This health stock has quietly doubled its clinical portfolio since 2018 and doesn’t plan on slowing down

Pic: Godji10 / iStock / Getty Images Plus via Getty Images

Healthia (ASX:HLA) has grown its suite of health businesses almost 170% since listing in 2018.

The health stock has its sights set on diversification through M&A and has grown from 104 businesses in 2018 to 281 businesses across its three divisions – Bodies and Mind (physiotherapy), Feet and Ankle (podiatry), and Eyes and Ears (optical).

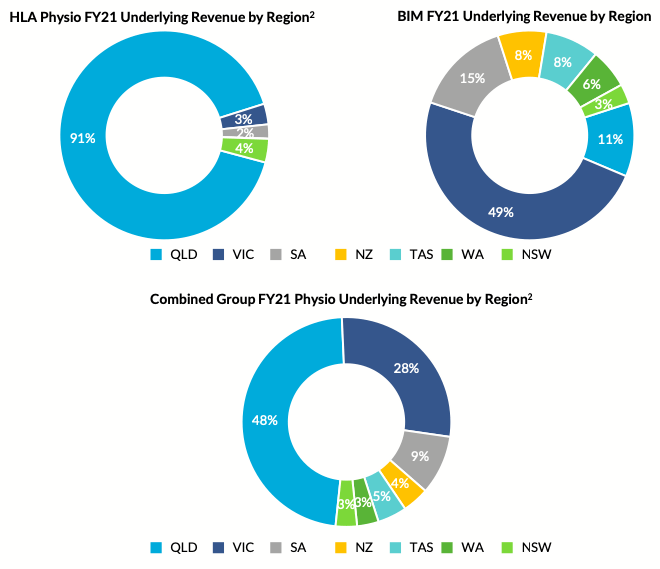

In early October the company announced the acquisition of Back In Motion which owns 64 physiotherapy clinics across the country.

So far, settlement has been reached for 32 clinics, and with 32 remaining, the company’s total physiotherapy business tally will soon hit a whopping 122 clinics across Australia.

Not to mention it holds just over 100 podiatry clinics and 46 optical stores as well.

Building a diversified allied health company

While this may seem like a bit of a jump, Healthia managing director and CEO Wes Coote says it’s all part of the company’s growth strategy.

“We’re aiming to be Australia’s leading diversified allied health company,” he said.

“We’re clinician led across the business, we’ve got the founders of each of the disciplines still actively involved in the business, so they’ve got a deep understanding of the industries they work in.

“We’ve got a really good handle on organic growth and achieving really solid organic growth from the portfolio.”

The company expects the aggregated BIM transaction to contribute underlying revenue of $62.9 million and underlying EBITDA of $12.3 million.

Addressable market is a cool $9.8 billion

The company has effectively doubled its market share in the physiotherapy space, and the addressable market is huge.

For the Feet and Ankles division its $2.7 billion, for Bodies and Minds it’s $3.8 billion and for Eyes and Ears its $3.3 billion – for a total of $9.8 billion.

And even once all 62 clinics are acquired Coote says the company will still have less than a 3.5% market share in BIM’s addressable industry revenue.

There’s plenty of room to grow.

“We’ve got an addressable revenue market of nearly $10 billion, we’re at less than 2.5% of that addressable market, in very fragmented industries with plenty of run rate for growth – so it’s an exciting story,” he said.

In FY22, Healthia also acquired AllCare Physiotherapy, John Holme Optometry, Anytime Physio and Rothwell Physiotherapy – which are expected to contribute underlying revenue of $6.08 million and underlying EBITDA of $1.00 million.

Spending $20 million per year on acquisitions

Coote said he gets asked frequently about the company’s run rate for growth.

“We told the market we’ll continue to deploy $20 million worth of capital per year on new acquisitions,” he said.

“We’re averaging about four times EBITDA on those acquisitions.

“We’ll continue to look for really well established, well run optical, podiatry and physio clinics as we go forward because they are the core of the businesses that we bring on, on a regular basis, to continue to grow the portfolio.

“And we’re comfortable to continue to fund those acquisitions through capacity we have in our $100 million debt facility with the bank.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.