Long-time Compumedics director voted out as China deal stalls and shares dive

Pic: Godji10 / iStock / Getty Images Plus via Getty Images

Thursday’s annual shareholder meeting didn’t bring the moment of triumph Compumedics directors would have been looking forward to six months ago.

In May the sleep-focused wearable tech maker announced a “significant and transformative” plan to partner with China-based Health 100 to sell a million of its Somfit sleep-tracking devices.

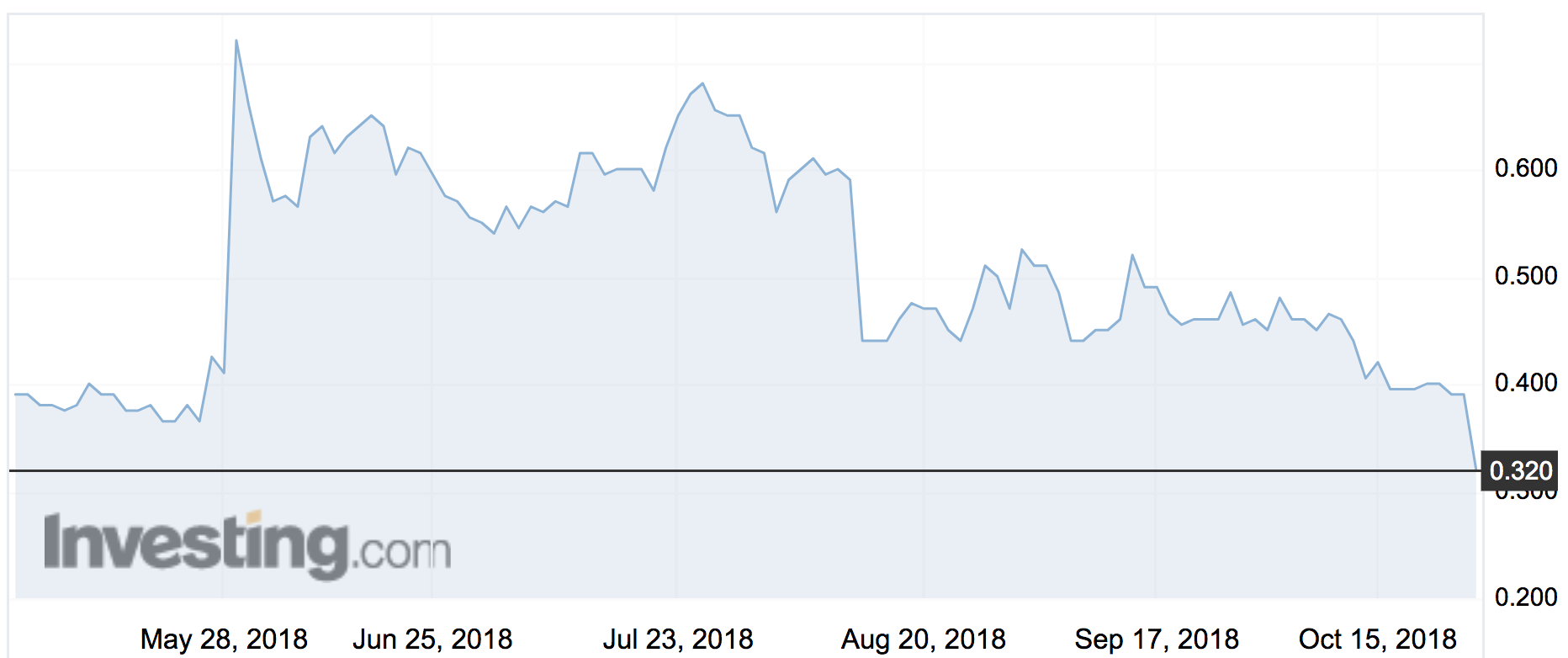

The stock (ASX:CMP) surged 75 per cent to an 18-month high of 72c at the time.

But on Thursday Compumedics told investors the deal had “stalled” due to issues concerning intellectual property and a conflict of interest with a third party who’d been “introduced to the joint venture discussions”.

The stock fell 13c to 34c — close to a three-year low.

At Thursday’s meeting shareholders voted overwhelmingly to boot a director who had been on the board for 18 years.

Dr Alan Anderson lost his bid for re-election by 91 per cent of the votes.

Compumedics chief David Burton believed the board needed rejuvenation, chief financial officer David Lawson told Stockhead.

Institutional shareholders had expressed a need for board renewal and Tucson Dunn had been voted in — but Dr Anderson believed he had more to contribute and wanted to stand again.

Mr Burton (who controls 55.3 per cent of the company) and other shareholders voted against his re-election.

Mr Lawson said there was no “recrimination or animosity” between the two men and it was “just a case of differing opinions”.

What’s ahead

The “rejuvenated” board has its work cut out for it winning back shareholder confidence.

In May, at the time of the Health 100 announcement, Mr Burton said Compumedics was about to “make history transforming health and leading the way of the future for primary, secondary and tertiary community-wide healthcare”.

He even convinced Victorian Premier Daniel Andrews and Victoria’s Commissioner to China Tim Dillon to attend an official signing of the deal (see picture above).

Six months later the company said it was “no longer able to commit to a conclusion date” for a joint venture with Health 100 and would look elsewhere for “other trade and investment opportunities for the Somfit technology in China”.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

The deal was derailed when a third party was introduced to the joint venture discussions.

The third party was a direct competitor to Compumedics, a spokesman told Stockhead.

Health 100 had always said another party would join the joint venture — but only identified that company this month.

Compumedics was concerned about allowing a big competitor access to the algorithms and tech behind the Somfit device — and decided it wasn’t in their interest.

The announcement sent the stock back to the price it was fetching three years ago.

Under the deal, Health 100 was supposed to buy a million Somfit devices over two years.

Somfit tracks a user’s activities during the day as well as collecting “medical-grade data” at night to provide insights and help understand a person’s “sleep architecture”.

The China story is not completely lost to the company.

Straight after the bad news they followed with a statement that the company had received a $1.1 million order from an existing China distributor for neuro-diagnostic products, and Chinese sales had grown about 20 per cent a year for the last five years.

The company has been working in China for about 20 years.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.