Weed Week: Medicinal cannabis will be here no matter what; and recent ASX pot winners

Medicinal cannabis will always play a part in healthcare. Picture Getty

- Key focus for cannabis in 2024 is still the US DEA’s potential rescheduling

- Whether or not that happens, medicinal cannabis will always play a part in healthcare

- Greens party endorses legalising cannabis to kill expensive black market

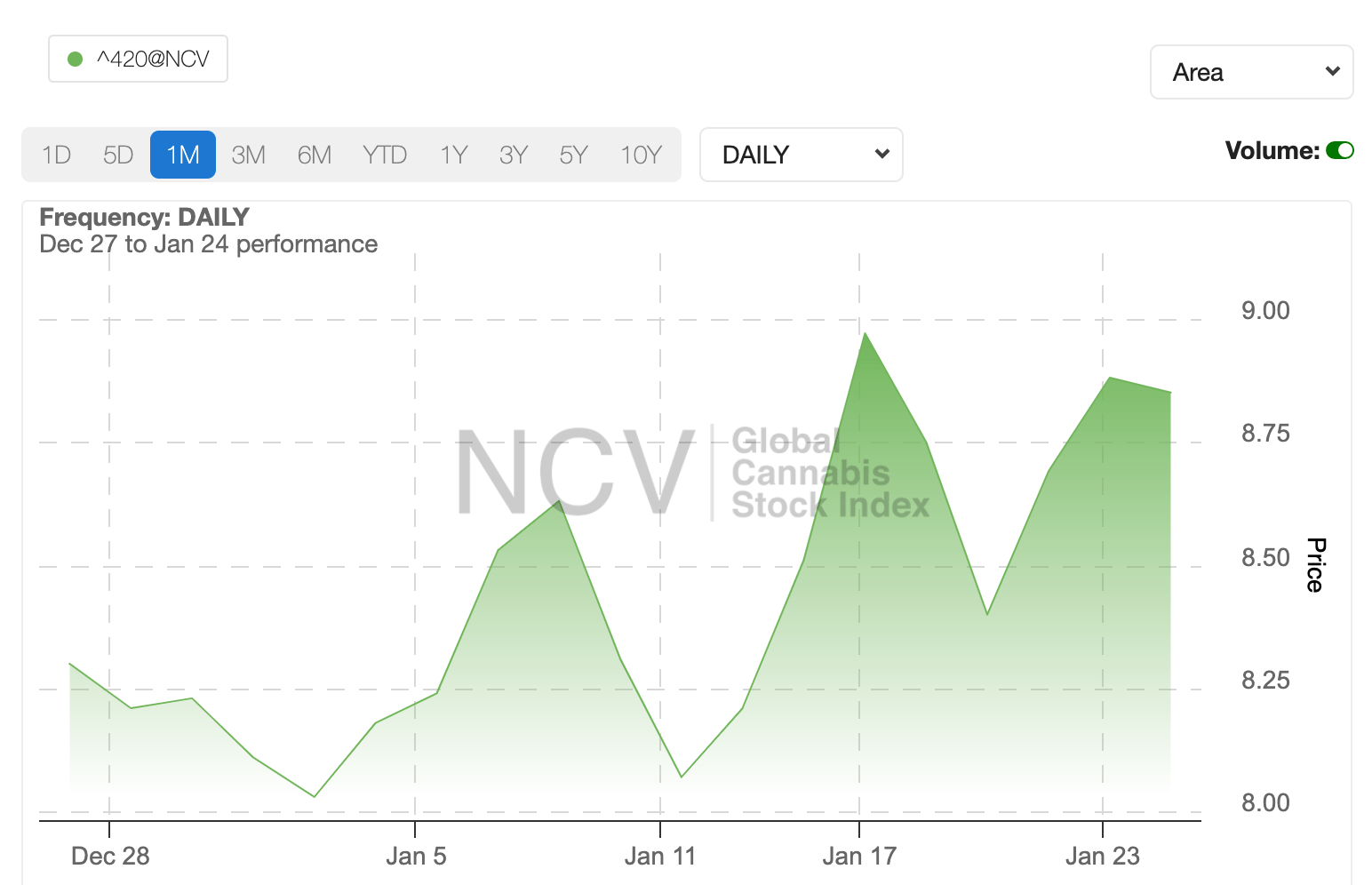

It’s been a good four weeks for global cannabis, with the NCV Global Cannabis Stock Index rising by around 7% in 2024.

But the index is still down almost 90% from its peak almost three years ago.

For 2024, the story will all be about the US Drug Enforcement Administration’s (DEA) potential rescheduling of cannabis from Schedule 1 to Schedule 3.

Rescheduling would rain cash on cannabis companies, and when that happens, a fresh new investment opportunity could finally come to the sector.

“We continue to keep our fingers crossed, but we have no basis for concluding that this will happen or when it might happen,” says Alan Brochstein of 420 Investor.

Read later: Growing excitement for cannabis stocks after marijuana rescheduling hopes in the US

Most experts however believe that even if the law doesn’t pass, medicinal cannabis will always have a part in the future of healthcare.

There’s already ample evidence that certain medicinal cannabis products may be useful in treating conditions such as ASL epilepsy, multiple sclerosis, as well as symptoms associated with cancer (nausea, pain and loss of appetite).

Multiple studies have also shown that medicinal cannabis can improve sleep for people with obstructive sleep apnea or fibromyalgia.

Legalise to kill black market

But one thing about medicinal cannabis is that it’s still incredibly expensive when compared to other therapies.

In Australia, the price of prescription cannabis in its dried herb form is on-par with the black market.

Prescription cannabis sells for about $135 to $150 per 10 grams, while Queensland police lists the street value of black market cannabis at $121 per 10g – according to a recent report from ABC News.

Data also revealed that the black market in Australia is earning around $25 billion a year.

“Law enforcement is spending billions of public dollars failing to police cannabis, and the opportunity here is to turn that all on its head by legalising it,” said Greens senator, David Shoebridge.

The other benefit of legalising, according to the Greens, is that it could net the government $28bn in tax revenue in nine years.

Under the Greens proposal, legalising cannabis will see the introduction of a national cannabis licensing scheme, and a regulator.

The Greens proposed that the regulator – the Cannabis Australia National Agency (Cana) – would also set the wholesale price in the country by acting as the wholesaler between producers and retailers.

And now, to ASX Weed Stocks ….

Here’s how the ASX weed stocks have performed, sorted by winners over the past month

| Code | Company | Price | % Week | % Month | % 6-Month | % Year | Market Cap |

|---|---|---|---|---|---|---|---|

| NTI | Neurotech Intl | 0.080 | 6.67 | 33.33 | 53.85 | 15.94 | $68,713,921 |

| IDT | IDT Australia Ltd | 0.105 | 0.00 | 8.25 | 47.89 | 40.00 | $36,905,344 |

| RNO | Rhinomed Ltd | 0.025 | -21.88 | 4.17 | -59.02 | -76.19 | $7,142,992 |

| EMD | Emyria Limited | 0.055 | -3.51 | 3.77 | -52.84 | -66.42 | $20,531,246 |

| WOA | Wide Open Agricultur | 0.155 | -13.89 | 3.33 | -52.31 | -26.19 | $28,643,747 |

| BOT | Botanix Pharma Ltd | 0.168 | -4.29 | 1.52 | 24.07 | 188.79 | $257,967,167 |

| AC8 | Auscann Grp Hlgs Ltd | 0.040 | 0.00 | 0.00 | 0.00 | 0.00 | $17,621,884 |

| AGH | Althea Group | 0.038 | -9.52 | 0.00 | -24.00 | -38.71 | $16,237,802 |

| AVE | Avecho Biotech Ltd | 0.003 | -25.00 | 0.00 | -50.00 | -78.57 | $9,507,891 |

| BOD | BOD Science Ltd | 0.024 | 0.00 | 0.00 | -73.63 | -80.80 | $4,256,124 |

| CGB | Cann Global Limited | 0.021 | 0.00 | 0.00 | 0.00 | 0.00 | $5,614,845 |

| EPN | Epsilon Healthcare | 0.024 | 0.00 | 0.00 | -4.00 | -7.69 | $7,208,496 |

| EVE | EVE Health Group Ltd | 0.001 | 0.00 | 0.00 | 0.00 | 0.00 | $5,274,483 |

| MDC | Medlab Clinical Ltd | 6.600 | 0.00 | 0.00 | 0.00 | -18.52 | $15,071,113 |

| ROO | Roots Sustainable | 0.007 | 0.00 | 0.00 | 16.67 | -61.11 | $1,124,217 |

| WNX | Wellnex Life Ltd | 0.024 | -4.00 | 0.00 | -40.07 | -57.08 | $25,991,414 |

| ALA | Arovella Therapeutic | 0.133 | -1.85 | -1.85 | 170.41 | 452.08 | $119,385,227 |

| ECS | ECS Botanics Holding | 0.023 | -6.25 | -2.17 | -2.17 | -16.67 | $24,901,440 |

| DTZ | Dotz Nano Ltd | 0.140 | 0.00 | -3.45 | -42.86 | -42.86 | $72,410,550 |

| ZLD | Zelira Therapeutics | 0.900 | 0.00 | -4.26 | -50.00 | -8.16 | $10,212,440 |

| LGP | Little Green Pharma | 0.130 | -7.14 | -7.14 | -27.78 | -38.10 | $37,511,655 |

| HGV | Hygrovest Limited | 0.047 | -2.08 | -7.84 | -6.00 | -33.80 | $9,884,598 |

| VIT | Vitura Health Ltd | 0.250 | -5.66 | -10.71 | -50.00 | -49.49 | $143,968,447 |

| IRX | Inhalerx Limited | 0.025 | 0.00 | -13.79 | -30.56 | -57.63 | $4,744,174 |

| CAN | Cann Group Ltd | 0.089 | -6.32 | -15.24 | -28.80 | -52.78 | $38,535,674 |

| EOF | Ecofibre Limited | 0.110 | 4.76 | -15.38 | -31.25 | -56.86 | $41,676,129 |

| EXL | Elixinol Wellness | 0.010 | -16.67 | -16.67 | -23.08 | -58.33 | $6,328,716 |

| WFL | Wellfully Limited | 0.003 | -25.00 | -25.00 | 0.00 | -85.00 | $1,478,832 |

| MXC | Mgc Pharmaceuticals | 0.335 | -23.86 | -30.21 | -88.83 | -96.65 | $13,155,489 |

| BP8 | Bph Global Ltd | 0.001 | -33.33 | -33.33 | -60.00 | -92.41 | $1,835,563 |

| ME1 | Melodiol Glb Health | 0.001 | 0.00 | -50.00 | -89.47 | -95.00 | $9,833,237 |

Shares of NTI has been rising since the company announced the completion of recruitment for its Phase 2/3 NTIASD2 clinical trial in December.

In total, 56 patients were enrolled, all with level 2 (requiring substantial support) or level 3 (requiring very substantial support) autism.

The trial will study the treatment of NTI’s proprietary lead drug formulation NTI164, derived from a unique cannabis strain with low THC and a novel combination of cannabinoids, including CBDA, CBC, CBDP, CBDB and CBN.

Emyria said its distinguished psychiatry specialist (unnamed) has been granted “Authorised Prescriber” status by the Therapeutic Goods Administration (TGA).

The authorisation enables the prescribing of MDMA according to an ethics committee endorsed care model developed by Emyria and within the strict regulatory framework established by the TGA for the treatment of Post-Traumatic Stress Disorder (PTSD).

Emyria said that achieving Authorised Prescriber status for MDMA-assisted therapy in PTSD care signifies a strategic step towards expanding Emyria’s service offerings.

The company also recently received a Research and Development (R&D) Tax Incentive refund from the governmebt of $2,527,316 for research activity performed during the financial year 2022/2023.

Botanix’s New Drug Application (NDA) for Sofdra was accepted by the US FDA as a complete response earlier this week.

The FDA also confirmed that the resubmission of the Sofdra NDA as a Class 2 response (i.e. a 6-month review period from resubmission), meaning that final approval remains targeted for late June 2024.

With the resubmission accepted as complete and target approval timing confirmed, Botanix says its commercial activities will ensure a rapid launch of Sofdra, a drug that treats primary axillary hyperhidrosis.

IRX conducted a pre-IND meeting with the FDA in March 2023, which provided valuable feedback on IRX’s roadmap to an NDA for IRX211 as a treatment for CRPS (Complex regional pain syndrome).

Whilst supportive overall, some of the feedback received encouraged the company to reconsider pain indications for which the path to registration required less exploratory work, and for which the IRX211 formulation was a closer fit.

Following a detailed review, the company has decided to promote BTcP as the primary indication of focus for the proposed Phase 2 trial of IRX211, as opposed to CRPS.

IRX believes the established path to registration for BTcP offers a more significant commercial opportunity for IRX211, and is also expected to significantly reduce the overall amount of exploratory work and better mitigate regulatory uncertainty (compared to the CRPS).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.