This ASX-listed healthcare ETF returned 33pc in 2020 – and it’s not Blackrock’s IXJ

There are four healthcare ETF on the ASX. Picture Getty Images

Healthcare is one of the most popular thematic investments, and Blackrock’s iShares Global Healthcare ETF (ASX:IXJ) is one of the biotech investing crowd’s favourite way to cover it.

Ageing populations, rising living standards and ongoing medical advancements are expected to underpin the sector long term.

Another factor that’s been driving the sector is COVID-19, which has and will continue to impact the industry in major ways.

The sector was clearly not prepared for the pandemic — hospital delivery, medical devices, pharmaceuticals — all fell short initially and were caught by surprise.

Ironically however, there has been tremendous leaps in the industry, such as the adoption of digital and telehealth, as a result of the pandemic.

On the ASX, the healthcare sector is very much dominated by three giant companies: CSL (ASX:CSL), Cochlear (ASX:COH), and Sonic Healthcare (ASX:SHL).

The rest of the field is made up of medium-sized and smaller-capped companies, mainly those that are at various stages of clinical trial developments.

Against this backdrop, investors who prefer a more global health exposure could choose to invest in four exchange traded funds (ETF) listed on the ASX.

Blackrock’s iShares Global Healthcare ETF (ASX:IXJ)

This is perhaps the most well-known ETF on the ASX.

The fund’s objective is to provide investors with the performance of the S&P Global 1200 Healthcare Sector Index.

In other words, the fund tracks global biotechnology, healthcare, medical equipment and pharmaceuticals companies throughout the world.

Since its inception in 2001, the index has more than tripled.

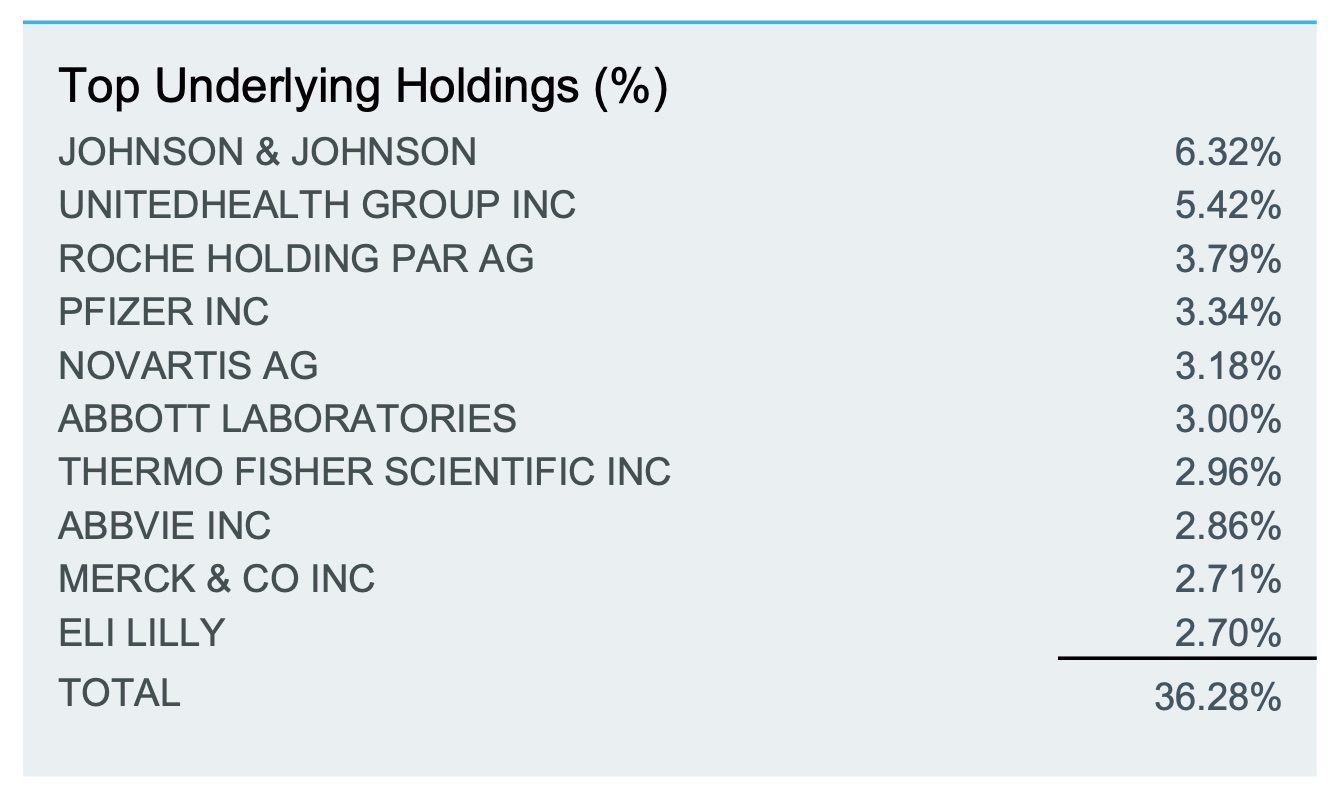

The fund invests 70% of its funds in US healthcare stocks, and as of July 31, its top biggest holdings are:

It’s a market cap-weighted index fund, meaning that it’s highly concentrated at the large end of town.

Last year, the fund returned 2.47%, falling from its best ever return of 23.06% in 2019. The fund charges 0.46% management fee.

Betashares Global Healthcare ETF-Curr Hedged (ASX:DRUG)

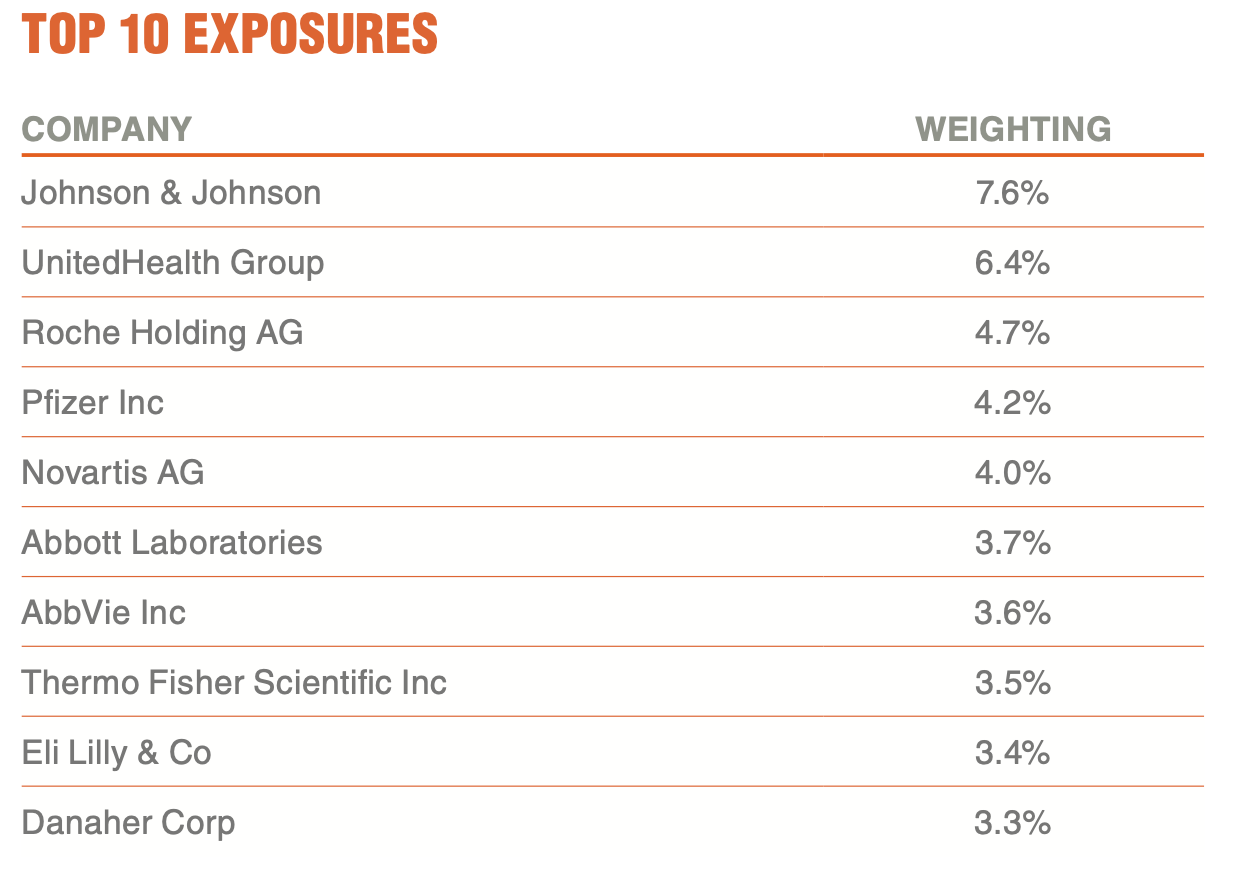

The main objective of this fund is to track the largest non-Australian global healthcare companies.

But the main selling point is that investors’ exposure is hedged back into Australian dollars, which eliminates currency risk for Aussie investors.

Just like IXJ, more than 70% of its portfolio is invested in US healthcare companies.

Here’s the fund’s top 10 investments as at 31st July.

The fund returned 5.87% in calendar year 2020, and so far this year it has returned over 15%.

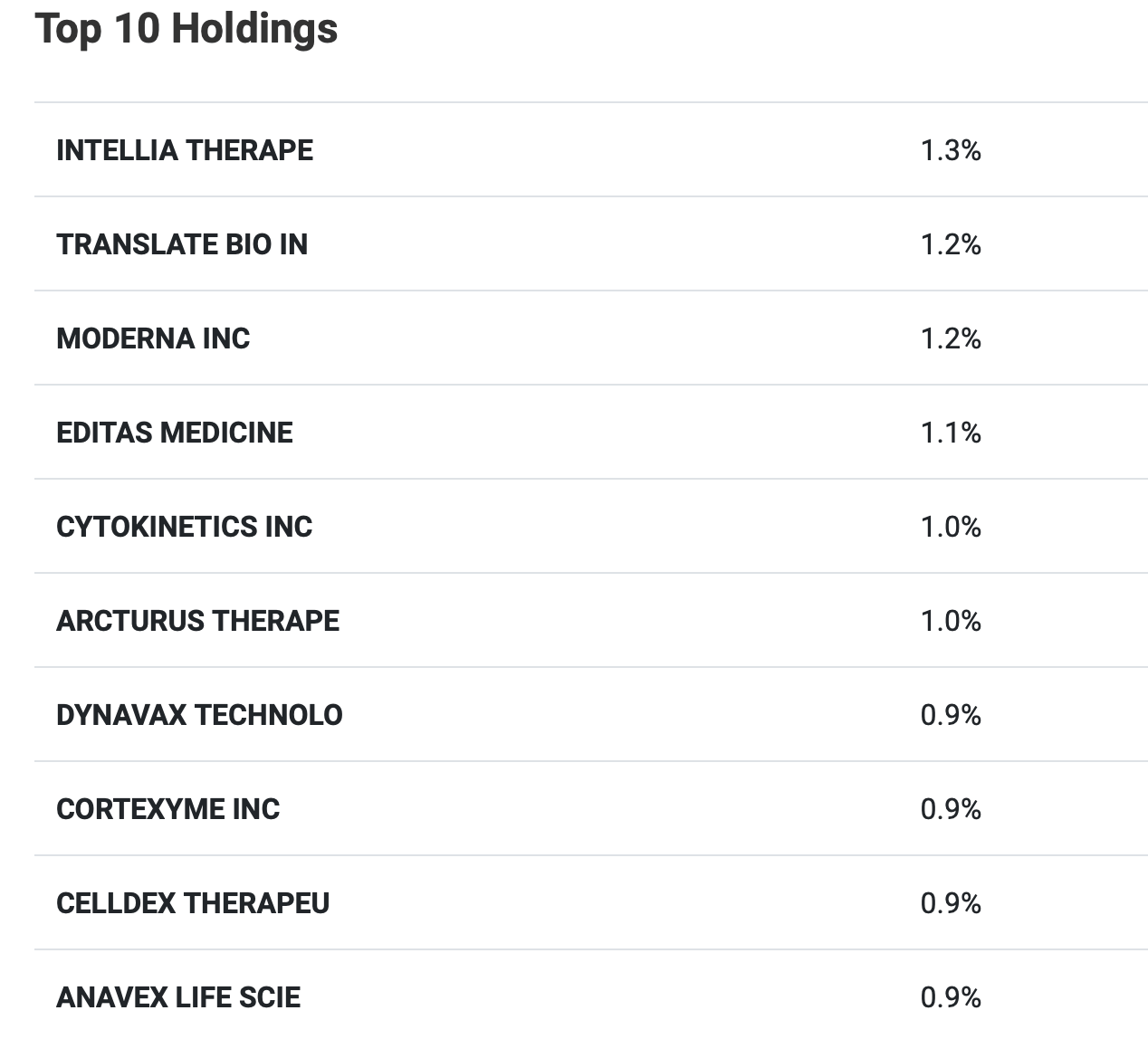

ETF Securities S&P Biotech ETF (ASX:CURE)

This fund offers investors exposure to only US healthcare biotech companies.

Specifically, it tracks the S&P Biotechnology Select Industry Index, which gives it access to the US biotech market benefitting from the FDA drug approval and US patent system.

CURE uses a full-replication strategy to track the index, meaning that it holds all of the shares that make up the index.

It’s also equal weighted, with each holding making up the same portion of the portfolio and therefore contributes equally to overall performance.

To be eligible for inclusion in the index, companies must be part of the biotechnology sub-industry of the US healthcare sector, and meet minimum market capitalisation and liquidity requirements.

But how does biotech differ from healthcare?

According to the CURE fact sheet, biotech is a sub-industry within the healthcare sector.

The Healthcare sector includes two main groupings: Equipment & services, and Pharmaceuticals, Biotechnology, & Life Sciences.

The equal weighting method employed by CURE means that large-cap stocks do not dominate, as they often do when holdings are weighted by market cap.

The fund’s top 10 holdings as of August 16 were:

The company’s 2020 return was 33.6%, and it charges a 0.45% management fee.

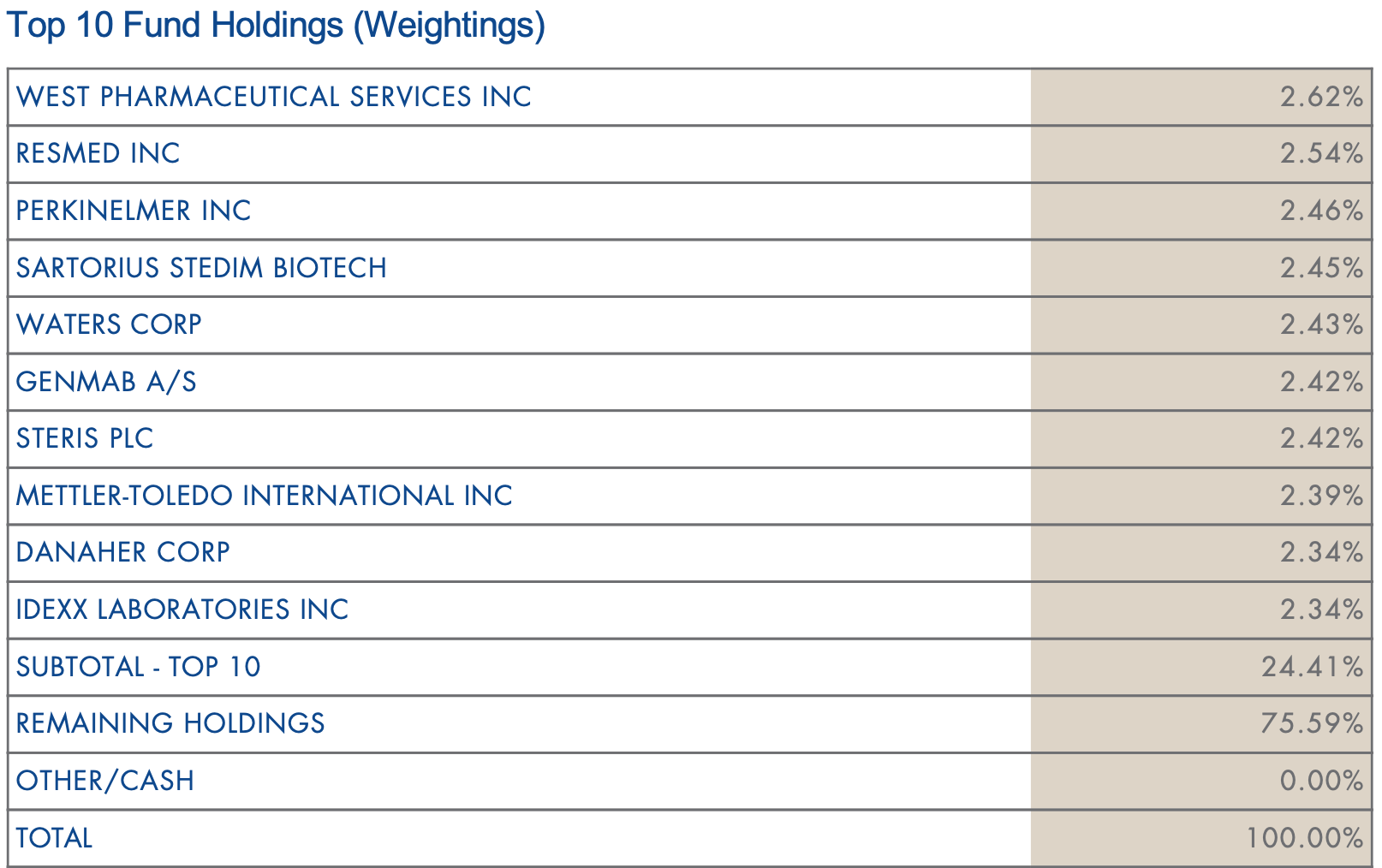

VanEck Global Healthcare Leaders ETF (ASX:HLTH)

The HLTH fund gives investors exposure to a diversified portfolio of the largest international companies from the global healthcare sector.

This is basically a passive index fund that tracks the MarketGrader Developed Markets (ex-Australia) Health Care Index, which consists of 50 healthcare from developed markets excluding Australia.

Its top 10 holdings as of July 31 are shown below, with 70% being invested in US stocks. The company charges a 0.45% management fee.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.