Time for eye specialist Psivida to step up to the plate

Pic: Godji10 / iStock / Getty Images Plus via Getty Images

When it comes to the prospects for the back-of-the-eye disease specialist Psivida, it’s a classic case of good news and bad news.

Ok – do you want the bad news first?

On its own admission, Psivida (ASX:PVA) only has enough cash to last until the end of the first quarter of calendar 2018, which casts existential doubt on the Massachusetts-based play.

Not surprisingly, management is pondering “multiple alternatives” including equity and debt financings, corporate collaborations, other partnerships and transactions.

The good news? Psivida and its partner Alimera Life Sciences already have a drug (or technically drug delivery system) on market and its clinical trials for extension products are promising.

Psivida is responsible for three of four sustained-release ophthalmic products approved by the US Food & Drug Administration.

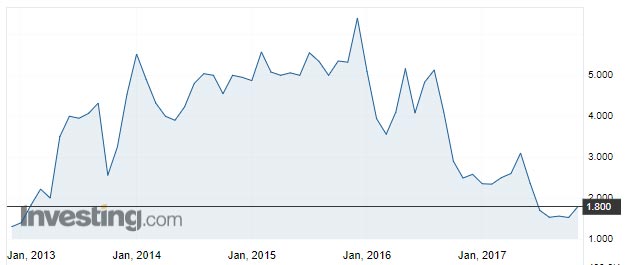

Despite Psivida’ s strong prospects in tackling hard-to-treat ophthalmic diseases, Psivida shares are trading near record lows, having peaked at around $5.70 in early 2016.

Or as one fund manager puts it, there’s a “disconnect between what appears to be a very strong execution relative to how the share price is doing”.

Eyeing prospects

The key achievement for Psivida to date has been a partnership with big pharma Alimera Life — inked more than a decade ago.

This was in relation to Iluvien, Psivida’s treatment for the difficult-to-treat eye disorder diabetic macular edema (DME).

The deceptive thing about one’s peepers is that while they look fragile, they have robust barriers to prevent the incursion of foreign bodies — including helpful drugs.

Psivida’s intellectual property is based on polymer layers that control the rate and duration of the release of the drug in question. The delivery object itself is tiny — about three millimetres long — but delivers a minute and controlled daily dose.

- Catch up with all the week’s ASX small cap news

- Follow us on Facebook or Twitter

- Discuss Stockhead small cap news in our Facebook group

Through Alimera, Iluvien has been sold in the US since 2015 and is also sold in the UK, Germany, Italy, Spain and Portugal.

Psivida also licensed Bausch & Lomb to sell Retisert (and a variant called Vitrasert) to treat posterior segment uveitis, a non-infectious inflammatory disease that is the third-leading cause of blindness in developed countries.

Retisert, which required a surgical procedure, is no longer sold.

Clinical success

Psivida’s current clinical work centres on its next-gen product called Durasert, which is licensed to Alimera except in the US.

Durasert aims to treat posterior segment uveitis with an insert that slowly releases a corticosteroid over three years.

The company is on track to file a new drug application to the FDA in December or early January.

“It’s an orphan disease and a relatively modest market [in the US],” CEO Nancy Lurker says. “We anticipate a market of 80,000 to 120,000 [patients]. However because we don’t expect to spend a lot on commercialisation it should be a nicely profitable product relatively soon.”

Two phase-three Durasert trials are taking place.

The first includes 129 patients across 16 US centres and 17 elsewhere.

Of these guinea pigs, 87 were treated with Durasert and 42 with a sham agent. On interim data, the trial reached its primary endpoint of preventing recurrence of the disease after six months.

Of the treated group, only 18.4 per cent saw recurrence of the disease while 78.6 per cent of the sham group did. After 12 months, it was 27.6 per cent versus 85.7 per cent.

The second trial, involving 153 patients across 15 centres in India, saw similar results: 21.8 per cent versus 53.8 per cent.

With Durasert, the patient requires only one injection into the eye, rather than repeat monthly visits.

Dr Lurker says patients with posterior segment uveitis have limited treatment options.

“The current standard of care is frequent injections of steroids or an implant that lasts only two to three months with a list price of $US1400 per device or a three-year equivalent price of nearly $US17000,” she says.

“Use of systemic steroids and immunosuppressants are associated with the potential for significant side effects. Steroid eye drops have limited efficacy, given their limited ability to reach the posterior segment of the eye.”

Other prospects

Psivida has also identified candidates for wet and dry AMD, glaucoma, osteoarthritis pain and other diseases.

In the US alone there were 600,000 procedures for severe knee osteoarthritis last year and “the number is expected to grow”.

In October Psivida announced a partnership with global ophthalmology company Nicox to develop sustained-release formulations of glaucoma drugs.

Initially, Nicox is funding $US750,000 of research, with additional payments of $US200,000 for ongoing development.

Forging a better deal

The Alimera tie-up initially delivered in spades, with Psivida pocketing a $US25 million milestone payment in October 2014.

Otherwise, it hasn’t exactly resulted in a river of cash, with Psivida chalking up $US970,000 of royalty income last year.

In July this year, the deal was amended so that rather than being entitled to a share of Alimera’s relevant profits, Psivida is entitled to a royalty stream. This cut starts at 2 per cent and rises to 6 per cent by January 2019; and then 8 per cent after annual sales hit $US75 million.

Lurker says the revised arrangement is a much better deal for Psivida, with greater transparency and more predictable revenue.

“We are more aligned with Alimera which is what you should be with partners.”

Dr Boreham’s diagnosis

Psivida admits the market for back of the eye diseases is “highly competitive”, with competition from big pharma as well as hospitals, government entities and not-for-profit organisations.

For example Genentech markets Lucentis for DME, while Roche’s cancer drug Avastin often is used off market for diabetic retinopathy.

“Most of our competitors and potential competitors are larger, better established and more experienced and have substantially more resources than we or our partners have.”

Oh!

Still, Psivida isn’t going to die wondering with an expected $US14.9m R&D spend in the current year, compared with $US14.4m in 2015-16 and $10.6m in 2014-15.

Dr Lurker, who took over from long serving chief Paul Ashton in September last year, has a long history in pharma commercialisation. “I saw companies that failed massively when they went to market and everything in between,” she says.

Psivida lost $US18.48m on revenue of $US7.54m in the 2016-17 year and has accrued losses of $US310m.

We reckon it’s time for Psivida to emulate the success of their home State heroes, the Boston Red Sox and step up to the plate.

This article first appeared in Biotech Daily

Disclosure: Dr Boreham is not a qualified medical practitioner and does not possess a doctorate of any sort. The thought of even one injection to the eye gives him the complete heebie-jeebies, but if the alternative is going blind he’ll take a stab at it.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions. The content of this article was not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.