This index of biotech stocks is up 782 per cent since the GFC

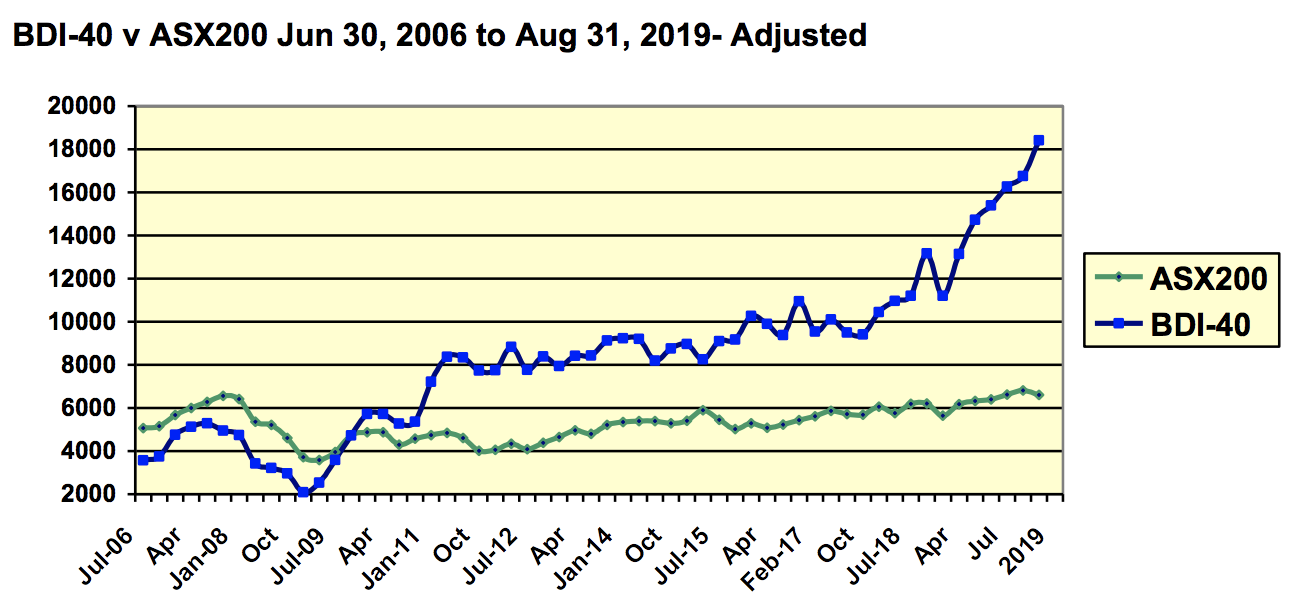

If you’re looking for an investment into the inherently risky health and biotech sector, you could do worse than the BDI-40, which has comfortably outperformed the ASX 200.

The brainchild of biotech analysis site Biotech Daily, the BDI-40 is an index of 40 rotating top-performing small and mid cap biotech stocks on the ASX. It does not include the mega caps like Cochlear, CSL or Resmed.

The index is currently sitting at a record high, having risen 13 per cent in the month of August. It is up 782 per cent since the global financial crisis, with its collective market cap skyrocketing in the past 13 years from $2.1 billion to $18.4b.

The ASX 200, meanwhile, considered a bellwether of the Australian stock market health, has largely treaded water.

And the performance of the biotech sector is even stronger when factoring in the “big three”, Biotech Daily editor David Langsam says.

“The three big caps of Cochlear, CSL and Resmed (which are not included in the BDI-40) have doubled in value in three years and continue to push through record highs, while on the other side of the Pacific, the Nasdaq Biotechnology Index (NBI) continued its fall,” he said.

In August, the BDI-40 had a 13 per cent gain, the big three were up 3 per cent, while both the ASX 200 and the NBI fell 3 per cent.

Opthea (ASX:OPT) was one of the biggest movers, unsurprisingly after positive phase II Wet AMD trial results.

In a testament to the consistency of the index, a quarter (10) of the BDI-40 stocks survived the distance through all 13 years.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.