Weed Week: Cannabis stocks down almost 20pc in 2023, but here’s why they could rebound by Q2 2024

Q2 of 2024 could see cannabis stocks bouncing back, says expert. Picture Getty

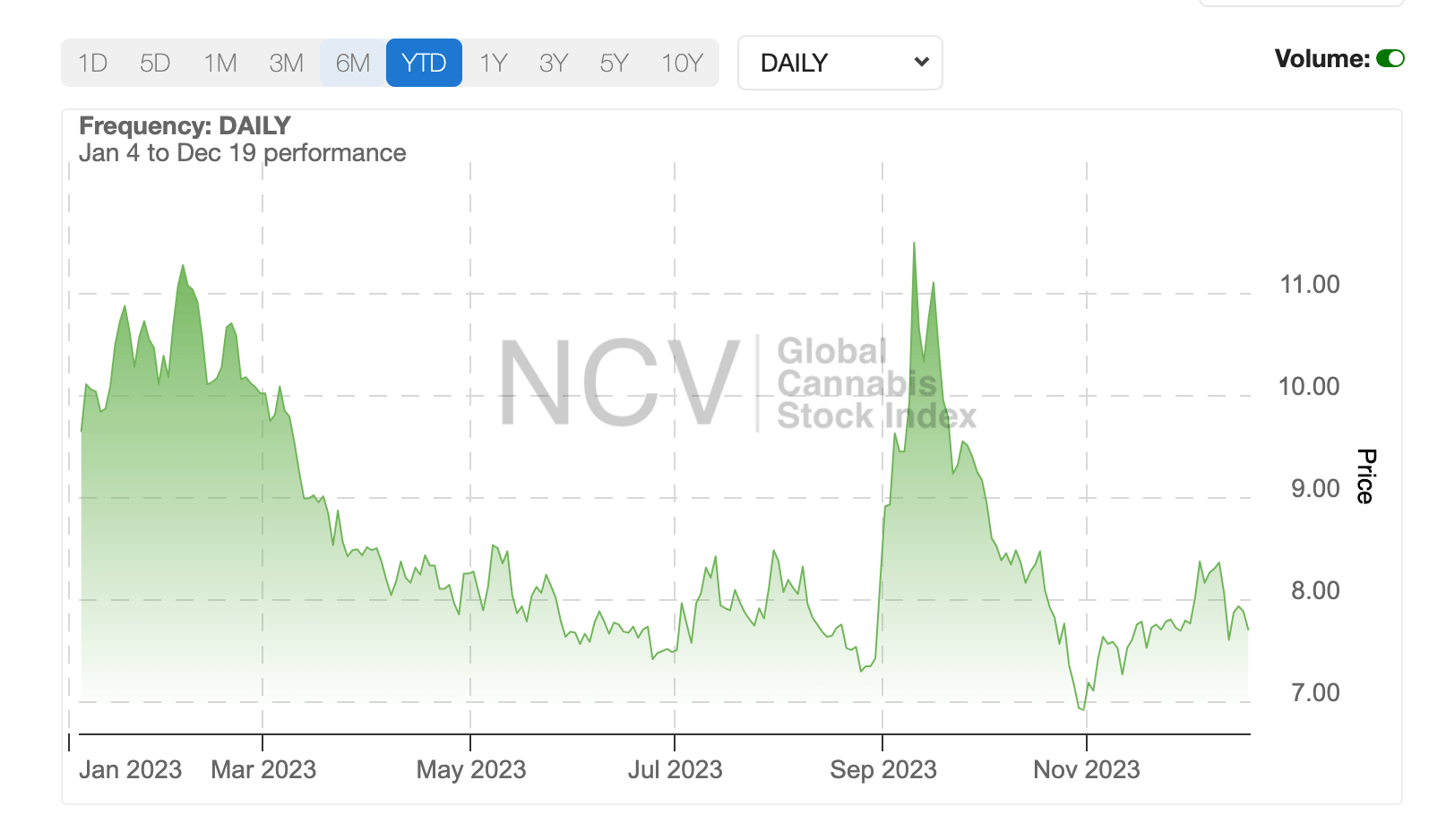

With just two weeks remaining in 2023, the NCV Global Cannabis Stock Index shows a drop of -18% for the year, compared to the +24% gain in the benchmark stock index (the S&P 500).

Despite the seemingly sluggish performance, cannabis stocks have actually done much better in 2023 compared to the horrible 2022 when the index fell more than -70%.

Experts now believe that the case for investing in cannabis stocks is the strongest it’s ever been.

The next catalyst on investors’ radar is the potential reclassification of marijuana in the US in 2024.

Hopes are high following a request made in August by the US Department of Health and Human Service (HHS) to the Drug Enforcement Agency (DEA) to consider easing restrictions on marijuana to a Schedule III drug.

Read more here: Growing excitement for cannabis stocks after marijuana rescheduling hopes in the US

If the DEA accepts HHS’s rescheduling recommendation, it could ease marijuana access and spur an industry hemmed in by US federal regulations, even as restrictions have begun to ease at state level.

A former FDA official, Howard Sklamberg, predicts the DEA would follow through with the request, reasoning that the DEA has to rely on the HHS for scientific and medical information, which strongly influences scheduling.

“I would be really shocked if it took the DEA longer than the second quarter of next year to come up with its final rule,” Sklamberg said.

“Even when I was at the FDA, we knew that important regulations that you wanted to get done in an election year, you want to get done by the summer before.”

From a valuation perspective however, some experts believe the valuation of cannabis stocks has now largely diverged away from fundamentals.

“The fundamentals don’t matter much at all, unfortunately,” Dan Ahrens of Advisorshares Investments told Bloomberg.

“They will again, but right now these companies and their stock prices are extremely tied to federal reform.”

Australia produces ever more weed

Meanwhile, according to new data published by the Office of Drug Control (ODC), Australian medicinal cannabis companies produced 24,900kg of cannabis in 2022, up from 16,700kg in 2021.

Of the 24,900kg produced, 1,510kg were shipped out of Australia last year, with 935kg ending up in Germany.

The United Kingdom was our second biggest export market with 407kg sold, followed by New Zealand (167kg) and France (1kg).

This is the first time ever that the ODC is publishing such data to the public, and data for 2023 will not be available until the third quarter of 2024.

To ASX Weed Stocks ….

Here’s how the ASX weed stocks have performed, sorted by winners over the past month.

| Code | Company | Price | % Week | % Month | % 6-Month | % Year | Market Cap |

|---|---|---|---|---|---|---|---|

| IDT | IDT Australia | 0.105 | 10.53 | 23.53 | 66.67 | 26.51 | $36,905,344 |

| ALA | Arovella Therapeutic | 0.11 | 15.79 | 19.57 | 111.54 | 340.00 | $99,994,426 |

| EXL | Elixinol Wellness | 0.013 | 0.00 | 8.33 | 0.00 | -44.68 | $8,227,331 |

| NTI | Neurotech Intl | 0.059 | 3.51 | 7.27 | 55.26 | -15.71 | $48,747,022 |

| LGP | Little Green Pharma | 0.135 | 0.00 | 3.85 | -18.18 | -20.59 | $39,012,121 |

| DTZ | Dotz Nano | 0.145 | 0.00 | 3.57 | -39.58 | -44.23 | $69,374,459 |

| ME1 | Melodiol Glb Health | 0.002 | 0.00 | 0.00 | -71.43 | -90.00 | $4,728,824 |

| AC8 | Auscann Grp Hlgs | 0.04 | 0.00 | 0.00 | 0.00 | 0.00 | $17,621,884 |

| MDC | Medlab Clinical | 6.6 | 0.00 | 0.00 | 0.00 | -4.35 | $15,071,113 |

| EVE | EVE Health Group | 0.001 | 0.00 | 0.00 | 0.00 | 0.00 | $5,274,483 |

| CGB | Cann Global | 0.021 | 0.00 | 0.00 | 0.00 | 0.00 | $5,614,845 |

| BOT | Botanix Pharma | 0.1575 | 12.50 | -1.56 | 43.18 | 181.25 | $247,543,143 |

| WOA | Wide Open Agricultur | 0.16 | -5.88 | -3.03 | -50.77 | -27.27 | $28,067,747 |

| HGV | Hygrovest | 0.05 | -1.96 | -3.85 | -1.96 | -28.57 | $10,515,530 |

| EPN | Epsilon Healthcare | 0.024 | -11.11 | -4.00 | 20.00 | -4.00 | $7,208,496 |

| ECS | ECS Botanics Holding | 0.022 | 0.00 | -4.35 | 10.00 | 10.00 | $24,348,075 |

| CAN | Cann Group | 0.105 | 0.00 | -4.55 | -16.00 | -49.60 | $43,298,510 |

| AGH | Althea Group | 0.038 | 5.56 | -5.00 | -13.64 | -39.68 | $15,445,714 |

| LV1 | Live Verdure | 0.345 | 9.52 | -6.76 | 228.57 | 50.00 | $38,707,812 |

| ZLD | Zelira Therapeutics | 0.9 | -3.23 | -8.16 | -40.79 | -16.67 | $10,439,383 |

| AVE | Avecho Biotech | 0.0035 | 16.67 | -12.50 | -30.00 | -65.00 | $12,677,188 |

| BOD | BOD Science | 0.024 | 0.00 | -14.29 | -50.00 | -84.00 | $4,256,124 |

| VIT | Vitura Health | 0.265 | -2.75 | -15.87 | -32.05 | -55.83 | $152,606,554 |

| EOF | Ecofibre | 0.12 | 14.29 | -22.58 | -42.86 | -52.94 | $45,384,868 |

| WFL | Wellfully | 0.003 | -25.00 | -25.00 | -50.00 | -80.00 | $1,478,832 |

| BP8 | Bph Global | 0.0015 | -25.00 | -25.00 | -25.00 | -88.61 | $2,753,345 |

| IRX | Inhalerx | 0.029 | -3.33 | -25.64 | -35.56 | -50.00 | $5,503,242 |

| EMD | Emyria | 0.052 | -7.14 | -27.78 | -58.09 | -70.90 | $19,064,729 |

| WNX | Wellnex Life | 0.026 | -35.07 | -35.07 | -35.07 | -44.50 | $24,364,116 |

| RNO | Rhinomed | 0.019 | -36.67 | -36.67 | -72.86 | -82.73 | $5,714,394 |

| MXC | Mgc Pharmaceuticals | 0.45 | -11.76 | -52.38 | -92.50 | -95.91 | $17,880,899 |

IDT says it has had a strong start to FY24, with the fifth consecutive rise in unaudited revenue in Q1 FY24.

Quarterly unaudited revenue jumped ~300% on pcp to $3m in the September quarter. All of its three business segments posted growth in the period vs pcp.

That momentum has now accelerated into Q2, as the company won three new contracts in October and November alone worth $6.9m.

IDT says the company has an opportunity to capture a slice of the huge market in the medicinal cannabis and psychedelics.

The total global addressable market (TAM) for these products is forecast to hit US$64b by 2026, it says.

Neurotech has completed recruitment for its Phase 2/3 NTIASD2 clinical trial with a total of 56 patients enrolled, all with level 2 (requiring substantial support) or level 3 (requiring very substantial support) autism.

NTI says all patients were enrolled at the Paediatric Neurology Unit at Monash Medical Centre through the trial’s principal investigator Professor Michael Fahey, who is head of the unit and director of neurogenetics.

The trial covers treatment of NTI’s proprietary lead drug formulation NTI164, derived from a unique cannabis strain with low THC and a novel combination of cannabinoids, including CBDA, CBC, CBDP, CBDB and CBN.

Little Green Pharma (ASX:LGP) believes it is poised to significantly capitalise on a major amendment to the French health security bill.

The bill relates to new laws governing a two-stage post-French Pilot medicinal cannabis supply in France, as the country moves to integrate medicinal cannabis into its healthcare system.

The first stage will be a nine-month transitional period covered by a €10m budget, during which LGP and two other suppliers have an exclusive right to supply medicinal cannabis oil.

The second stage is a bespoke, subsidised public access regime for medicinal cannabis products meeting certain product registration requirements.

LGP says this legislation could pave the way for a substantial transformation in how medicinal cannabis is integrated into the French healthcare system.

France is one of the largest potential medicinal cannabis markets in Europe, with a Total Addressable Market of €5.6 billion.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.