US banks closer to legally doing business with cannabis, as ASX-listed Incannex pushes its way into the country

US banks and insurers can now deal with the cannabis industry. Picture: Getty Images

The US cannabis market reacted in jubilation last week, after the Secure and Fair Enforcement (SAFE) Banking Act — which would make it legal for insurers and banks to work with the cannabis industry — was successfully passed by the House of Representatives.

Meanwhile, the recent influx of states electing to legalise cannabis prompted analysts at the investment firm Cowen Inc to revise their annual market forecast for the US recreational market to $41 billion by 2025.

In an interview with The Street, Cowen senior analyst Viven Azer stated that the company had also identified Green Thumb Industries (CSE:GTII) as its “top pick” for the North American sector.

“They are one of [only] ten cannabis license holders in New York, which is poised to be a multi-billion dollar market. We think that Green Thumb has a really nice geographic mix and an attractive profitability margin,” Azer said.

“They are not the largest operator in the space in terms of the number of doors (places where the brand retails), but they do have a healthy geographic mix operating across a dozen states, and they have a solid EBITDA margin.”

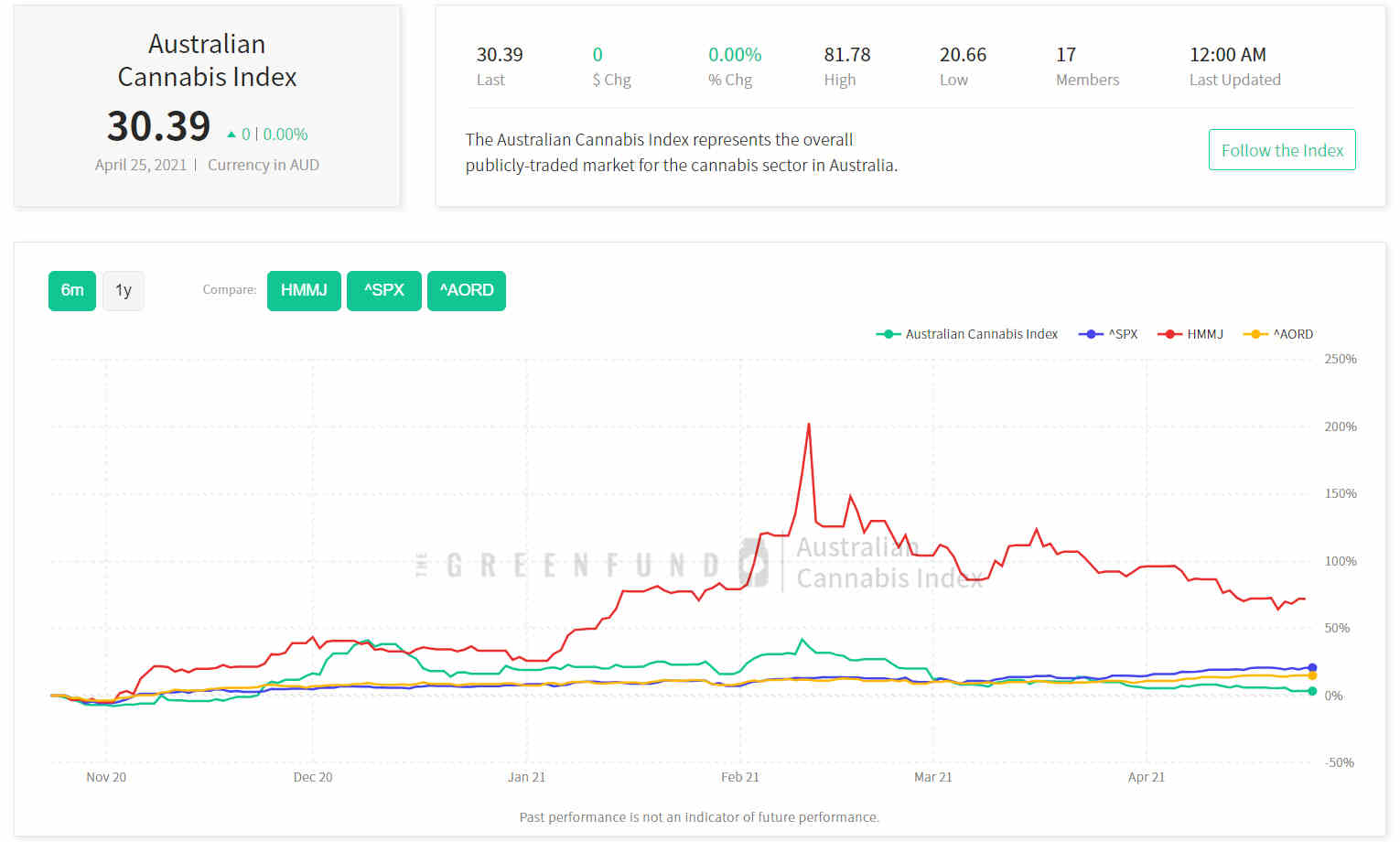

The news also marked the beginning of a rally for the Horizons Marijuana Life Sciences Index ETF (HMMJ), which saw its stock reach 10.76 by close of trading Friday. At the same time, the S&P 500 managed to record an increase of 20.63% on this six-month performance chart, while Australia’s All Ordinaries saw a gain of 14.66%.

Conversely, the Australian Cannabis Index continued to underperform again last week, as investors directed their attention towards the booming US Cannabis Market, although it is still showing a 2.86% improvement on its November 2020 outlook.

The Australian pharmaceutical developer Incannex Healthcare (ASX:IHL) also saw its share price climb last week, after the company announced that it will be assessing the potential of its IHL-675A formulation to be classified as a “multi-use drug”.

The change was made in response to recommendations from the US Food and Drug Administration (FDA), which recently met with Incannex to discuss the regulatory pathway that IHL-675A will need to navigate to gain access to the American market.

“The combined annual global market size of the indications being targeted by Incannex with IHL-675A is over US$125 billion so we consider the economic potential, as well as the benefit to patients over incumbent treatments, to be enormous,” Incannex CEO and managing director Joel Latham said.

The Green Fund’s Australian Cannabis Index allows investors to benchmark top players in the Aussie cannabis space against the S&P500, the AORD, and HMMJ, giving them an overview of the health of the industry Down Under.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.