Spark Plus sees 225pc upside in biotech player Neurizon

Spark Plus sees plenty of growth potential for Neurizon. Pic: Getty Images

- Spark Plus puts a target price of 69.6 cents on Neurizon, a 225% upside to its October 23 price

- Corporate advisory specialist said Neurizon was set to capitalise on numerous catalysts

- Spark Plus said Neurizon had made significant strategic advances in recent months

Special Report: Corporate advisory specialist Spark Plus has put a target price on Neurizon Therapeutics of 69.6 cents, an upside of ~225% to its trading price on October 23, forecasting the company is set to capitalise on numerous catalysts in coming months.

In a research note Spark Plus said Neurizon Therapeutics (ASX:NUZ) (formerly PharmAust) had a critical milestone in clinical development of its lead investigational product NUZ-001 (formerly known as monepantel) for Amyotrophic Lateral Sclerosis (ALS) treatment.

The company will enrolment in the Phase 2/3 HEALEY ALS Platform Trial in Q1 CY25, following a successful Phase 1 MEND Study in February 2024.

The clinical-stage biotech – which is developing new therapeutics for neurodegenerative diseases – reached full enrolment for its OLE study in Q2 CY24. The study followed success of the MEND study.

Spark Plus, a corporate advisory firm based in the Asia-Pacific region, said notably several patients have now surpassed the two-year mark of continuous treatment with NUZ-001, a small molecule drug that has been shown to modulate the mTOR pathway.

“The potential for monetising Neurizon’s pipeline is bolstered by the US FDA granting orphan drug designation (ODD) in May 2024,” Spark Plus said.

“Additionally, Orphan Medicinal Product Designation (OMPD) status is anticipated in December 2024, expanding Neurizon’s commercial reach across Europe.”

Spark Plus said alongside these clinical achievements, NUZ had made significant progress in enhancing its manufacturing capabilities, assembling a revamped board and management team, and establishing a new scientific advisory board.

“This refreshed corporate strategy positions Neurizon well, with encouraging progress in both clinical and commercial areas expected to de-risk its value proposition in the near term.”

Potential entry into US and Europe by FY27

Spark Plus said the fastest and most efficient path-to-market (via potential accelerated approval) in the US and EU positioned the company to enter these regional markets as early as FY27.

“Furthermore, the optimal path to creating accretive shareholder value lies in strategically focusing on the development and commercialisation of their lead asset and target indication (NUZ-001 for ALS),” he said.

“Notably, the underlying mechanism of action (of NUZ-001) allows the company to pursue other neurodegenerative diseases such as Parkinson’s disease and Alzheimer’s disease utilising similar modus operandi.”

HEALEY trial key endorsement

The company announced in July it had been selected for inclusion in the prestigious HEALEY ALS Platform Trial in the US under a Clinical Research Support Agreement with Massachusetts General Hospital.

The HEALEY ALS Platform Trial was a competitive process led by a group of expert ALS scientists and members of the Healey & AMG Center Science Advisory Committee, leading the first Platform Trial initiative for ALS.

“Inclusion in the HEALEY ALS Platform Trial firstly stipulates independent validation of NUZ-001’s potential as an ALS treatment,” the firm said in its research note.

“This serves as a key endorsement of Neurizon’s lead clinical asset from industry KOLs and places the company in full view of potential BioPharma partners (maximum visibility).

“The fact that the cost of research is considerably subsidised is a significant benefit to smaller companies.”

Advance in manufacturing capabilities

Spark Plus noted that NUZ had continued to advance its manufacturing capabilities to support the development and commercialisation of NUZ-001.

“Significant progress was made in the GMP manufacture campaign, with an engineering batch currently in progress,” the firm said.

“These efforts are critical to ensure a consistent and high-quality supply of NUZ-001 for both clinical trials and future market needs.”

The manufacturing process involves collaboration with several key partners, including Syngene International Ltd and Catalent, Inc.

“These partnerships are essential in ensuring that NUZ-001 is produced to the highest standards required for clinical and commercial use,” Spark Plus said.

Refreshed strategy and name change

Following the encouraging results from the Phase 1 MEND study, NUZ has strategically narrowed its focus and resources to concentrate on the development and commercialisation of NUZ-001 for the treatment of ALS and other neurodegenerative diseases.

“In our view, Neurizon’s new focused and refreshed strategy to leverage NUZ-001s inherent mechanism of action across neurodegenerative diseases was a welcomed step forward in the company’s new trajectory,” Spark Plus said.

“Resultingly, a revamped Board and Management team whose specific skills and area of expertise closely aligns with the renewed strategy was established in FY24.

“Furthermore, the company’s headquarters were relocated to Melbourne to enhance operational efficiency and collaboration between the Board and Management team.”

On October 15, PharmAust officially changed its name to Neurizon Therapeutics.

“The Neurizon Therapeutics name and brand align with our focus on creating a promising horizon for patients facing complex neurodegenerative diseases,” chair Sergio Duchini said.

“Starting with Amyotrophic Lateral Sclerosis (ALS), the most common form of Motor Neurone Disease, we’re committed to reshaping patient treatment and making meaningful progress in neurodegenerative research.”

Valuation findings

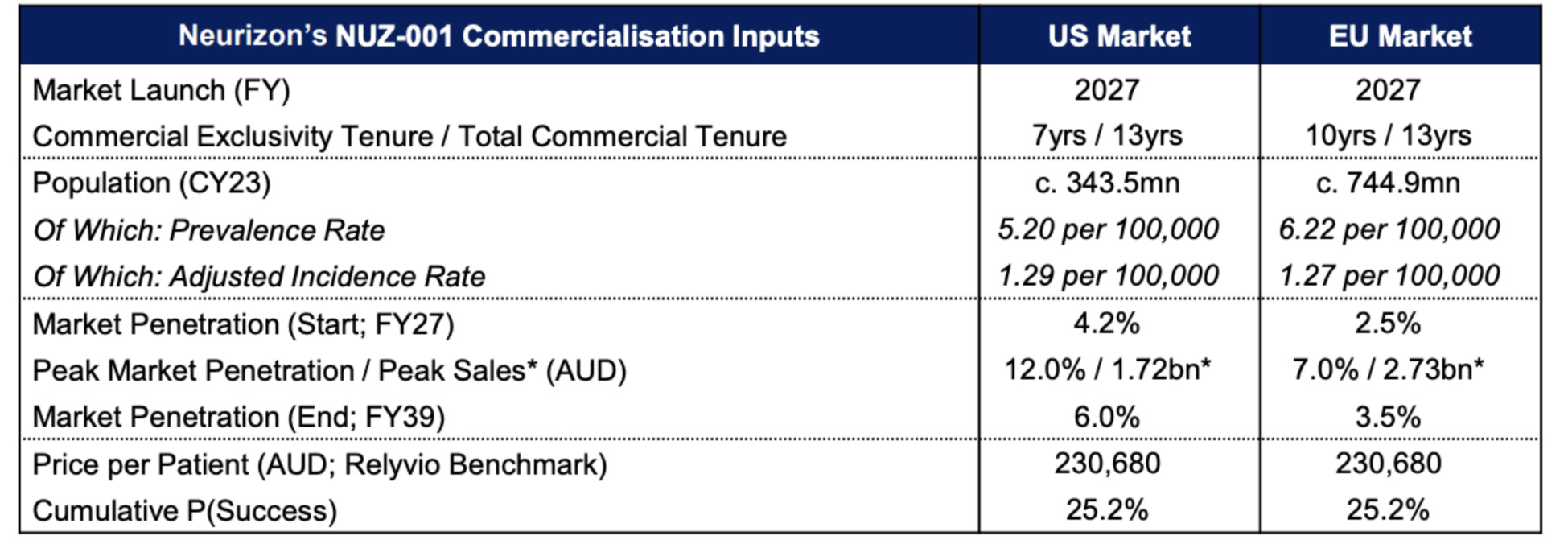

Spark Plus said a robust risk-adjusted NPV (rNPV) model was used to estimate the present value of the NUZ in a scenario whereby NUZ-001 (lead asset) for the treatment of ALS was being administered across the US and Europe.

“We acknowledge that other neurodegenerative indications (non-ALS) is still at a speculative pre-clinical stage in its development and as a prudent measure, did not include this in the valuation,” Spark Plus said.

Based on the intrinsic rNPV methodology, Spark Plus’s implied target price for NUZ as of October 23, 2024 stood at 69.6 cents/share, representing a ~225% upside from its share price of 21.5 cents on that date.

Spark Plus also noted as of the date of the report on November 1 NUZ was well funded with $17.5m of cash and cash equivalents following a $10m institutional placement in June and $7.8m heavily oversubscribed share purchase plan in July 2024.

This article was developed in collaboration with Neurizon Therapeutics, a Stockhead advertiser at the time of publishing.

Neurizon Therapeutics Limited currently are, or in the past 12 months have been, a client of Spark Plus Pte Ltd.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.