Pitt Street Research sees upside in ‘undervalued’ Imagion, tips ASX minnow as takeover target

Pitt Street sees potential for Imagion to roll higher, deeming it undervalued. Pic via Getty Images

- Pitt Street Research says Imagion is significantly undervalued and sits around 75-80% below target range of 12.3 to 14.9 cents per share

- Research house sees further upside if MagSense imaging agent tech progresses to commercialisation in additional indications beyond HER2+ breast cancer

- Pitt Street says there’s a high chance of strategic partnering or M&A, even prior to commercialisation, which could create significant upside for shareholders

As global pharma giants pour billions into radiopharma assets, Sydney-based Pitt Street Research says a $7m ASX-listed minnow with MRI imaging nanoparticle technology is flying under the radar – significantly undervalued and potentially ripe for a takeover.

In a new report, Pitt Street Research said Imagion Biosystems (ASX:IBX) was trading at a steep discount, sitting at 2.9 cents – around 75–80% below its valuation range of 12.3 to 14.9 cents per share.

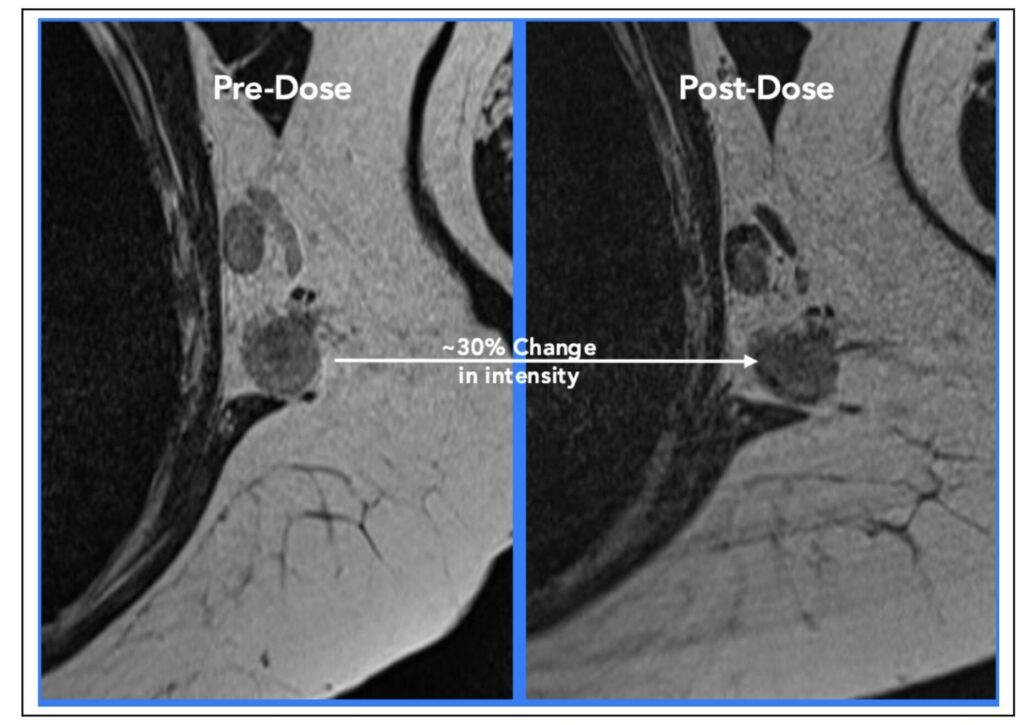

Imagion’s first-of-its kind imaging agent technology, dubbed MagSense, is firmly in focus and underlies the company’s promising outlook. MagSense has the potential to diagnose cancers, with its first target being HER2+ breast cancer. Pitt Street sees further upside for the biotech if MagSense progresses to commercialisation in additional indications.

The research house said the MagSense imaging agent tech has “potential to revolutionise cancer screening” by providing molecular confirmation of cancers rather than mere suspicion, enabling earlier detection and treatment.

“Compared to other agents, MagSense has the potential to be safer and better at identifying cancers at an earlier stage, which for patients can mean intervention is cheaper, less invasive and more likely to succeed,” the research house explained.

“It is also less invasive and painful than mechanisms such as biopsies.”

Investors ‘unfairly impatient’ with partnering interest ‘plausible’

Pitt Street Research added that Imagion has made significant progress with recently delivered successful phase I results in what was the first-ever clinical study of a molecular MRI contrast agent.

It noted the company is now “at a pivotal point of its history” with plans to file an investigational new drug application with the US Food and Drug Administration (FDA) and then conduct a phase II study in HER2+ breast cancer.

“Since Imagion listed, investors have been unfairly impatient with the company, but it has come a long way since its listing,” read the report.

“We see partnering interest as a plausible scenario, particularly if MagSense can show strong interim data.

“We would also note that as a diagnostic imaging agent, MagSense is more likely to succeed in clinical development compared to drugs or devices.”

Pitt Street said it is also worth noting MagSense works seamlessly with existing MRI scanners and clinical workflows and that the company has developed a “capital-light business model”.

“MagSense is compatible with all of the world’s MRI scanners and can be used across many cancers.

“If approved more widely and proven superior to existing options, oncologists are likely to adopt it quickly.”

ASX peers shine light on ‘undervalued’ Imagion’s potential

The race for advanced imaging technologies globally in oncology is heating up, with several ASX-listed companies already making their mark.

At the big end of town Telix Pharmaceuticals (ASX:TLX) has gained attention for its targeted radiopharmaceuticals, while Clarity Pharmaceuticals (ASX:CU6) and Radiopharm Theranostics (ASX:RAD) have shown the growing commercial and clinical potential of diagnostic and therapeutic imaging agents.

“We think the success of peers such as Telix, Clarity and even Radiopharm Theranostics depict potential for a re-rating. Moreover, the growth in the use of imaging agents in medicine generally and M&A activity in the space, demonstrates that there is an opportunity for Imagion to make a difference,” the report continued.

Pitt Street believes Imagion is undervalued and “trading barely above cash backing”:

“Our valuation places the company at A$0.123–0.149 per share, which could be conservative given it only assumes MagSense is commercialised for one indication.”

The research firm noted there’s a high chance of strategic partnering or M&A even before commercialisation, creating shareholder upside ahead of clinical or commercial success.

“A relevant example is Radiopharm Theranostics, which received an $18m investment from Lantheus as part of a $70m financing deal,” wrote Pitt Street.

Higher chance of approval with lucrative markets in sight

Although MagSense is first-of-its-kind, it is not an untested approach, noted Pitt Street – and as a “contrast media product”, the technology has a higher likelihood of regulatory approval.

“Fundamental technical risks have been addressed, and showing non-inferiority to ultrasound may be sufficient to gain approval,” wrote the analysts.

Beyond its initial focus on HER2+ breast cancer, Imagion is eyeing additional indications where MagSense could make a significant impact.

MagSense’s total addressable market (TAM) is substantial and Pitt Street believes the company has a major market opportunity:

“MagSense’s TAM just for HER2+ breast cancer is $500m. Prostate cancer is $1bn and ovarian cancer is $500m.”

There are more than 400,000 annual diagnoses of HER2+ breast cancer in the US alone as well as 1 million biopsies for prostate cancer.

“As an imaging agent, Imagion could charge premium pricing and deliver high margins when it reaches market,” the firm extrapolated.

Imagion aims to play role in rise of AI in healthcare

With artificial intelligence (AI) set to play a major role in healthcare, Imagion aims to be part of that rise.

The company is developing AI-compatible imaging protocols for its MagSense technology through a new partnership with researchers at Wayne State University, building on its long-standing collaboration with Siemens, the world’s leading manufacturer of MRI equipment.

The work will optimise MagSense dosing and MRI sequences, while generating quantitative imaging data that can feed into AI models to boost cancer detection accuracy.

With Siemens’ backing, Imagion plans to incorporate the optimised MRI sequences developed by the leading researchers into its upcoming phase II clinical trial.

Longer term, Pitt Street said AI could also help refine molecules for stability and safety, and even accelerate the discovery of new imaging agents.

Experienced team to guide through next steps

Pitt Street Research said it’s also worth investors noting Imagion is led by a highly experienced team with deep expertise in medical imaging, corporate finance, and commercialising new technologies.

Chairman Robert Proulx has guided MagSense from proof-of-concept to the clinic, alongside Ward Detwiler, founder of an MRI quantitative imaging company.

Its leadership team also includes former vice president of worldwide medical affairs at Nasdaq-listed Hologic, Dr Susan Harvey, and Dr Kayat Bittencourt, a recognised leader in cancer radiology. Meanwhile Dimerix CEO and managing director Dr Nina Webster was recently appointed a non-executive director.

Imagion is currently manufacturing the MagSense agent for its phase III clinical trial and has enlisted surgical oncologist at the University of Oklahoma Health Sciences College of Medicine Dr William Dooley as the principal investigator for the study.

Dooley is a renowned cancer expert having developed and directed the Johns Hopkins Breast Center which became an award-winning model for cancer care.

At Stockhead, we tell it like it is. While Imagion Biosystems is a Stockhead advertiser, the company did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.