Pitt Street sees strong upside as Prescient advances phase 2a cancer trial

Pitt Street Research has updated its valuation for oncology company Prescient. Pic: Getty Images

- Pitt Street Research updates valuation for Prescient Therapeutics, one of the most advanced oncology companies on ASX

- Prescient has kicked off a phase 2a trial of PTX-100 in patients with a rare blood cancer

- Pitt Street says PTX-100 could have broader application in cancers that could be defeated with RAS therapy

Special Report: Prescient Therapeutics has signalled its position as one of the most advanced oncology companies on the ASX, according to Pitt Street Research.

The declaration by the research house comes after PTX started its phase 2a trial of PTX-100 in patients with rare blood cancer relapsed/refractory Cutaneous T-Cell Lymphoma (r/r CTCL).

Pitt Street’s report has updated its valuation for Prescient Therapeutics (ASX:PTX) to 14.6 cents per share in a base case for a $118 million market cap and 20.3 cents per share in a bull case for a market cap of $163.2m.

The report said 72% of its valuation came from PTX-100, 23% from Prescient’s next-generation cell therapy platform CellPryme – designed to boost effectiveness of CAR-T treatments – and the balance from the company’s net cash/debt position.

The US Food and Drug Administration (FDA) has granted PTX-100 orphan drug designation (ODD) for all T-cell lymphomas and fast-track designation for treatment of adults with relapsed or refractory mycosis fungoides, the most common subtype of CTCL.

Prescient this week announced it had successfully initiated its first US site for the phase 2a trial at the VCU Massey Comprehensive Cancer Center in Richmond, Virginia.

The US site adds to three existing Australian phase 2a trial sites, where four patients have already been enrolled.

Prescient is in a potentially pivotal clinical trial with PTX-100, which was granted Investigational New Drug (IND) status from the FDA in December 2024.

“Specifically, it is a phase 2 trial and whilst a phase 3 trial would ordinarily be required, the FDA could potentially give approval if the therapy is stronger than the standard of care, given the lack of current treatment options,” Pitt Street said.

It will also be a faster and smaller trial (aiming to enrol around 40 patients) given it was focused on relapsed and refractory CTCL.

A decade-long journey toward targeted cancer therapy

Prescient’s journey with PTX-100 started in 2014, when prominent Australian biotech entrepreneur Paul Hopper licenced the rights to the compound, then known as GGI-2418, from Yale University.

PTX-100 was originally developed at Yale by renowned cancer researchers Dr Said Sebti and Dr Andrew Hamilton, with Sebti still advising Prescient today.

Recognising the urgent need for therapies that could overcome cancer’s resistance to chemotherapy, Hopper focused on a promising mechanism – switching off the Ras and AKT pathways, which play a central role in driving uncontrolled tumour growth.

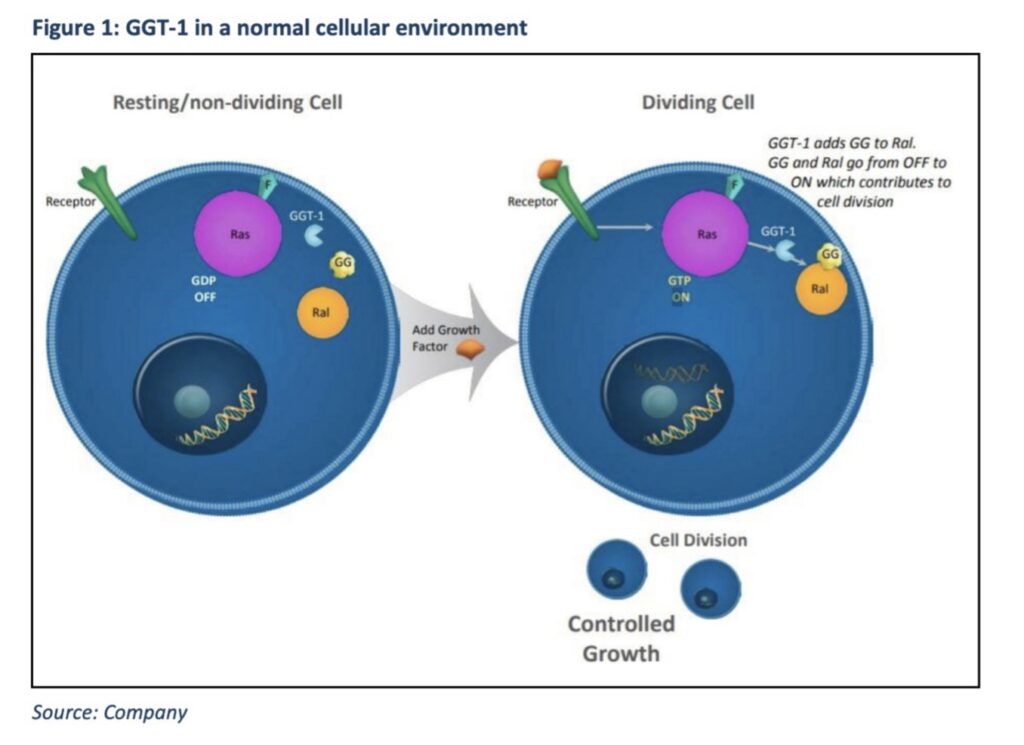

These pathways act like on/off switches that regulate normal cell division.

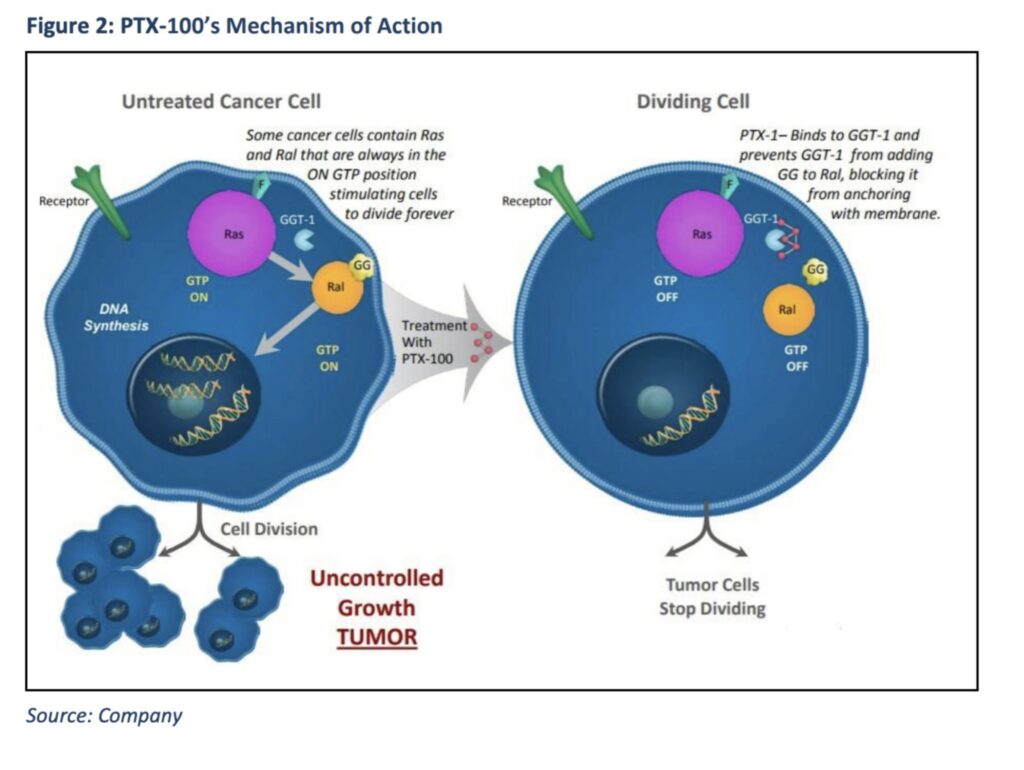

“Uncontrolled cell growth can occur when the Ras pathway is ‘on’ and when it is effectively ‘stuck’ on, cancer can spread quickly,” Pitt Street said.

“PTX-100 can prevent this.”

PTX-100 is a first-in-class compound with the ability to block cancer growth enzyme geranylgeranyl transferase-1 (GGT-1).

The action disrupts Ras-driven signalling circuits, specifically Rho, Rac, and Ral, triggering apoptosis (programmed cell death) in cancer cells.

Unlike other inhibitors, PTX-100 can also block multiple pathways simultaneously, and is currently believed to be the only GGT-1 inhibitor in clinical development globally.

The compound demonstrated safety and early clinical activity in a previous phase I study along with a recent PK/PD basket study of haematological and solid malignancies.

In a phase 1b expansion cohort study in T-cell lymphomas, PTX-100 showed encouraging efficacy and safety.

“Most noteworthy was one T-cell lymphoma patient that had failed five prior treatments yet with PTX-100 generated a partial response and no disease progression for the next 17 months,” Pitt Street said.

“For comparison’s sake, the usual standard of care would see some progression within just four months.”

Targeting urgent medical need

CTCL is a rare type of cancer of white blood cells (T-cells), normally involved in immune function.

Cancerous T-cells travel to, and live in, the skin where they grow, divide and attack uncontrollably.

There are currently limited options for patients with relapsed or refractory CTCL.

Pitt Street said Prescient was targeting an urgent need and one of the deadliest forms of cancer, with overall survival in relapsed or refractory forms of the disease tending to be less than one year “barring vehemently expensive stem cell transplant”.

“But PTX-100 has shown strong potential in phase 1, not just trouncing existing standards of care, but working in patients where previous treatments have failed,” the report said.

Lucrative market with potential to expand to other cancers

Pitt Street said even though the US market for all TCLs was only 5000-6000 patients, the market opportunity could be substantial given the high price for which PTX-100 could sell.

“This may not sound like many, but with a price of US$450,000 (using Acrotech Biopharma’s Folotyn as a guide), reaching just half of these patients could make US$2.5bn in sales,” the report said.

Folotyn is an FDA-approved treatment for relapsed or refractory peripheral T-cell lymphoma.

Pitt Street noted that PTX-100 could potentially be approved for all T-cell lymphomas, supported by the company’s existing ODD covering the full category.

Over time, PTX-100 could have broader application in cancers driven by RAS mutations involved in up to 22% of all cancers.

“And eventually, PTX-100 could be applicable to any cancer that could be defeated with a RAS therapy,” it said.

These mutations are especially prevalent in cancers like pancreatic, lung and colorectal, highlighting significant future market potential.

“(It’s) also worth noting that market opportunities for PTX-100 wouldn’t just be restricted to use as a monotherapy, but also as part of … drug combinations,” Pitt Street said.

This article was developed in collaboration with Prescient Therapeutics, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.