianwealth 16/2/2024 $0.25 0.305 22.00% $22,681,325 BB1 Blinklab Limited 4/4/2024 $0.20 0.24 20.00% $14,696,678 MAC MAC Copper 20/2/2024 $16.00 17.86 11.80% $670,312,210 WHI Whitefield Income 11/12/2024 $1.25 1.28 3.60% $206,788,173 BWN Bhagwan Marine 30/7/2024 $0.63 0.64 1.60% $167,872,145 PCX Pengna Glbal Private 21/6/2024 $2.00 2 0.00% $169,507,137 MRE Metrics Real Estate 16/10/2024 $2.00 1.985 -0.80% $299,047,104 VFY Vitrafy Life Science 26/11/2024 $1.84 1.78 -4.90% $67,901,281 CCL Cuscal Limited 25/11/2024 $2.50 2.34 -6.80% $448,255,672 DGT Digico Infrastr REIT 13/12/2024 $5.00 4.52 -9.40% $2,427,145,265 SYL Symal Group Limited 21/11/2024 $1.85 1.665 -10.80% $401,473,219 RNV Renerve Limited 26/11/2024 $0.20 0.17 -15.00% $15,773,320 FUL Fulcrum Lithium 22/11/2024 $0.25 0.14 -44.00% $12,835,000 FNR Far Northern Res 12/4/2024 $0.20 0.11 -45.00% $3,989,241 LMS Litchfield Minerals 15/3/2024 $0.20 0.1 -50.00% $2,821,135 KM1 Kalimetalslimited 8/1/2024 $0.25 0.11 -54.00% $8,451,039 PR2 Piche Resources 15/7/2024 $0.20 0.09 -55.00% $7,226,149 RAU Resouro Strategic 14/6/2024 $0.50 0.215 -57.00% $9,358,636 D3E D3 Energy Limited 13/5/2024 $0.20 0.079 -60.50% $5,960,625 AXL Axel Ree Limited 23/7/2024 $0.20 0.073 -62.50% $7,546,545

Sun silver steals the show

Resources managed to steal the show, with two stocks gaining +190%.

The winner was Sun Silver (ASX:SS1) with a 212% gain on its listing price of $0.20, even hitting highs of $1.12 in October.

It’s been one of the most successful mining IPOs of 2024, with a current market cap of $57.3m.

The pickings for quality silver exposure on the ASX are fairly slim, but SS1 brought some shine when it closed its IPO early in May after raising the maximum $13m in mere days before surging +170% in its first month on the bourse.

Sun’s advanced Maverick Springs asset in Nevada has a resource of 423Moz at 67.25g/t silver equivalent or 253Moz at 40.25g/t silver, making it the largest pre-production primary silver project on the ASX.

The deposit itself remains open along strike and at depth, with multiple mineralised intercepts located outside of the current resource constrained model.

With inaugural drilling complete, the company is awaiting the results for remaining drill holes which are expected over the next 4-6 weeks.

It is also a top pick by MineLife’s Gavin Wendt and Seneca Financial Solutions’ Luke Laretive who reckons the stock is ‘far too cheap relative to their peers’.

Soaring off positive uranium sentiment

Lithium/uranium explorer Infini Resources (ASX:I88) was a close second, up 195% for the year, listing with a diverse portfolio of eight greenfields and brownfields projects in tier 1 mining jurisdictions across Canada and WA.

The company closed a $5.3m raise with funds to be used over its assets at a time when uranium headwinds worked in its favour.

From the lows of US$18/lb in 2018, uranium spot prices more than doubled from January 2023 to 2024, hitting a 16-year high of US$107/lb before falling to under US$80/lb.

The $26.8m market cap company’s plan to carry out maiden drilling at its Portland Creek uranium project was approved by the Newfoundland Mines Department in mid-December.

Initial soil sampling at the project back in August pulled in 11,792ppm and then a second, even-better eye-watering peak grade of 74,997ppm.

The results were so rich in uranium they fell outside the detection limits of conventional technology with I88’s results sitting a casual ~9375 times higher than the normal ~8ppm U3O8 level.

This program for up to 23 holes to test the high-grade Talus prospect will begin in late January 2025 with the mobilisation of the first heli-supported diamond rig to site. A second rig will be available from early February.

It’s also worth noting it’s a favourite stock pick of Lowell Resources Fund chief investment officer John Forwood.

Who rounds out the top 5?

Tasmea (ASX:TEA) was also in the top 5. This company’s share price gained 97.4%, trading at $3.07 per share at the time of writing.

The company provides maintenance and engineering services across mining and resources, oil and gas, wastewater, power and renewable energy, and defence and infrastructure sectors.

Exciting? No. Dependable? Yes. Currently, Tasmea owns 18 businesses and has grown its revenues via six acquisitions over in the last year.

Proving that everyone loves Mexican food, Guzman y Gomez (ASX:GYG) made a solid show for the consumer services sector. The company was up 89.80% on its listing price of $22 per share, trading at $41.53 with a massive market cap of $4.1 billion.

It’s been a growth year for GYG, with FY24 EDITDA of $44.8 million up 53% on the previous year. Pro forma profit before tax increased to $16.3 million, for a strong 114% year-on-year growth.

The company also opened its 200th restaurant and also saw some neat stats like an opening-day sales record of $46,236 at its Cannon Hill restaurant, which saw more than 7500 burritos and bowls sold in just one day.

And rounding out the top 5 we have wool product manufacturer and distributor Merino & Co (ASX:MNC) – a clothing company up 80%, with a market cap of $20m.

Working out of Wangara WA, the company has a new 1400m2 premises with direct transport lines to Fremantle Port for importing materials and exporting finished products.

“I look forward to providing further updates as we continue to expand our capabilities, and work towards our vision of delivering high-quality Merino wool products to new and emerging global markets,” co-managing director Fiona Yue said last month.

At Stockhead, we tell it like it is. While Sun Silver is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.