Weed Week: Storm before the calm as cannabis market set to boom after SAFE Banking Act passed

A storm before the calm as cannabis market expected to grow after SAFE Banking Act passed. Picture Getty

- The weed industry has slumped as it faces several headwinds

- But new data suggests the industry will grow significantly over the next few years

- We take a look at how the ASX weed stocks have performed over the past week

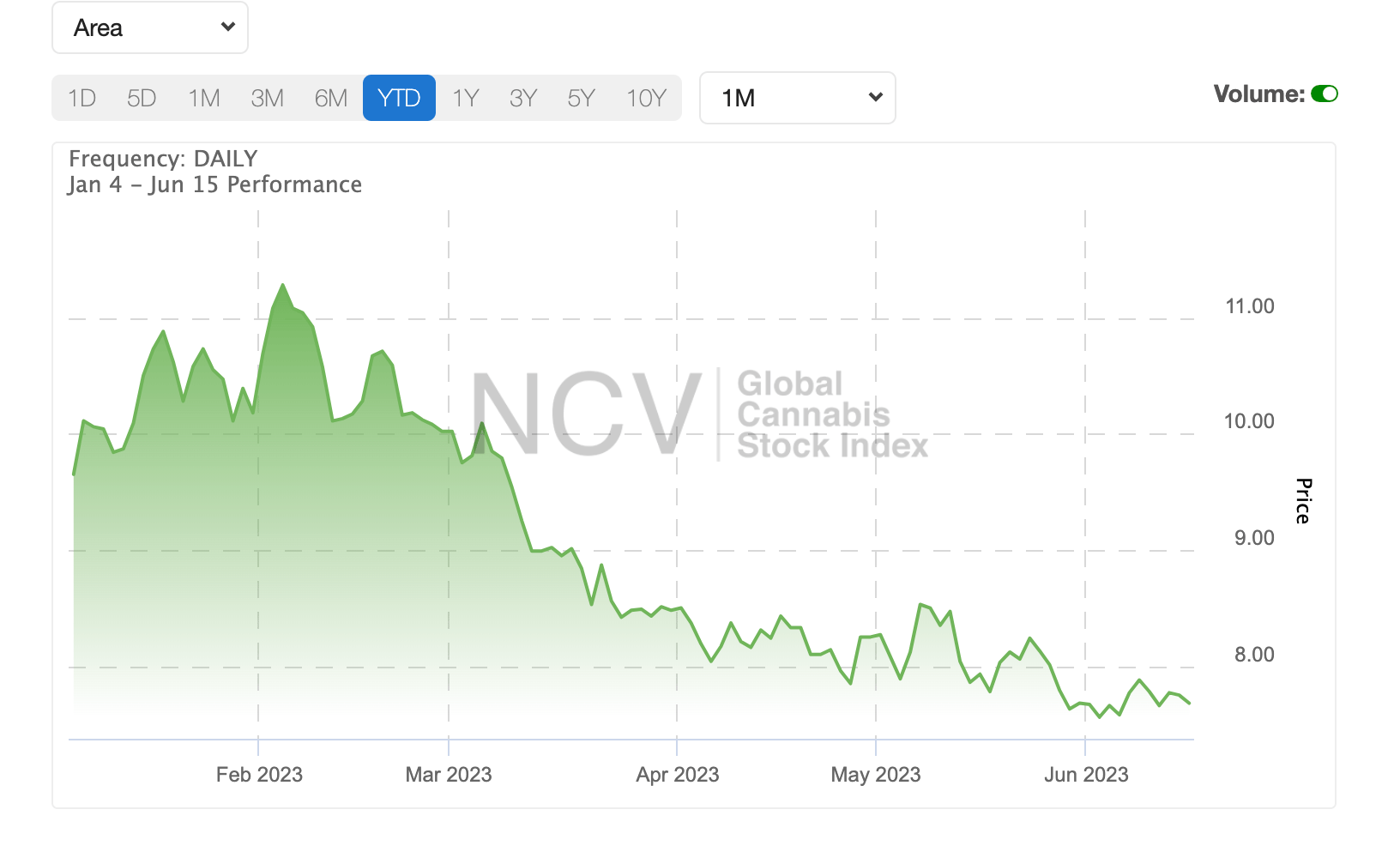

As we head into the halfway point of 2023, the Global Cannabis Stock Index shows a fall of around -20% this year.

There’s a number of reasons why the cannabis space is languishing, most important one being that there’s just simply too much supply.

There is a glut in the market as the pandemic boom that sent sales of cannabis soaring has tapered off. This has caused prices to fall – for example retail marijuana prices have fallen 10% in California, the US’ largest market.

Another headwind has been the snail’s pace at which the US – which is supposed to be the world’s largest cannabis market – is legalising across the country.

Cannabis remains illegal at the Federal level, which means that cannabis companies operating in the US must navigate overlapping regulations between States, creating confusion and sometimes chaos.

Then there’s the two elephants in the room, namely high inflation and interest rates.

This represents a double whammy for the industry. The first is that high inflation forces consumers to forego alternative therapeutics like CBD-based therapies, and secondly, cannabis firms are finding it increasingly difficult to cap raise in a tightening credit market.

Majors are also struggling now

It’s just not the smaller players that are struggling, major Canadian cannabis house Aurora (which is listed on Nasdaq) announced this week that its full year profit has collapsed from CA$21.2m to just CA$0.77m.

Aurora management tried to put a positive spin on the results, but investors had the final word, selling the shares down -10%.

Another Nasdaq listed giant, Canopy Growth, has also hit a major setback.

The company’s ticker is expected to be removed from the S&P/TSX Composite Index (INDEXTSI:OSPTX) before the markets open on June 19, after a stunning 70% collapse in its share price this year.

It’s not all bad news

There is however some good news this week for the cannabis industry, as a new report is projecting significant sales growth in the next decade in the US market.

According to cannabis research firm BDSA, the US cannabis industry will reach US$45 billion in legal sales by 2027, from US$29 billion in 2023.

BDSA says that a critical vote on a banking reform bill designed to help the US cannabis industry could see approval in the Senate in just a matter of weeks from now.

The bill in question is the SAFE Banking Act, a law which will bar federal regulators from taking punitive steps against banks doing business with cannabis companies.

Democrat Senate leader Chuck Schumer spoke at a marijuana rally in New York City in May, vowing again to pass the bill.

“The SAFE Banking Act is a good thing,” Schumer said.

“We will put the bill on the floor, God willing we get the votes in committee — and we will add to it expungement of the records of all of those who suffered from the over criminalisation of marijuana.”

To ASX Weed Stocks ….

Here’s how the ASX weed stocks have performed, sorted by winners over the past week.

| Code | Company | Price | % Year | % Six Month | % Month | % Week | Market Cap |

|---|---|---|---|---|---|---|---|

| BOT | Botanix Pharma Ltd | 10.25 | 62.70 | 76.72 | 15.17 | 7.89 | $131,128,462 |

| LGP | Little Green Pharma | 17.50 | -32.69 | 6.06 | -5.41 | 6.06 | $50,807,871 |

| ECS | ECS Botanics Holding | 2.00 | 17.65 | -4.76 | 0.00 | 5.26 | $21,027,883 |

| BOD | BOD Science Ltd | 5.10 | -43.20 | -66.00 | -7.27 | 2.00 | $7,809,196 |

| EMD | Emyria Limited | 12.75 | -34.62 | -32.89 | -8.93 | 2.00 | $40,085,411 |

| CTV | Colortv Limited | 0.80 | 33.33 | 0.00 | 0.00 | 0.00 | $1,236,985 |

| RNO | Rhinomed Ltd | 7.00 | -48.15 | -36.36 | -12.50 | 0.00 | $20,000,379 |

| WFL | Wellfully Limited | 0.70 | -85.71 | -56.25 | -22.22 | 0.00 | $3,450,609 |

| ROO | Roots Sustainable | 0.50 | -88.10 | -79.17 | -16.67 | 0.00 | $693,611 |

| EXL | Elixinol Wellness | 1.40 | -44.00 | -41.67 | -22.22 | 0.00 | $6,854,871 |

| WOA | Wide Open Agricultur | 32.50 | -48.82 | 32.65 | 0.00 | 0.00 | $42,016,576 |

| RGI | Roto-Gro Intl Ltd | 22.00 | 0.00 | 0.00 | 0.00 | 0.00 | $4,333,920 |

| AVE | Avecho Biotech Ltd | 0.60 | -53.85 | -50.00 | 50.00 | 0.00 | $12,972,955 |

| AGH | Althea Group | 4.50 | -37.50 | -27.42 | -8.16 | 0.00 | $17,206,038 |

| EPN | Epsilon Healthcare | 2.00 | -31.03 | -16.67 | 11.11 | 0.00 | $6,007,080 |

| AC8 | Auscann Grp Hlgs Ltd | 4.00 | -11.11 | 0.00 | 0.00 | 0.00 | $17,621,884 |

| MDC | Medlab Clinical Ltd | 660.00 | -35.29 | -9.59 | 0.00 | 0.00 | $15,071,113 |

| EVE | EVE Health Group Ltd | 0.10 | 0.00 | 0.00 | 0.00 | 0.00 | $5,274,483 |

| CGB | Cann Global Limited | 2.10 | 10.53 | 0.00 | 0.00 | 0.00 | $5,436,345 |

| WNX | Wellnex Life Ltd | 5.30 | -25.35 | -23.19 | -8.62 | 0.00 | $22,457,117 |

| EOF | Ecofibre Limited | 20.00 | -23.08 | -25.93 | 11.11 | -1.23 | $69,842,910 |

| VIT | Vitura Health Ltd | 37.50 | 38.89 | -37.50 | 7.14 | -1.32 | $208,699,527 |

| HGV | Hygrovest Limited | 4.60 | -28.13 | -36.99 | -23.33 | -2.13 | $11,037,791 |

| ALA | Arovella Therapeutic | 4.40 | 83.33 | 76.00 | -38.89 | -4.35 | $37,395,982 |

| IDT | IDT Australia Ltd | 6.50 | -48.00 | -17.72 | -23.53 | -4.41 | $19,805,071 |

| IHL | Incannex Healthcare | 10.00 | -64.29 | -48.72 | -4.76 | -4.76 | $158,701,036 |

| ME1 | Melodiol Glb Health | 0.85 | -81.11 | -57.50 | -57.50 | -5.56 | $20,538,795 |

| NTI | Neurotech Intl | 3.90 | -27.78 | -45.07 | -22.00 | -7.14 | $34,082,470 |

| IRX | Inhalerx Limited | 4.50 | -35.71 | -15.09 | 0.00 | -10.00 | $8,539,513 |

| DTZ | Dotz Nano Ltd | 22.50 | -27.42 | -13.46 | -2.17 | -10.00 | $111,533,428 |

| CAN | Cann Group Ltd | 13.00 | -52.73 | -38.10 | -16.13 | -18.75 | $54,340,281 |

| TSN | The Sust Nutri Grp | 0.80 | -94.29 | -94.29 | -38.46 | -20.00 | $1,126,103 |

| ZLD | Zelira Therapeutics | 170.00 | 70.00 | 60.38 | 86.81 | -21.30 | $19,403,635 |

| LV1 | Live Verdure Ltd | 11.00 | -38.89 | -52.17 | -24.14 | -24.14 | $9,323,496 |

| MXC | Mgc Pharmaceuticals | 0.50 | -70.59 | -58.33 | -37.50 | -28.57 | $20,098,158 |

| BP8 | Bph Global Ltd | 0.20 | -84.81 | -84.81 | -50.00 | -33.33 | $3,854,189 |

Botanix secured a new sublicence and distribution agreement for its Sofpironium Bromide product in South Korea.

Dong Wha Pharma, one of Korea’s first and oldest pharmaceutical companies, will commercialise Sofpironium Bromide in the Korean market.

Botanix’s partner Kaken and in turn Botanix, will receive a share of upfront payments, milestones and royalties based on net sales of the product.

Emyria was granted a Human Research Ethics Committee (HREC) approval to commence a pivotal MDMA-assisted therapy trial for Post-Traumatic Stress Disorder (PTSD).

The study will be conducted at the PAX Centre, one of Australia’s leading psychiatric services specialising in the treatment of complex trauma.

Emyria says MDMA-assisted therapy has shown promising results for patients with PTSD. The use of MDMA-based therapies to treat mental conditions has gained attention after the TGA allowed MDMA to be used on PTSD patients starting July 1.

Zelira shares slumped 20% during the week on profit taking after surging by 200% the previous week.

Last week, Zelira stunned the market after announcing that its diabetic nerve pain drug outperforms multi-billion dollar Pfizer’s drug, Lyrica.

Top line results demonstrated that Zelira’s proprietary ZLT-L-007 drug outperformed Lyrica by achieving a significant reduction in NRS pain scores, indicating a decrease in symptom severity.

ZLT-L-007 was found to be safe and well-tolerated, meeting the primary endpoint for safety with no Serious Adverse Events (SAE).

Neurotech presented at the 2023 International Rett Syndrome Foundation meeting in Nashville, Tennessee on 5-7 June by Associate Professor Carolyn Ellaway, titled: “NTI164: A Novel, Full-Spectrum Medicinal Cannabis-Derived Treatment for Rett Syndrome”.

Associate Professor Carolyn Ellaway is the Principal Investigator of Neurotech’s planned Phase I/II Trial in Rett Syndrome, which is currently awaiting Human Research Ethics Committee approval and Clinical Trial Notification (CTN) scheme clearance by the TGA.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.