Opthea’s 100pc jump was great, but only scratched the surface, says CEO Megan Baldwin

Opthea (ASX: OPT) doubled on Wednesday after announcing its anti-AMD treatment (OPT-302) worked; but as CEO Megan Baldwin said yesterday, this was just the start.

The announcement was just initial results of the trial – more detailed results were to come. They’ll be more specific about parameters including what OPT-302 did to eye fluids.

But the initial results were enough to send the stock from below 90 cents to over $2.

READ MORE: Opthea’s anti-macular degeneration drug passes Phase IIb clinical trial; shares double

Stockhead was a guest at a broker lunch hosted by the company yesterday. CEO Megan Baldwin said she was “exceptionally pleased that we hit our end point”.

She noted eye disease was a pathway close to her heart having done her Phd on this subject over two decades ago.

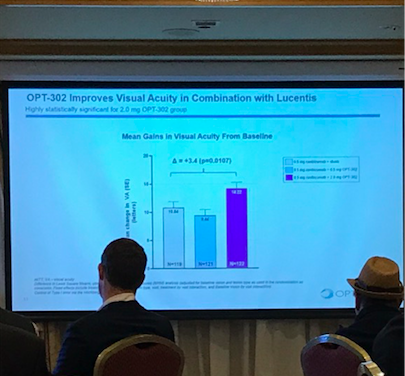

One slide proved Opthea’s success. Compared with Lucentis (another AMD treatment) taken in isolations, patients gained more vision with both Lucentis and OPT-302.

The numbers allude to the number of letters you can see on a typical eye chart. AMD causes sufferers to lose vision in the centre of their eyes but the drug helps this better than Lucentis does.

Why does it work better?

Its success is simple. It targets multiple growth factors (specifically VEGF-C and VEGF-D) rather than just VEGF-A.

As we age, more vessels grow and they become leaky and swell and this causes blindness and affects the quality of our life. Existing drugs can stabilise vision but it is difficult to recover…until now.

“We have a drug we’ve demonstrated in a highly powered trial that’s showing a clinically meaningful benefit over and above standard treatment,” said Baldwin. “This is the only drug that has achieved this endpoint to this level of significance.”

Admittedly, not all patients were completely cured, some still lost vision – 3.4 per cent of those patients with just Lucentis. Meanwhile, of OPT-302 patients, only 0.8 per cent did.

Of course, if the majority had not improved it would not have gained this week and 70 per cent had a gain in 10 or more lines compared with 56 per cent with just Lucentis.

“We’ve now injected it in over 400 patients across two disease indictions and 10 countries,” said Baldwin. “We’re comfortable with safety. This is the highest bar – showing its better not just the same”.

The future

It would seem the drug is ready to commercialise now that there’s proof it works.

While the company was quiet on specific targets it sees a large opportunity. It noted 3 million people had AMD and it was the leading cause of blindness. The market for anti-AMD drugs was $10 billion.

Some companies have their eyes firmly fixed on acquisition. Opthea was keen to commercialise in its own right but noted if approached, and “it’s in the interests of shareholders, we would entertain it”.

But for now, it is waiting on further data on the study which will be more comprehensive than the initial set. Opthea will also test its drug in relation to DME (Diabetic macular edema). Baldwin noted it would be a competitive advantage if OPT-302 could treat multiple diseases.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

One problem some investors think it may have but Baldwin is not concerned about is getting people comfortable to have eye injections.

When quizzed at yesterday’s lunch she noted millions of these happened every day and was actually an easier method to treat eye disease than others such as pills.

“Why expose your entity body to a drug that’s just for your eyes?” she said. “[Injections] are over in 0.1 of a second.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.