The health sector has been the ASX’s top performer in 2019, but could a recession stop it in its tracks?

Pic: sinology / Moment via Getty Images

No other sector among ASX small caps has had a better year than the health sector.

On average small caps in this industry have gained 27 per cent. By comparison, mining has only gained 11 per cent and tech 18 per cent.

There have been several success stories of small caps growing into large caps, like Clinuvel Pharmaceuticals (ASX:CUV), Pro Medicus (ASX:PME) and Nanosonics (ASX:NAN).

Pitt Street Research analyst Stuart Roberts is a true believer in the life sciences.

“It’s just continued to grow,” he said at the Pitt Street Life Sciences conference in Sydney last week.

“We have seven universities in the top 100 and a whole network of people who’ve done it before – it’s a recipe for success.

“If there’s a takeaway message, there is one direction in which it’s going and it’s forward.”

Chances of recession

But don’t mention the r word (recession) to these companies. It has been on the lips of the big financial firms.

In recent weeks economists from Legg Mason and JP Morgan declared the probability of a recession in 12 months was 50 per cent. Others are less cautious — Barclay’s Michael Gapen thinks it’s 20 per cent while Goldman Sachs’ David Solomon says 25 per cent.

The biggest global warning was the inverted yield curve, where long-term rates are lower than short-term rates, in mid-August. Every time this has happened in the last 40 years a recession has occurred within two years.

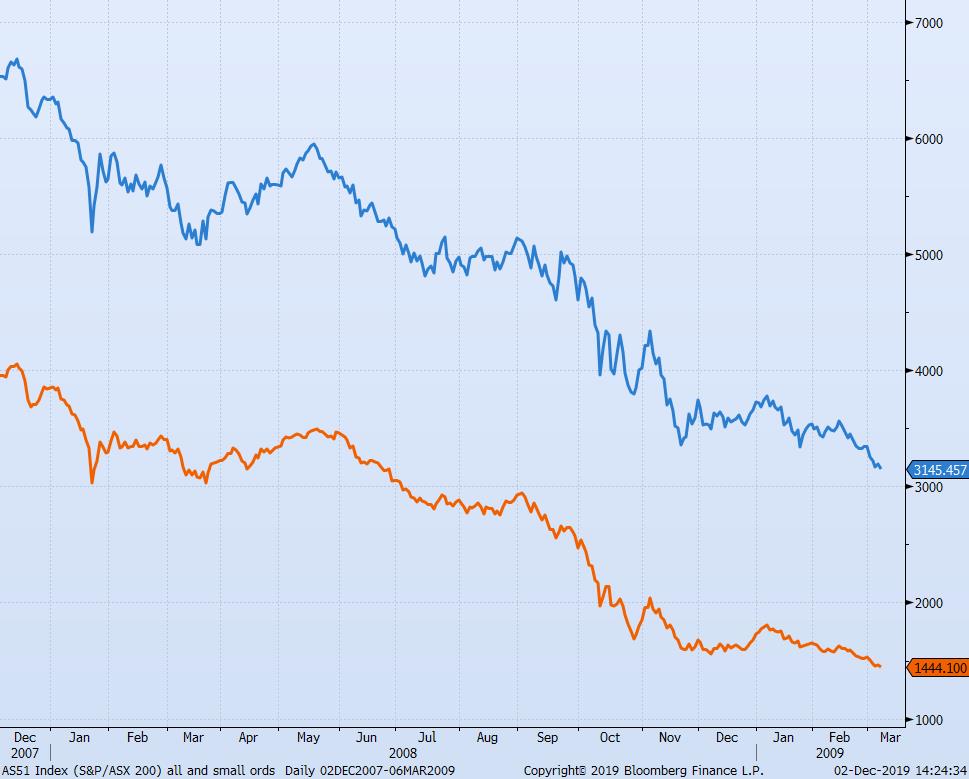

Australia did not enter a recession during the GFC but the market’s value halved at the time. From early December 2007 to early March 2009 the ASX 200 fell 53 per cent while the ASX Small Ords fell 65 per cent.

Healthcare stocks on the ASX lost 51 per cent in that time.

Small caps don’t fear a recession

Pharmaxis (ASX:PXS) is one company that is confident it could weather a recession.

CEO Gary Phillips told Stockhead if a recession hit, it would be big pharma that would cop it worst and smaller companies with solutions would be fine. In fact, big pharma is already undergoing a shift.

“What we see globally is pharmaceutical companies are becoming less efficient at generating assets and relying on smaller companies for innovation,” he said.

“[Big companies] are prepared to pay as long as we have novel mechanisms and there is an unmet need.”

Pharmaxis has a pipeline of drugs facing key decisions in the next few months. The key is its drug (BI 1467335) targeting inflammation and stress enzyme AOC3.

Pharmaceutical giant Boehringer Ingelheim is testing this in relation to NASH (a liver disease) and diabetic retinopathy (a complication of diabetes causing blindness).

Neither of these diseases have approved treatments. But market estimates suggest peak sales potential to be US$2 billion ($2.9 billion) and US$800m respectively.

Results of phase 2a clinical trials are due by the end of this year for NASH and mid-2020 for diabetic retinopathy. Both will come with Boehringer’s decision and sales execution plan – if successful.

“These [NASH and diabetic retinopathy] are diseases where governments will find money to fund drugs that treat their population,” Phillips said.

“Pressure may come under their pricing but that won’t affect investments – if anything they have to become more efficient.”

Even if healthcare companies have more difficulty in raising capital, Phillips said Pharmaxis was fine – it didn’t need more cash.

It has $23m in the bank right now, and with milestone payments if drugs are successful (as well as research and development incentives) this would increase. If further trials are needed, Boehringer would pay, according to Phillips.

Staying private

One possibility is that firms may choose to stay private for longer or potentially permanently.

One med-tech seeking to go public next year, 4Dx, is 14 years old and is only now looking at listing.

Last month PwC Australia CEO Luke Sayers told Stockhead the current regulatory environment was also encouraging short termism, particularly among small caps, and they may look to go private.

Rick Holliday-Smith chairman of the ASX and Cochlear (ASX:COH), as well as private drug maker QBiotics, told the Pitt Street conference he only agreed to join QBiotics if it stayed private.

READ MORE: Here’s what policymakers must do to keep ASX life science companies from going overseas

LISTEN TO: Health Kick Podcast: Developing drugs, fighting fibrosis and squeezing squishometers

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.