ScoPo’s Powerplays: Health sector rattled but ASX X-ray stocks dance, led by boss PME up 28% since June

Pic: Getty Images

- The ASX Health sector has fallen in its last full trading week of 2022

- Health imaging firms doing good, led by Pro Medicus, up 28% 6 months to Xmas.

- Volpara Health Technologies is gearing up for solid Q3 FY23 results in mid-January.

Healthcare and life sciences expert Scott Power, who has been a senior analyst with Morgans Financial for 24 years, explains what the movers and shakers have been doing in health and gives his ASX Powerplays.

Good news for people concerned about having bad breath. A new meta-analysis has found four probiotics can reduce the buildup of foul-smelling volatile sulphuric compounds (VSCs) which cause bad breath.

VSCs are produced in the mouth by anaerobic bacteria, which feed on food left behind, and are a main cause of halitosis, otherwise known as bad breath, along with poor dental hygiene.

The four beneficial probiotics for bad breath, which can be found in fermented foods, include:

- Lactobacillus salivarius

- Lactobacillus reuteri

- Streptococcus salivarius

- Weissella cibaria

Results of the meta-analysis, which were published in BMJ Open, shows the probiotics help eliminate the buildup of VSCs in oral biofilms.

To conduct the meta-analysis, researchers examined results of seven randomised controlled trials (RTCs) involving 278 participants.

Eeach trial varied from 23 to 68 participants, while ages ranged from 19 to 70. Each trial was analysed to measure halitosis subjectively and objectively for up to 12 weeks.

Researchers detected halitosis levels from participants who closed their mouths for one minute before exhaling into the evaluator’s nose from 10 centimetres away.

Subjective impressions produced organoleptic scores (OLPs), based on senses like smell and taste.

VSCs, were objectively measured using a halimeter, which is an instrument that detects and measures the presence of gases.

Compared to control groups, OLP scores decreased by 58%, while VSC scores dropped by 26%.

According to the VSC scores, the positive effect of the probiotics didn’t last beyond four weeks, however, improvement in OLP scores remained beyond this time frame.

To markets….

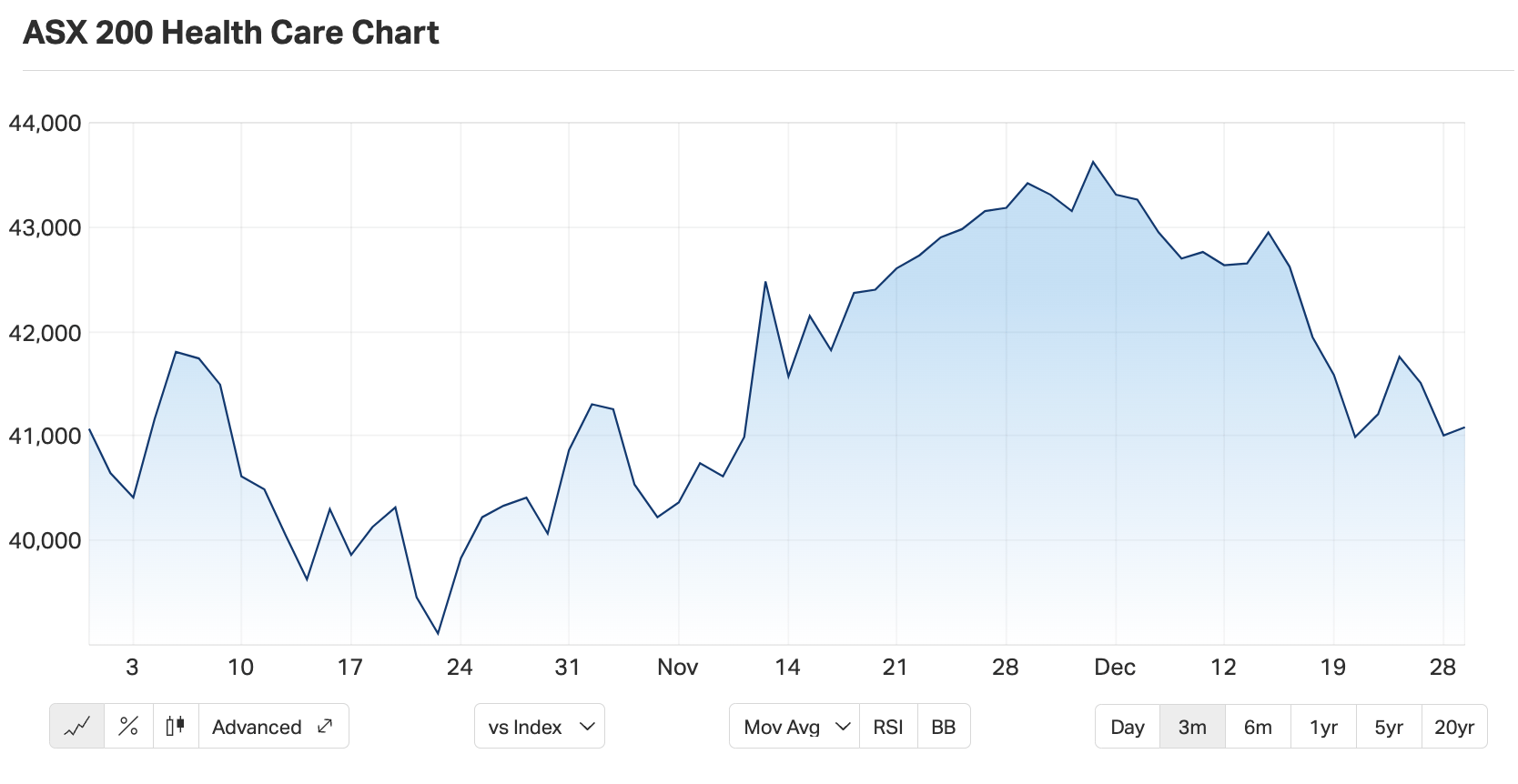

And ASX health stocks are not smelling that good in their final week of trade for 2022. Power said the S&P/ASX 200 healthcare index (ASX:XHJ) was light in volume and flat in trade for the week, but more than 5% down for month.

The XHJ barely eeked out a 0.15% gain for the quarter to Xmas.

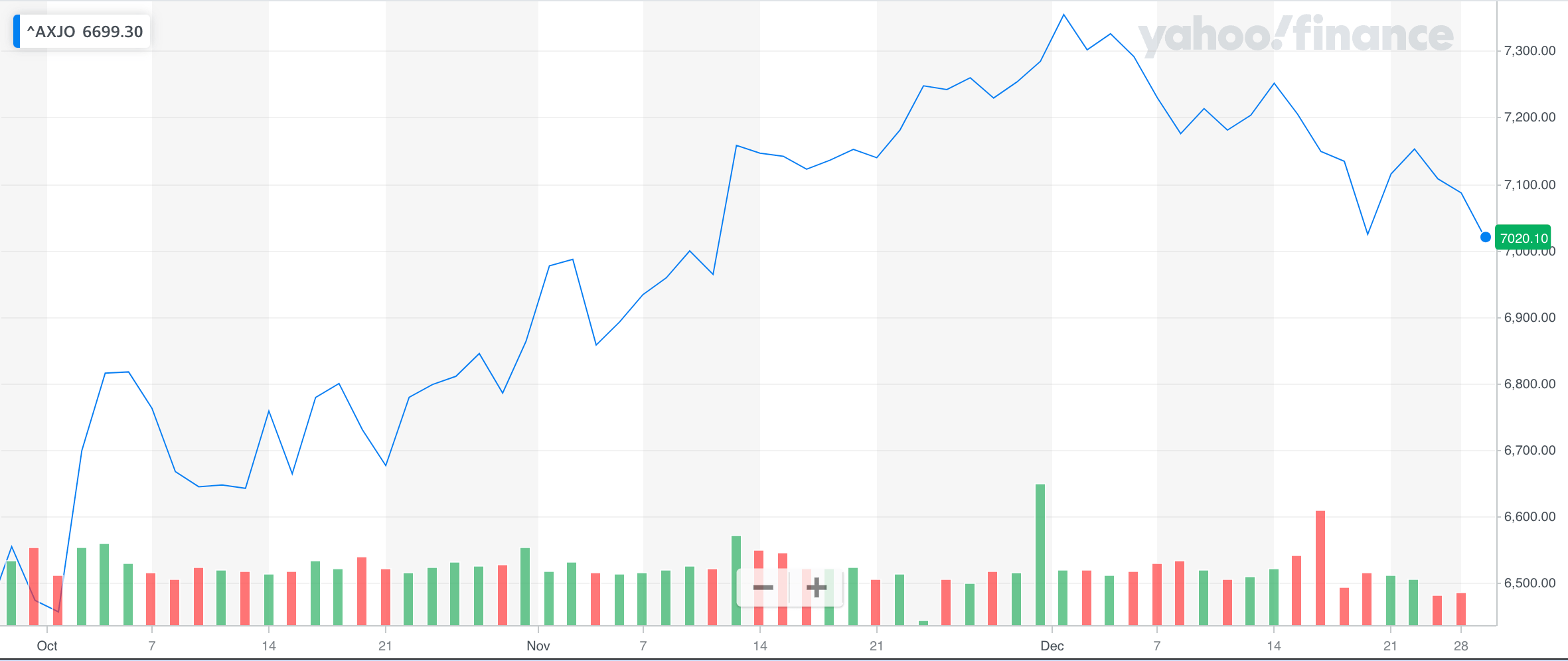

In comparison the benchmark S&P/ASX 200 (ASX:XJO) is 1.2% down over the last five sessions 2.9% down for month, but up about 8.7% up for quarter.

However earlier this week, in what could be a positive omen for the sector into 2023, as local markets crashed to a 20-day low, health was a surprise stand out and the only sector in the green.

“I think our Christmas rally really petered out at the beginning of December but we did have a good run October and November for the broader market but the healthcare sector was at best flat,” Power said.

“We have had a pretty ordinary year across the space with a couple of exceptions.”

However, Power remains optimistic heading into 2023.

“If we look back at the past decade there’s probably been two years where the healthcare sector has underperformed to the broader market and given we’ve just done that there’s a good chance we will outperform next year,” he said.

Week of good news for health imaging companies

Power said in the final week of 2022 it’s all about the health imaging players with good announcement from three companies in the space.

“One of the themes in healthcare is hospitals without walls, including trying to read images remotely to improve efficiency and all of these companies are in that space,” Power said.

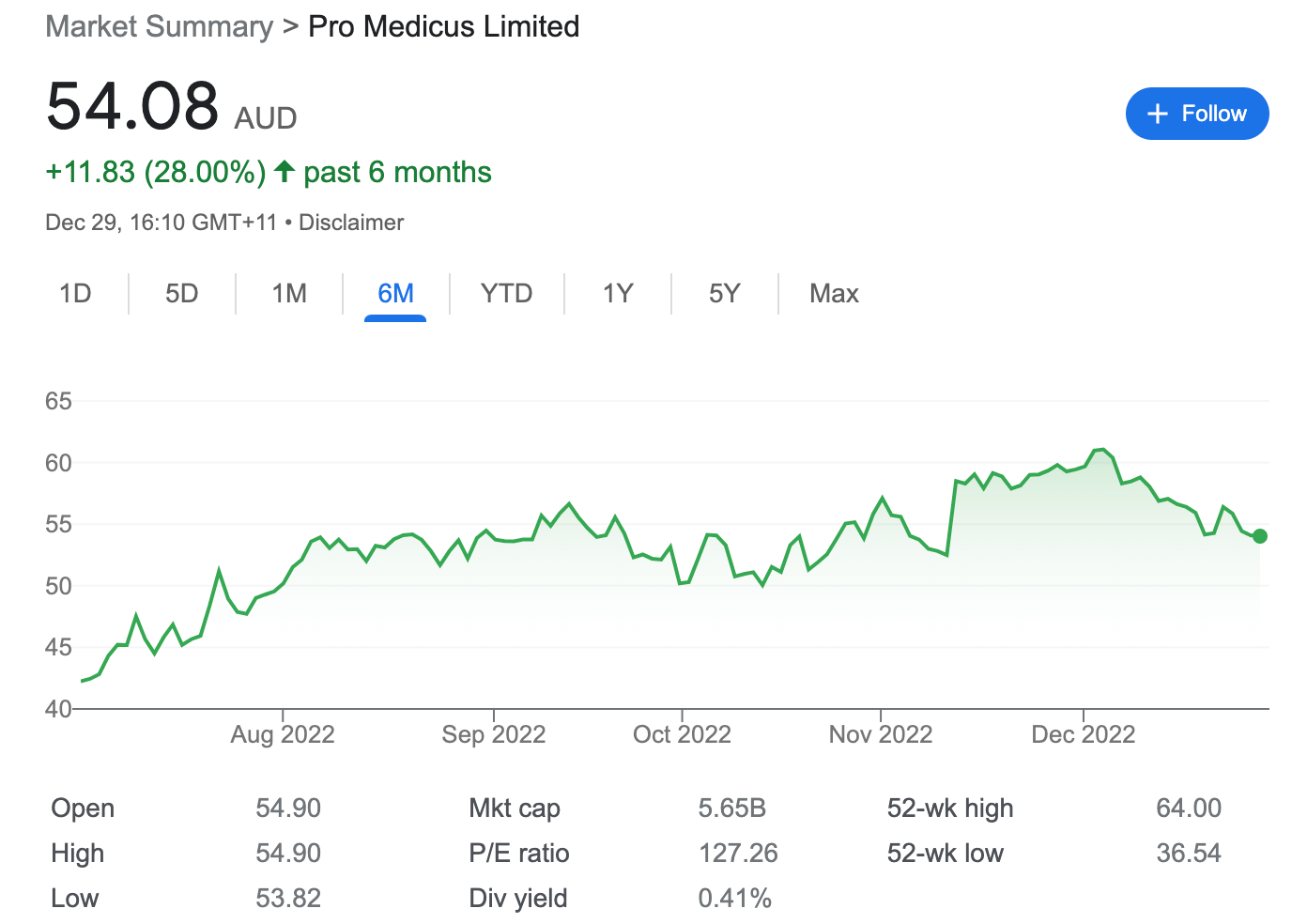

Pro Medicus: Just killing it in the health space

PME signs US$15 million contract with Luminis Health

Leading Scott Power’s six stock basket of 2023 winners, Pro Medicus (ASX:PME) this week announced another multi-million, multi-year (7-years) contract with the US not-for-profit integrated delivery network (IDN) Luminis Health, which serves communities across Maryland, from Washington, DC to Delaware.

The deal – a transactional licensing model thingy – has PME’s cloud-engineered Visage 7 Enterprise Imaging Platform (Visage 7, made up of Visage 7 Open Archive and Visage 7 Workflow modules), providing a unified diagnostic system across the Luminus network.

“PME has had a lot of success moving into these IDNs and the important aspect of this contract is it’s cloud-based again and transaction based using all their different solutions,” Power said.

“Its a good solid contract which is what we are now used to with Pro Medicus which have had a very good year in terms of contract wins and is one of the outstanding companies on the ASX over the last decade.”

PME has five-year forward contracted revenue of $450m with many of its customers being tier one hospitals and IDNs.

“Even though the formal recommendation is a hold we are looking to buy it closer to $50 and the share price has been drifting down in the past week so it is starting to look attractive,” he said.

IME secures Mexico social security deal

Described by Power as a “much smaller version of Pro Medicus” IMEXHS (ASX:IME) has won a 3-year contract to provide enterprise imaging solutions to Mexico’s Social Security Institute (IMSS).

IME said the deal will contribute between US$230,000 and $300,000 (~A$340,000 to $440,000) in annual recurring revenue (ARR).

Mexico has one of the largest social security programs in the world, with six out of every 10 Mexicans a part of the IMSS.

Under the deal, IMEXHS’s local partner Ingenieria para el Cuidado de la Salud, S.A. will implement both AQUILA (IME’s radiology platform) and ALULA (IME’s pathology platform).

The software is expected to go live in the first quarter of 2023.

“They are primarily located in South America, so their origins and CEO is from there with a lot of contacts in the region,”

“It is a good quality contract and I think will have very good margins.”

Mach 7’s new $2.5 million deal with Nuvodia

Power said the mid-size player in the health imaging space is Mach 7 (ASX:M7T), which has announced its inaugural sales order from new partner Nuvodia.

Headquartered in Spokane Washington, Nuvodia is a national IT and radiology service provider that

creates, manages, and supports mission-critical IT environments.

The agreement with Nuvodia involves M7T’s entire enterprise imaging platform including its

Vendor Neutral Archive (VNA), eUnity Diagnostic Viewer and Workflow applications to provide a true

enterprise wide PACS solution for healthcare providers.

The licence agreement allows Nuvodia to install Mach7’s software in its cloud infrastructure enabling the resale and deployment of its products to Nuvodia’s existing and new customers, creating ongoing sales and service opportunities for Mach7.

The subscription contract has a five-year term and a total contract value (TCV) of $2.5 million.

Power said health imaging is an area which will continue to be of interest to Morgans.

“From an ESG perspective they are very attractive with zero carbon footprint and not polluting the environment, ” he said.

“The thematic of hospitals with walls is strong and structurally will continue to grow so these companies are winning business to make healthcare more efficient and its all about moving an image from one location to another, assist in interpretation and storage of images which is big business.”

The PME, IME, M7T share price today:

ScoPo’s Powerplay:

Continuing on the health imaging trend is Power’s stock of the week Volpara Health Technologies (ASX:VHT), which was also in his basket of six stocks for 2023.

Power said VHT specialises in the early detection of breast cancer is gearing up for a solid Q3 FY23 results report in mid-January.

“Volpara is continuing to head towards a break even position using there existing cash reserves and are continuing to win new business,” Power said.

“The share price remains subdued but as each quarter passes the market should gain confidence that the business is growing.”

Power said the company updated FY23 revenue guidance to growth of 28-34% on FY22 and re-affirmed their confidence in achieving cashflow breakeven by Q4 FY24 with current cash reserves.

Morgans has an add rating on VHT with a 12 month target price of $1.21.

The VHT share price today:

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse, or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.