Pharmaxis just posted a $12.6m half-year loss, but it’s not as bad as it looks

Pic: REB Images / Tetra images via Getty Images

After making a $5.9 million profit for the 2018 financial half-year, drug developer Pharmaxis’ bottom line has fallen by 312 per cent.

For the 2019 half-year, Pharmaxis (ASX:PXS) posted a $12.6 million loss.

That seems extreme, and extremely bad — but it’s not quite so dire.

The reason for the gap is that Pharmaxis received a significant payment from German pharmaceutical giant Boehringer Ingelheim during the 2018 financial year.

In 2015, BI bought the rights to develop Pharmaxis’ fatty liver drug PXS-4728A and renamed it BI 1467335. When certain trial conditions were fulfilled, Pharmaxis received $42 million in milestone payments.

So Pharmaxis made $31.3 million in total revenue for the 2018 half-year, but with no milestone payments trickling in for the current half-year, that dropped to just $3 million in revenue and was the reason for the hefty overall half-year loss.

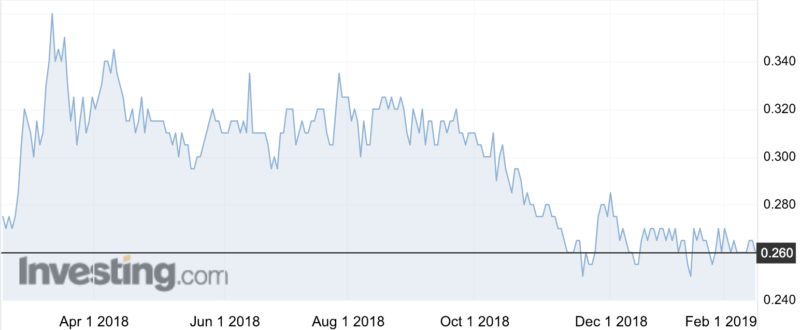

Shareholders were aware, and the company’s shares fell just 2 per cent on the news, to 26c.

Pharmaxis told investors back in November that “several large pharma companies” were interested in the company’s Lysyl Oxidase Like 2 (LOXL2) inhibitor compounds.

It is developing two LOXL2 inhibitor compounds to treat conditions such as non-alcoholic steatohepatitis (NASH, or fatty liver) and idiopathic pulmonary fibrosis (IPF, or a type chronic lung disease).

It also has two drugs currently on the market; Bronchitol, an inhaled dry powder for the treatment of cystic fibrosis, and Aridol, a lung function test for asthma.

Stockhead has contacted Pharmaxis for comment.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.