We spoke with the boss of Australia’s biggest pot stock on what’s next for cannabis

Pic: Godji10 / iStock / Getty Images Plus via Getty Images

Australia’s top cannabis boss Peter Crock doesn’t give away much about Cann Group — the ASX’s most valuable medical marijuana play with a $300 million market cap.

He won’t say how much cannabis he is producing.

Nor will he speak about where his two operational plants in Victoria are or their related security arrangements. (The latter would risk losing the group’s coveted growing licences.)

But he has a lot to say about the journey ahead for Australia’s burgeoning cannabis industry.

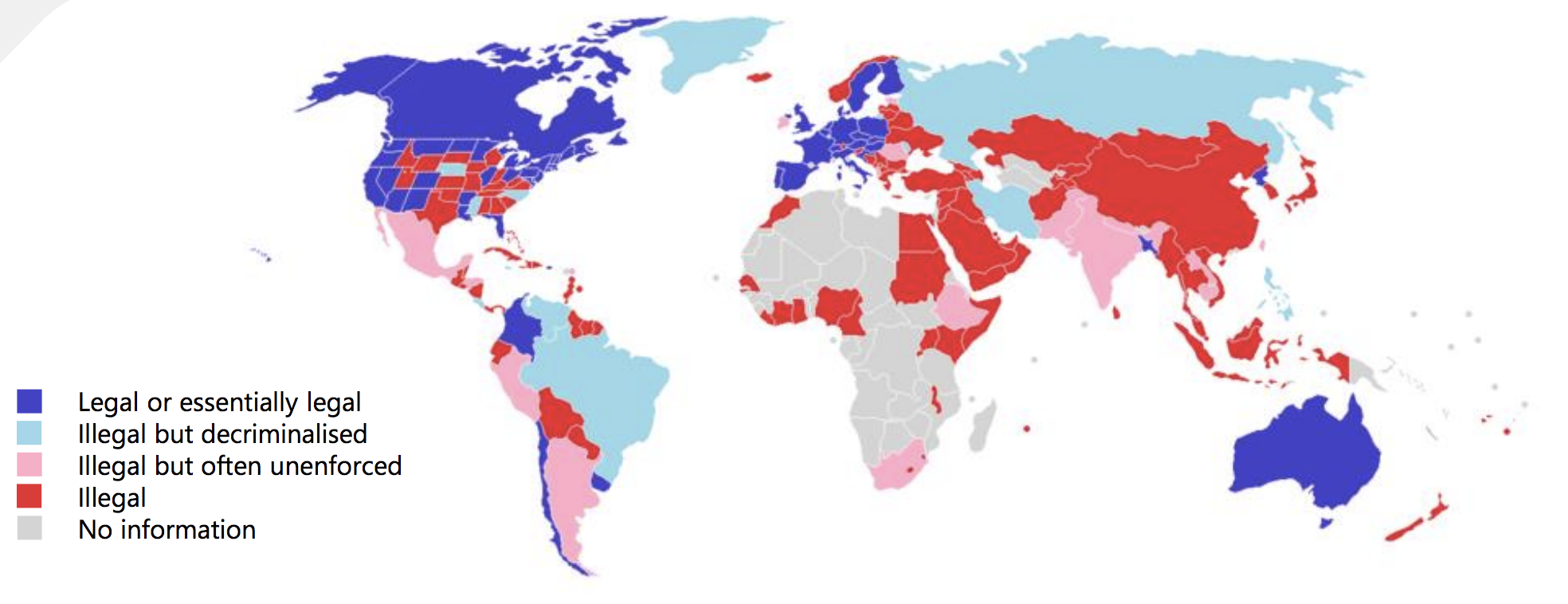

Australia won’t follow the Canadian path to legal recreational pot for five to ten years despite the new Greens campaign, he says. And that’s a good thing because it means more focus on medical applications.

Cann (ASX:CAN) was the first of 26 Australian companies to get cannabis licences, and the first of two companies believed to have received permission to actually start growing cannabis.

It has a commercial deal to sell cannabis to the Victorian government for pediatric epilepsy trials but is investing heavily to stay at the front of the wider industry.

Cann’s half-year loss at the end of 2017 was $1.5 million on $44,000 worth of revenue and R&D credits.

Mr Crock says Cann is in discussions to support other clinical trials and working on their own dosages which can be used in trials around chemotherapy-induced nausea, palliative care, epilepsy, or multiple sclerosis.

“In terms of having a dose form for the cannabis that we’re producing, yes we’re doing the steps of finalising that for use in those clinical trials,” he told Stockhead.

Though patient access portal partner Medlab (ASX:MDC) is not part of those discussions.

Instos love the exports

Exports are a key plank of Cann’s strategy, although Mr Crock is quick to repeat that their policy is “Australia first”.

The company bet $60 million in November last year — three months before the government revealed its policy turnaround — that exports would be allowed.

“It was a calculated risk that we were prepared to put forward, but it was clear there was bipartisan support, both in Parliament and at State level.”

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

He characterised the hefty institutional support for the fundraising as a change in attitude towards the industry, which had been seen as a speculative investment.

Legislation for exports came through in February and Cann was, of course, the first to get a licence.

Australia won’t follow Canada into recreational pot anytime soon

Mr Crock thinks it’ll be five to 10 years before recreational marijuana will be palatable politically and to the broader community.

“In terms of community acceptance of cannabis use and where it goes I think that’s going to take some time to shift.”

The Greens are campaigning for legal weed and Victoria Labor has committed to consider a report on the issue.

Canadian legislation to legalise the drug is before their Senate now.

With demand expected to soar to 650,000kg a year, all eyes are on the opportunity to break into the medical cannabis market as the industry there diverts resources into plant production to sate Canada’s potheads.

“Everyone knows that the recreational market is going to take a lot of focus away from production of medical products in Canada, so that leaves a natural opportunity for Australia to step up,” Mr Crock says.

ASX-listed cannabis stocks:

| ASX Code | Name | 3-month price change (Jan-Mar) | Market Cap (end of Mar) |

|---|---|---|---|

| ZLD | ZELDA | 0.075 | 79.31M |

| SCU | STEMCELL UNITED | -0.002849002849 | 15.40M |

| RGI | ROTO-GRO | -0.0126582278481 | 32.68M |

| QBL | QUEENSLAND BAUXITE | -0.259259259259 | 63.75M |

| MMJ | MMJ PHYTOTECH | -0.197802197802 | 79.52M |

| MXC | MGC PHARMA | -0.0752688172043 | 95.03M |

| MDC | MEDLAB CLINICAL | -0.214285714286 | 131.05M |

| LSH | LIFESPOT HEALTH | 0.0384615384615 | 10.87M |

| THC | HYDROPONICS | -0.215827338129 | 68.64M |

| EVE | EVE INVESTMENTS | -0.333333333333 | 21.99M |

| ESE | ESENSE-LAB | -0.431034482759 | 13.31M |

| EXL | ELIXINOL GLOBAL (*floated Jan 2018) | 0.71 | 174.98M |

| CPH | CRESO PHARMA | -0.193548387097 | 83.22M |

| CP1 | CANNPAL ANIMAL | 0.0975609756098 | 21.88M |

| CAN | CANN GROUP | 0.0454545454545 | 429.80M |

| BOT | BOTANIX PHARMACE | 0.617647058824 | 78.42M |

| BDA | BOD AUSTRALIA | -0.0128205128205 | 20.45M |

| AC8 | AUSCANN GROUP | 0.968944099379 | 437.96M |

| ATP | ATLAS PEARLS | -0.148148148148 | 10.27M |

| AEB | ALGAE.TEC | 0 | 19.87M |

| 1PG | 1-PAGE | 0 | 25M |

Then again, once Canada passes that law it will be in direct contravention of three UN conventions prohibiting the production, possession and consumption of drugs.

At worst it could see countries impose sanctions on Canada, drag it into the International Court of Justice to bring them back in line with other signatories, or cause restrictions on Canadian pot companies trading internationally.

“That’s a ‘watch this space’ one,” Mr Crock said.

“The most likely option is that it will be a protracted and drawn out process that will probably take three to five years to play out fully.”

Importing Canadian pot smarts

The influence of Canada on the local industry can’t be underestimated.

An analyst, who wished to remain unnamed, told Stockhead that investments by Canada’s big two Canopy Growth and Aurora Cannabis in Auscann (ASX:AC8) and Cann respectively meant the Australian industry is able to leverage Canada’s body of experience.

Mr Crock says the Office of Drug Control looked closely at the Canadian model,

For companies like Cann and Tasmanian Alkaloids which are aiming to operate at scale, there’s no doubt that Aurora and Canopy are setting the pace.

“Even just with the socialisation of the idea of what role cannabis has to play from a medical perspective is important. And in terms of the technology, the genetics, other aspects of it we’ll be using their experience.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.