US law changes could open a monster cannabis market says Elixinol chief

Pic: Oscar Wong / Moment via Getty Images

The United States is likely to become a major exporter of cannabis which could change the landscape for ASX-listed pot stocks, says the boss of hemp grower and medical marijuana developer Elixinol.

Paul Benhaim, who heads up newly listed Elixinol (ASX:EXL), says new US federal legislation could open the doors for American hemp growers to export high-cannabidiol products.

Also known as CBD, cannabidiol is a chemical derived from marijuana that’s said to offer nutritional and wellness benefits without getting you high.

Elixinol this week signed an agreement to expand its hemp growing operation in Colorado.

“That is our belief today — depending on the details of the final Bill, there will be an opportunity for us to export from the US into Australia,” Mr Benhaim told Stockhead.

The Bill, which apparently has bipartisan support in Washington D.C., would legalise industrial farming of hemp, a variety of the cannabis plant which is low in the psychoactive compound THC.

Critically, cannabidiol (CBD) is expected to be classed as food or dietary supplement because it doesn’t have that psychoactive component.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

In Australia it’s classified as a medical drug.

That means US manufacturers like the foreign arm of Elixinol would be able to make CBD products freely in the US, and export them to countries like Australia, Canada or Germany as medical products.

Mr Benhaim says much still depends on the details of the Bill though — and how Australia might interpret any final legislation.

“In 25 years of working in this industry I can probably say this piece of legislation is the biggest change,” Mr Benhaim said.

The legislation, put forward by House of Representatives leader Mitch McConnell, does not legalise at a US federal level medical or recreational use of cannabis.

But one indication of how fast medical cannabis is moving in the US is last week’s unanimous recommendation for approval by the powerful Food and Drug Administration (FDA) of a cannabis-based epilepsy drug.

The oral CBD drug Epidiolex, made by British company GW Pharmaceuticals, would be the first cannabis-based prescription medicine available in the US.

Playing with the big kids

The US is widely seen as being the elephant in the room for cannabis.

It’s borders are currently shut to exports or imports of medical or recreational cannabis because it is illegal at a federal level.

But Mr Benhaim believes it’s time for Australian businesses to start taking notice of of the behemoth.

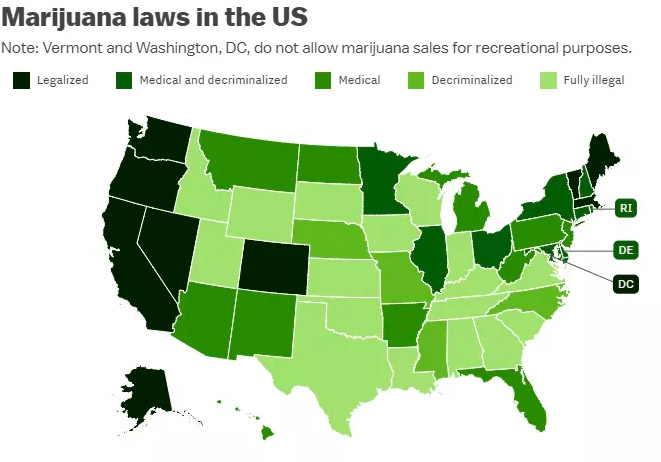

Its 326 million strong population and the sector’s rapid growth and depth in the 38 states which have legalised the drug in some form, will dwarf Canada’s market once the inevitable — and most analysts do believe legalisation is inevitable — happens.

The hemp Bill, defections from formerly rabid anti-marijuana politicians like former House speaker John Boehner, and President Donald Trump’s backflip on a federal crackdown on weed, suggest a more amenable environment for legalisation campaigners.

Among Australia’s cannabis players, only Mr Benhaim’s company Elixinol has operations in the US.

“Elixinol Global is one of the largest businesses in the US and we have been showing a strong growth curve,” he said.

According to Forbes, it’s one of the top five cannabis businesses in terms of size there.

The US part of Elixinol, Elixinol Global, has been investing to take advantage of looser federal laws for “years” that will allow them to not only advertise in that country, but export.

Further, Peak Asset Management’s Niv Dagan believes legalised cannabis — not just hemp — is “only a matter of time”.

“The legalisation of cannabis on a federal level in the US will be an absolute game changer,” he told Stockhead.

“The addressable market in North America is at least twenty times larger than the Australasian market, and what we are seeing right now is US-based cannabis companies head to the Canadian Stock Exchange (CSE) for funding and growth capital.

“The federal move will open the flood gates of fresh capital from around the globe, making it more accessible to investors.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.