Vet Greencross reports lower profit but investors like the outlook

Pic: REB Images / Tetra images via Getty Images

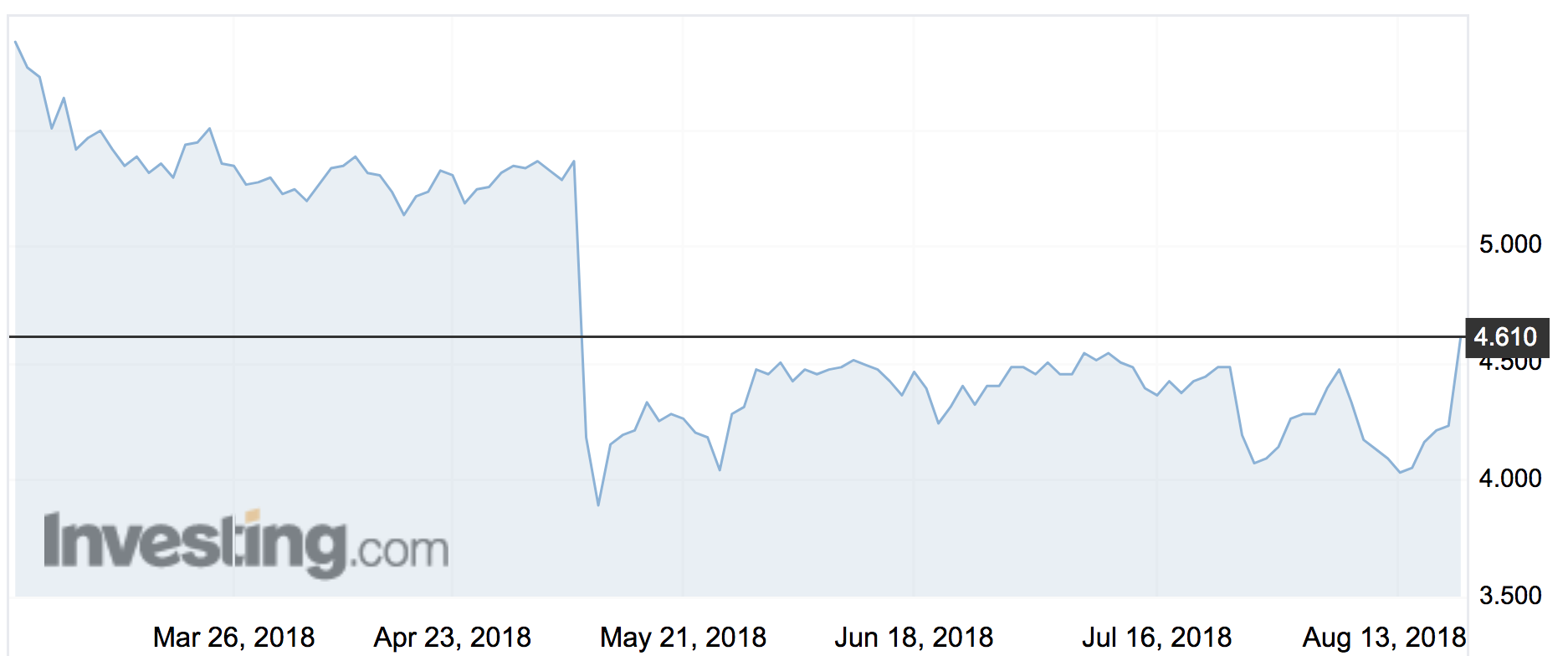

Greencross’s new managers have cut the dividend in half but a positive outlook for 2019 has saved the share price from a second plunge this year.

The vet chain’s (ASX:GXL) full-year profit dropped 51 per cent to $20.6 million, and as a result the dividend has fallen from 9.5c to 5.5c.

Investors were prepared for an EBITDA earnings drop: they were forewarned in May about a $21.8 million write-down after it became clear that the veterinary side of the business wasn’t performing.

After fleeing in May and causing a 22 per cent share price drop, on Monday investors jumped back in and sent the stock up 9 per cent to $4.61.

The new chief executive Simon Hickey launched a strategic review when he was appointed in February, and the company outlined in the annual report five ways it can stop the bleeding.

These are:

— expanding the “integrated pet care model”, or retail stores with a clinic attached

— invest in “omnichannel” — online and offline sales

— differentiate the retail product from other vet chains

— upgrade the vet clinic business so it is more convenient for customers and offers better service

— and the ambition to “focus on service excellence across all parts of the business”

Greencross says an integrated model is the way forward.

It now has 54 sites which meld a retail store and a clinic together, representing 22 per cent of the total network, and these delivered like-for-like sales growth of 8.5 per cent in fiscal 2018.

That compared to just 3.8 per cent sales growth at its traditional vet clinic sites.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Greencross also says it can maintain the same rate of expansion with less money.

It intends to slash capital spending to $50 million from $75 million in fiscal 2018, but doesn’t plan to slow down store openings or acquisitions.

“Greencross intends to add between three and five stores and between 10 and 15 in-store clinics to our network in FY19 and will continue to make strategic acquisitions and roll out services.

“Network investment will be focused on optimising sales per square metre and piloting a smaller store format to lower capital cost and reduce payback period,” the company said.

Mr Hickey said while vet clinic performance was disappointing, sale stabilised in the fourth quarter and they have programs in place, such as a pet wellness program to encourage people to use the clinics more often, better labour rostering, and the introduction of a vet incentive program.

“To improve customer convenience, we are also taking the first steps in modernising the delivery of our vet services through implementing extended hours, mobile vet, telemedicine and team-based medicine,” he said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.