Palla is sticking with opioids, says no thanks to pot

Cannabis and opiates don’t mix.

Not for opiate grower Palla Pharma (ASX:PAL), the company formerly known as TPI Enterprises, even though it has all of the licences needed to get a cannabis operation underway.

CEO Jarrod Ritchie is yet to be convinced it’s a money maker.

“I’ve probably been one of the naysayers of the cannabis industry in Australia, particularly in Australia,” he told Stockhead.

“What customers want is not yet well defined. The industry is in a conundrum where traditionally a medicine like this would go through extensive clinical trials and it would be very clear what prescription rates would be required to treat certain conditions.

“Whereas the medical cannabis industry is almost back in the 1800s where it’s an apothecary approach.”

There’s limited knowledge yet around how cannabis behaves in the body; researchers know it helps for many indications, but not specifically how and not how each of the 10s of cannabinoids interact with each other in the body.

Unlike rival Tasmanian Alkaloids which is getting into pot, Palla Pharma is sticking to opiates and its long-fought-for strategy as a pharmaceuticals manufacturer.

Because until last year Palla’s future as an opiates grower was looking distinctly unhealthy.

Turnaround a long-time coming

Palla listed as TPI in 2015, after a spate of bad weather and crops in Tasmania, and state government rules against importing raw poppy straw, pushed it to expand into Europe, NSW, and shift its manufacturing site to Victoria.

But if revenues rose, the company was still taking heavy losses.

The turnaround, it promised in 2017, would come with the purchase of a pharmaceutical manufacturing factory in Norway and the use of a new, cheaper, secret technology.

The Norwegian deal would turn it into a fully integrated vertical opioid company: it would grow and process the raw poppies, pass that onto the division that extracted the active pharmaceutical ingredients (APIs), and then turn it into pills.

The tech was a step up on the current extraction process, developed 80-100 years ago in Hungary which has heavy infrastructure and people needs because it’s highly explosive.

Palla’s tech uses water to make opiate pills and needs just 50-60 people to make 80 tonnes of product a year, compared to 100-150 people. It’s not patented and is Coca-Cola-recipe level secret.

But it took longer than anyone expected. Revenue was still doubling year-on-year but so were those losses and investors began to bail out.

Shareholders gave the company’s remuneration report a first strike at the AGM — when the report has a 25 per cent or more ‘no’ vote against it — which Ritchie put down to frustration over the time it’s taken for the company to sort itself out.

Fast forward 18 months and the promised turnaround has arrived: full year revenue more than doubled again in 2018 and finally the company began to cut its losses, by 65 per cent last year to $5.8m.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Not all opiates are bad

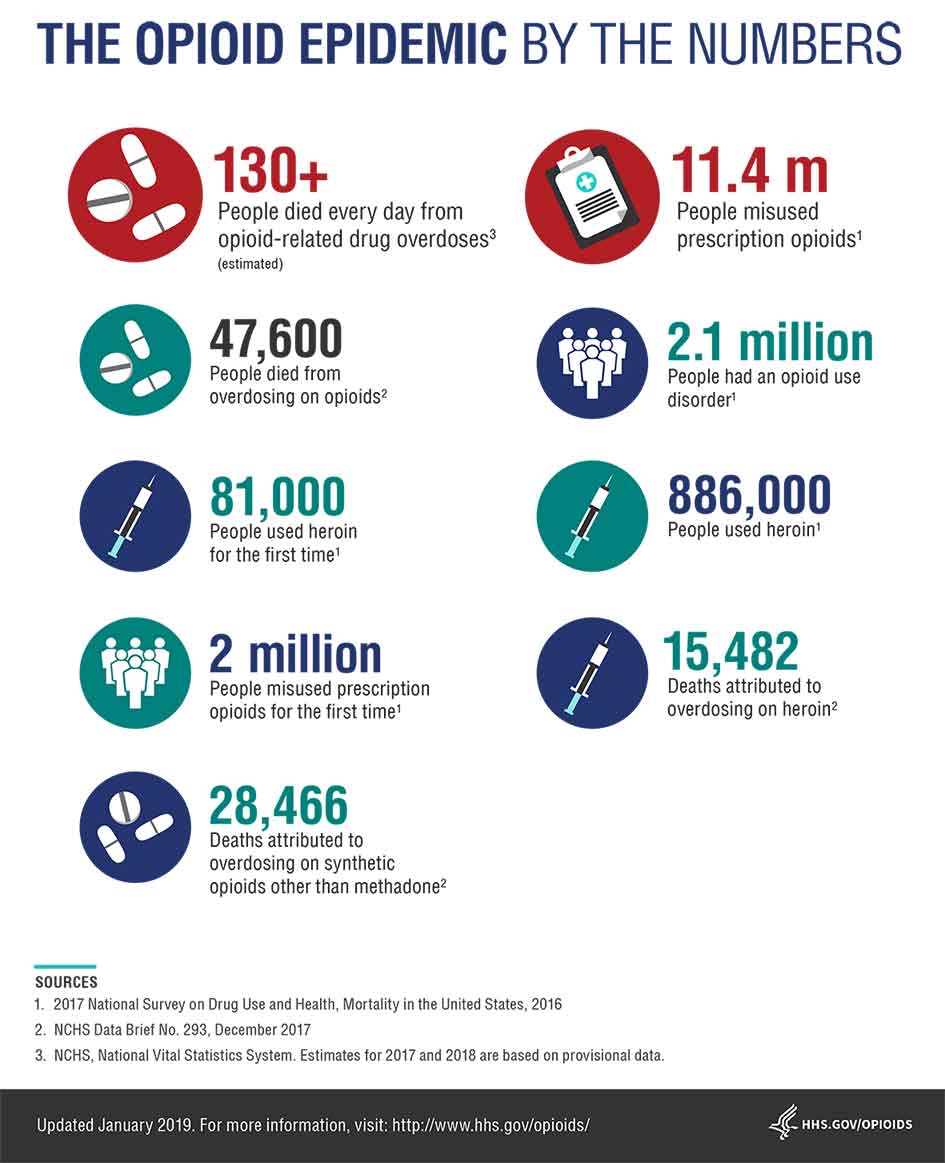

It’s not possible to talk about opiate manufacturing without mentioning the US crisis, where over 42,000 people have died from opioid overdoses and it’s pushed tens of thousands more into heroin use.

Ritchie says it definitely had an impact on Palla’s profitability.

“There’s no doubt there’s been a significant correction in the US, and that was needed,” he said.

But not all opiates are the same.

Palla’s focus is on morphine, not oxycodone, and the company is in the process still of setting up a naloxone pill, which is used for anti-addiction rather than pain relief.

Ritchie says it’ll take three years to get into the US market, but right now Palla has strong sales in South America and southeast Asia.

Contrary to reports in the Australian media, Ritchie does not believe there’s a risk of Australia going down the US addiction route.

Prescription numbers are being maintained here, in Europe and the rest of the world and “the levels of consumption that were occurring in the US were extraordinary”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.