Weed Week: Short sellers burned as cannabis stocks stage a rebound. Where to next?

Cannabis stocks are rebounding, catching short sellers off guard. Picture Getty

- Cannabis stocks are rebounding, catching short sellers off guard

- Next signpost for weed investors is the Section 280E of the US IRS tax code

- We take a look at the best performing weed stocks in last couple of weeks

Having been mauled for the best of part of the last 30-plus months, cannabis stocks are starting to bounce back.

Sentiment is high after the US Department of Health and Human Services requested the Drug Enforcement Agency (DEA) on August 31st to consider easing restrictions on marijuana to a Schedule III drug.

A downgrade to Schedule III – defined as “drugs with a moderate to low potential for physical and psychological dependence” — could be a significant catalyst for an industry hemmed in by US federal regulations, even as restrictions have begun to ease at state level.

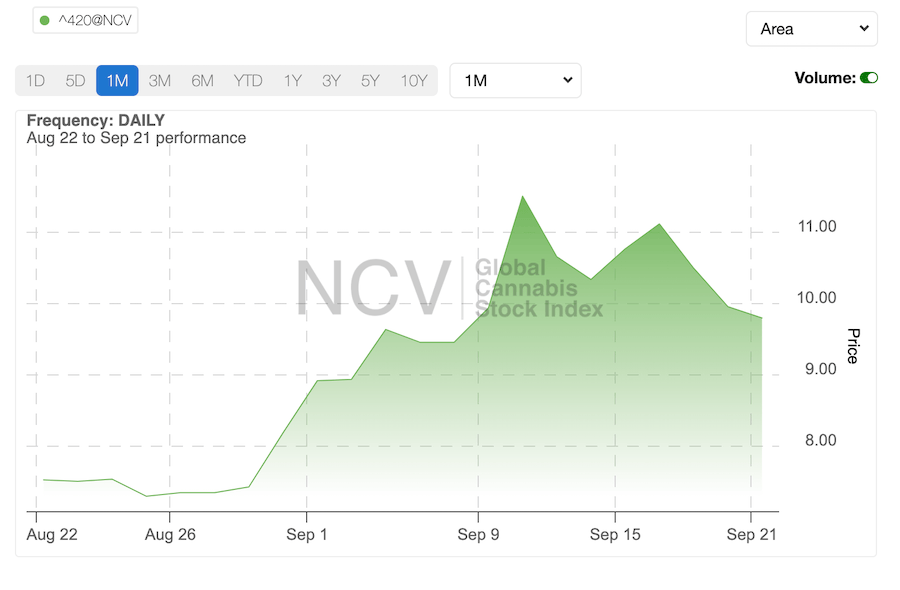

While we’re still watching carefully to see how this will shake out, the Global Cannabis Stock Index has been rising steadily over the past couple of weeks

Tax code change the next catalyst for cannabis stocks

Another sign post investors are looking out for is the potential amendment to Section 280E of the US IRS tax code.

At the moment, Section 280E prohibits marijuana businesses from taking traditional business deductions, because the plant is currently listed as a Schedule 1 drug.

However, more states in the US – 20 so far – have approved laws that exempt, or “decouple,” businesses from Section 280E.

Accountants believe that if US cannabis companies were now allowed to operate under normal circumstances, they could be saving a third of the tax burden.

“If Biden is going to reschedule, it’s very important that he does it to Schedule 3 or lower – not 2 – because if it was just rescheduled to 2, it wouldn’t fix 280E,” said Karen O’Keefe, director of state policies at Marijuana Policy Project.

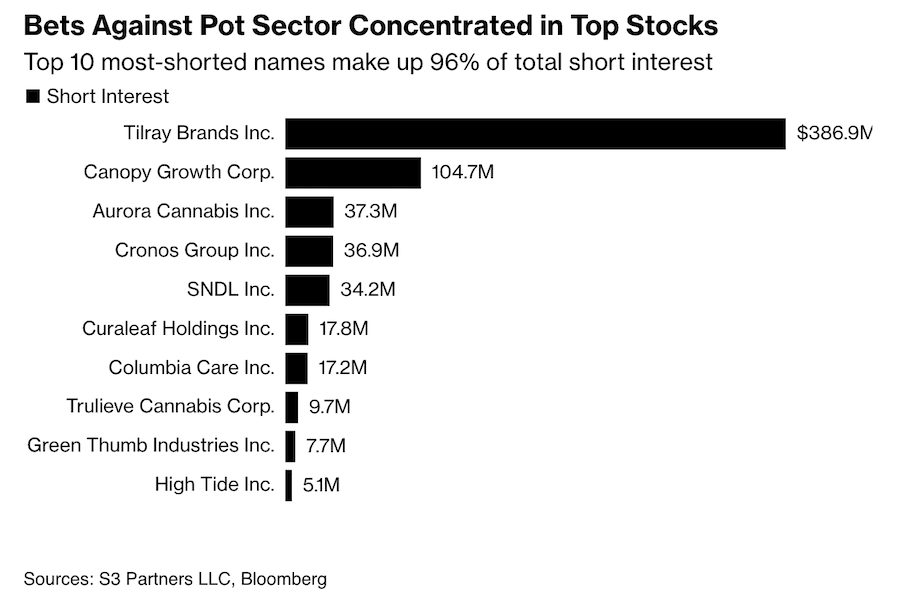

Cannabis short sellers burned

Meanwhile according to data from Bloomberg, the recent surge in cannabis stocks have burned short sellers, costing them more than US$105 million in losses this year.

Most short sellers are still counting on the possibility that the SAF Banking Act might fail to be passed, as it has previously failed to reach a vote in congress.

Bets against the pot sector is concentrated among the world’s top cannabis stocks:

Data shows that short positions on Canadian stock Tilray Brands (NASDAQ:TLRY) stands at 12.5% of the total float.

In a note to investors this week, Kerrisdale Capital – which has a short position on Tilray – described the company as a “failing cannabis player”.

“Tilray is a familiar playbook for unsuccessful businesses trading in the public markets,” said Kerrisdale.

To ASX Weed Stocks …

Here’s how the ASX weed stocks have performed, sorted by winners over the past week.

| Code | Company | Price | 1-week return | 1-mth return | 6-mth return | 1-year return | Market cap |

|---|---|---|---|---|---|---|---|

| NTI | Neurotech Intl | 0.08 | 44.23 | 70.45 | 38.89 | -17.58 | $66,173,211 |

| LV1 | Live Verdure Ltd | 0.27 | 22.73 | 203.37 | 74.19 | 8.00 | $30,282,945 |

| ME1 | Melodiol Glb Health | 0.01 | 20.00 | -14.29 | -40.00 | -82.86 | $17,683,922 |

| BOT | Botanix Pharma Ltd | 0.20 | 11.43 | 8.33 | 101.03 | 195.45 | $277,133,379 |

| EOF | Ecofibre Limited | 0.20 | 11.11 | 5.26 | 0.00 | -13.04 | $75,398,466 |

| CAN | Cann Group Ltd | 0.13 | 4.17 | 4.17 | -3.07 | -51.54 | $52,185,500 |

| ALA | Arovella Therapeutic | 0.08 | 4.05 | 60.42 | 113.89 | 196.15 | $69,451,290 |

| IDT | IDT Australia Ltd | 0.06 | 3.39 | -10.29 | -8.96 | -44.55 | $21,361,538 |

| VIT | Vitura Health Ltd | 0.31 | 3.33 | -31.11 | -21.52 | -44.64 | $172,989,942 |

| CTV | Colortv Limited | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | $1,236,985 |

| BP8 | Bph Global Ltd | 0.00 | 0.00 | 0.00 | -84.81 | -84.81 | $3,336,824 |

| ROO | Roots Sustainable | 0.00 | 0.00 | 0.00 | -66.67 | -90.48 | $554,889 |

| EXL | Elixinol Wellness | 0.01 | 0.00 | -36.36 | -66.67 | -78.13 | $4,385,379 |

| WOA | Wide Open Agricultur | 0.33 | 0.00 | 0.00 | 103.13 | -36.27 | $46,566,576 |

| RGI | Roto-Gro Intl Ltd | 0.22 | 0.00 | 0.00 | 0.00 | 0.00 | $4,333,920 |

| IRX | Inhalerx Limited | 0.05 | 0.00 | 11.36 | 22.50 | -16.95 | $9,298,581 |

| MXC | Mgc Pharmaceuticals | 0.00 | 0.00 | -33.33 | -71.43 | -86.67 | $8,855,936 |

| AGH | Althea Group | 0.04 | 0.00 | -16.67 | -23.91 | -59.30 | $13,623,110 |

| EPN | Epsilon Healthcare | 0.03 | 0.00 | 23.81 | 23.81 | 8.33 | $7,809,204 |

| AC8 | Auscann Grp Hlgs Ltd | 0.04 | 0.00 | 0.00 | 0.00 | 0.00 | $17,621,884 |

| MDC | Medlab Clinical Ltd | 6.60 | 0.00 | 0.00 | 0.00 | -47.20 | $15,071,113 |

| EVE | EVE Health Group Ltd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | $5,274,483 |

| CGB | Cann Global Limited | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | $5,436,345 |

| WNX | Wellnex Life Ltd | 0.05 | 0.00 | 0.00 | -17.19 | -36.14 | $22,704,470 |

| ZLD | Zelira Therapeutics | 0.99 | -0.50 | -20.80 | 4.21 | -30.77 | $11,233,683 |

| DTZ | Dotz Nano Ltd | 0.19 | -2.63 | -2.63 | -19.57 | -28.85 | $94,623,347 |

| EMD | Emyria Limited | 0.08 | -3.61 | -13.34 | -52.59 | -67.10 | $26,799,672 |

| ECS | ECS Botanics Holding | 0.02 | -4.00 | 4.35 | 20.00 | 14.29 | $26,561,536 |

| HGV | Hygrovest Limited | 0.05 | -5.45 | 15.56 | -20.00 | -22.39 | $10,936,151 |

| LGP | Little Green Pharma | 0.16 | -5.88 | -8.57 | -20.00 | -38.46 | $47,934,135 |

| BOD | BOD Science Ltd | 0.06 | -10.00 | -21.25 | 1.61 | -23.17 | $11,054,200 |

| RNO | Rhinomed Ltd | 0.05 | -10.71 | -33.33 | -50.00 | -69.70 | $14,285,985 |

| AVE | Avecho Biotech Ltd | 0.00 | -20.00 | -42.86 | -55.56 | -63.64 | $10,793,168 |

| WFL | Wellfully Limited | 0.00 | -25.00 | -25.00 | -80.00 | -90.32 | $1,478,832 |

| IHL | Incannex Healthcare | 0.07 | -25.56 | -33.00 | -36.19 | -80.58 | $106,329,694 |

| MRG | Murray River Grp | 0.00 | -100.00 | -100.00 | -100.00 | -100.00 | $10,808,210 |

| TSN | The Sust Nutri Grp | 0.00 | -100.00 | -100.00 | -100.00 | -100.00 | $1,409,029 |

Neurotech was the best performing weed-focused stock over the past week.

The company announced earlier that it has concluded the last patient last visit at the Children’s Hospital at Westmead in Sydney for its groundbreaking Phase I/II trial of NTI164 into the treatment of orphan disorder PANDAS/PANS.

A total of 15 paediatric patients have now successfully completed daily oral treatment with NTI164 over the initial 12 weeks of the trial, with 100% of patients continuing to receive treatment under the extension phase (54 weeks) of the trial protocol.

The hemp specialist announced that CEO Mark Tucker has ceased his position as CEO effectively immediately on September 8th.

The current Chair, Gernot Abl, will assume in an interim Executive role.

LV1 says the decision was in line with the evolving direction of the company, and it will keep the market informed of any updates on further appointments.

BOT received a speeding ticket from the AXX regarding the recent rise in its share price and trade volumes.

In a statement, the company responded:

“As previously announced by the company to the ASX, including most recently in its Preliminary Final Report released on 31 August 2023, the company’s lead product, Sofpironium Bromide, is awaiting decision from the FDA, which is anticipated to be received in late September 2023.

“The company notes that if FDA decision is received, it will represent a significant milestone for the company, as it will pave the way for an expansion of the company’s operations and revenue generation.”

Cann has signed a variation agreement with a key customer, Levin Health, for additional supply of cannabis flower products to 31 December.

The most recent variation will now see Cann supply, and Levin commit to, purchasing, additional flower products to meet Levin’s production schedule to the value of approximately $1.58 million from 1 September 2023 – 31 December 2023.

Cann will supply a total of $2.29 million in flower products to Levin for the period 1 July 2023 to 31 December 2023.

Cann will also supply oil products to the value of $0.85 million under the agreement to 31 December 2023.

Arovella Therapeutics (ASX:ALA)

ALA announced that David Simmonds, Non-Executive Director, will retire from the Board of Directors at the 2023 Annual General Meeting, expected to be held on 10 November.

Simmonds was appointed to the Board of Directors in March 2019.

ALA has upcoming milestones, including a still-in-progress due diligence to obtain a license for a technology owned by the University of North Carolina.

ALA is also in preliminary early stage negotiations to enter into an intellectual property licence agreement with a prospective licensor, Sparx Therapeutics.

The company’s lead asset is ALA-101, a potential treatment for B cell lymphomas and leukaemias.

At Stockhead we tell it like it is. While Neurotech is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.