Orthocell gets its grow-your-own-jawbone tech into a UK hospital

Pic: Oscar Wong / Moment via Getty Images

Orthocell, the company that is trying to regrow nerves, has got its grow-your-own-jawbone technology into a UK hospital.

The company (ASX:OCC) has developed a ‘bio-scaffold’ called CelGro out of a collagen membrane which it’s using to help the body regrow bones, nerves and even tendons.

And today, it said that tech is about to start being used in the NHS-run Birmingham Dental Hospital in the UK.

About 300,000 dental implant procedures are performed in the UK each year, of which 60,000 are done in public dental hospitals. A dental implant is the part that sticks a prosthesis such as a crown or denture to the jawbone.

Orthocell managing director Paul Anderson says they received their first certification for the jaw product in December last year, when Europe approved it for use. The company has since targeted Italy, Poland and the UK as the starting points for sales.

He says the $450-500 medical device should be approved in Australia by the middle of 2019.

Orthocell is in the process of scaling up its manufacturing capability as it starts down that early commercialisation track, and Mr Anderson is convinced it’s a takeover target.

“This company will be an Australian star. It will be acquired by a large multinational in due course,” he told Stockhead.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Orthocell published new data in May indicating that the bio-scaffold worked well on 10 people who’d had to have parts of their jawbones removed for implants.

The data showed the quality of newly formed bone was 26 per cent higher than for Orthocell rival BioGide.

“The area of missing bone [after surgery for a dental implant] is often filled with a natural bone mineral material after placement of an appropriately-sized titanium implant,” the company said at the time.

“Use of a collagen membrane is necessary to direct the regeneration of bone tissue as it prevents the defect being filled by the faster growing gingival tissues.”

The company is beginning to make money on the CelGro product — $232,000 in the three months to September — but is spending just under $2m a quarter.

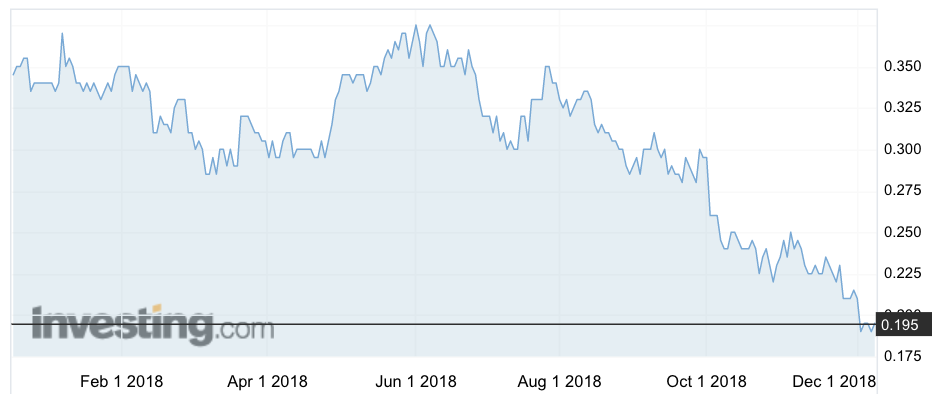

The stock rose by 3 per cent to 19.5c on Tuesday morning, but has been in free-fall since June this year.

Mr Anderson says the stock has been punished after a retail investment magazine put a ‘sell’ target on the company, and because they had to raise money — which they did this month with a $1.8m capital raise.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.