Weed Week: How do you compete in the US? Money and Martha Stewart

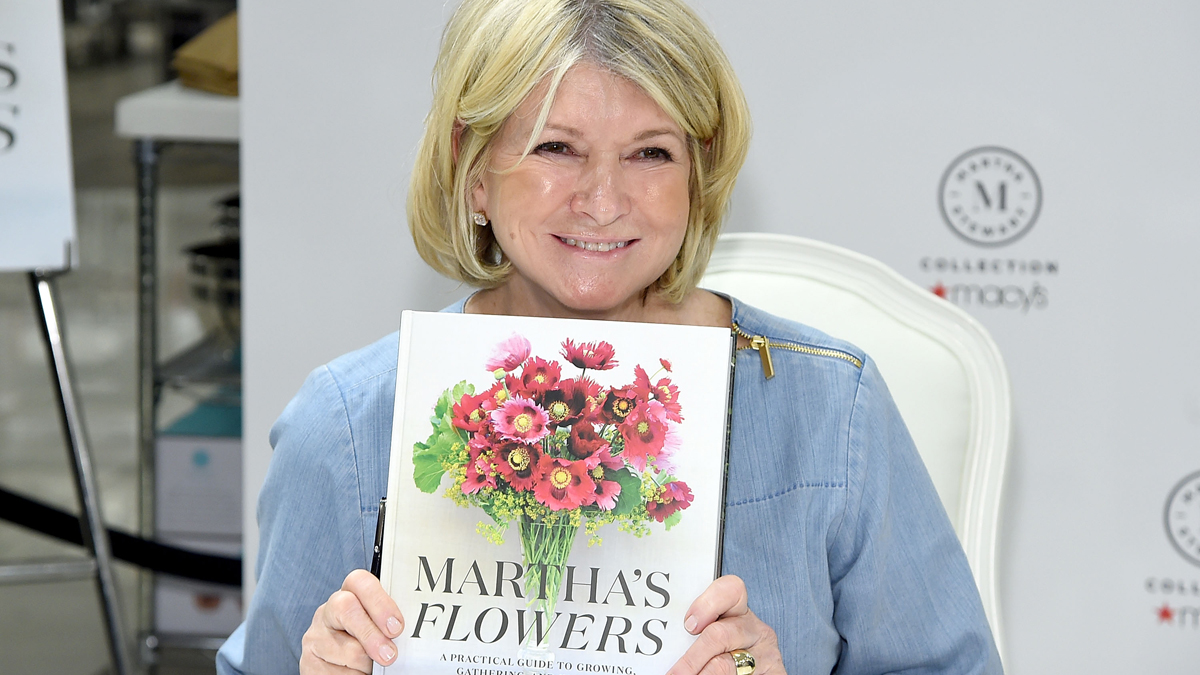

Martha Stewart - knows plants, has inside knowledge. Picture: Getty Images

Now that hemp is legal in the US, it has become one of the world’s most popular, powerful and profitable plants. Which begs the question: how does a wee Aussie pot stock compete?

Elixinol Global (ASX:EXL) boss Paul Benhaim says for a start they’re spending more than expected — 20 per cent of the budget is going on marketing this year.

He also believes their economic moat — the competitive advantage they have over high-rolling newcomers and talent legacy outfits alike — is his experience, five years worth of production and investment, and their team’s experience.

He reckons it’ll be hard to out-spend that.

The world’s biggest grower Canopy Growth believes it’s on the right track to compete in the US by its uber-celebrity name drops. First they hooked rapper Snoop Dogg and have now snared Martha Stewart — “retail executive” and convicted fraudster — as an advisor on a new line of hemp products.

Marijuana capital raisings around the world totalled 75 at the end of February, raising $US1.3 billion, compared with 118 this time last year when $US1.8bn had been raised, according to the Viridian Cannabis Deal Tracker.

The obvious prize this week goes to scientists who have proved that smoking the reefer makes people buy more biscuits. Some ice cream, but mostly biscuits. No word on which flavour is the stoner preference, however.

In Australia, there’s a land grab going on by growers looking for the easiest regulations and best growing conditions (which is in Victoria, NSW, Queensland, South Australia or Western Australia — depending on who you talk to).

Tim Boreham goes into detail here about the phenomenal amounts of money being paid.

And the NSW Greens are super keen to — you guessed it — legalise cannabis.

They have a plan to introduce a bill within the first 100 days of the election to legalise and regulate pot. You’ll be able to own up to six plants and light up anywhere it’s legal to smoke tobacco.

Keeping up with the companies

eSense’s (ASX:ESE) Haim Cohen was in the Pot Seat last week. The interview was fresh, honest and at times a little bit inflammatory.

eSense has signed two major contracts in the last six months so we asked him straight up: why should investors believe in these ones, when none of the nine contracts beforehand had worked?

He gave us a very interesting reason — all centered around the boardroom fight, of course — which you can read about here.

AusCann (ASX:AC8), a company that is trying the patience of a number of investors we’ve spoken to, has finally sourced a CEO.

Five months after they began looking, they’ve snagged Ido Kanyon, currently Israeli firm Teva Pharmaceutical’s global head of specialty products. He starts at the end of May, and gets paid 35 per cent more than the outgoing female head.

1 Page — sorry, European Cannabis — isn’t listed anymore, but it will be again soon. Harry Karelis has left cannabis-cancer-fighting biotech Zelda (ASX:ZLD) for the now-German marijuana supplier.

European Cannabis, for those of you who have cash trapped in there, will list by November on London’s AIM market with what Mr Karelis says is a market cap that will equal all of the ASX’s pot stocks combined.

Stockhead’s list of 29 pot and pot-related stocks have a combined market cap of $1.6 billion, so there you go.

Chapmans (ASX:CHP) is gone, soonish. We realise they’re not really a pot stock, but they did have a stake in a convertible note to Aunt Zelda’s in the US.

It’s more of an involvement than some ASX companies can boast, who claim an interest in the sector via MoUs only.

Medlab Clinical (ASX:MDC) has scored a licensing deal for its cannabis cancer drug with a Canadian pharma company. NanaBis is currently in phase 2 clinical trials.

The “leading medical cannabis company” THC Global (ASX:THC) made $815 from medical cannabis in the six months to December 31, while Elixinol’s revenue doubled.

Wide Open Agriculture (ASX:WOA) joined the pot stock family by getting a WA hemp licence.

Is Affinity Energy (ASX:AEB) having problems raising money? Probably. They went into a trading halt on February 1 over a pending capital raising, and extended it for the fourth time this week.

Affinity was initially gung-ho about algae energy, then algae-based nutraceuticals, then cannabis. It’s still not really making any money from any of them.

The losses keep climbing — $4.4m in the half year — and they had $10,259 left at the end of December.

So that cap raise it looking pretty critical right now.

| Ticker | Name | Price $ March 6 | 2-week % change | Market cap |

|---|---|---|---|---|

| IDT | IDT AUSTRALIA LTD | 0.16 | -0.06 | $36.7M |

| EXL | ELIXINOL GLOBAL LTD | 3.51 | -0.03 | $438.4M |

| RNO | RHINOMED LTD | 0.18 | 0.16 | $25.5M |

| BOT | BOTANIX PHARMACEUTICALS LTD | 0.12 | 0.25 | $95.2M |

| BDA | BOD AUSTRALIA LTD | 0.44 | -0.02 | $30.2M |

| IHL | IMPRESSION HEALTHCARE LTD | 0.02 | 0.11 | $10.9M |

| THC | THC GLOBAL GROUP LTD | 0.59 | 0.01 | $70.0M |

| TPE | TPI ENTERPRISES LTD | 1.00 | -0.04 | $81.9M |

| SCU | STEMCELL UNITED LTD | 0.02 | 0 | $10.3M |

| RGI | ROTO-GRO INTERNATIONAL LTD | 0.26 | -0.09 | $26.8M |

| CAN | CANN GROUP LTD | 1.81 | 0.01 | $248.6M |

| MMJ | MMJ GROUP HOLDINGS LTD | 0.25 | -0.02 | $56.3M |

| MDC | MEDLAB CLINICAL LTD | 0.38 | -0.03 | $79.0M |

| EVE | EVE INVESTMENTS LTD | 0.01 | 0 | $11.6M |

| LSH | LIFESPOT HEALTH LTD | 0.07 | -0.03 | $5.3M |

| CP1 | CANNPAL ANIMAL THERAPEUTICS | 0.12 | -0.04 | $10.7M |

| ZLD | ZELDA THERAPEUTICS LTD | 0.06 | 0.02 | $42.3M |

| CPH | CRESO PHARMA LTD | 0.38 | 0 | $50.2M |

| MXC | MGC PHARMACEUTICALS LTD | 0.04 | -0.03 | $46.1M |

| AEB | AFFINITY ENERGY AND HEALTH L | 0.01 | -0.18 | $8.8M |

| SUD | SUDA PHARMACEUTICALS LTD | 0.00 | -0.2 | $10.3M |

| CAE | CANNINDAH RESOURCES LTD | 0.02 | -0.25 | $2.5M |

| AC8 | AUSCANN GROUP HOLDINGS LTD | 0.39 | -0.14 | $120.5M |

| CLI | CROPLOGIC LTD | 0.01 | 0.08 | $3.9M |

| ROO | ROOTS SUSTAINABLE AGRICU-CDI | 0.09 | -0.02 | $5.9M |

| YPB | YPB GROUP LTD | 0.01 | -0.33 | $7.3M |

| ESE | ESENSE-LAB LTD-CDI | 0.02 | -0.13 | $3.9M |

| WOA | WIDE OPEN AGRICULTURE LTD | 0.18 | 0.28 | $12.7M |

| AGH | ALTHEA GROUP HOLDINGS LTD | 0.39 | -0.01 | $80.3M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.