Normal service is resuming for pot stocks as WSB buzz dies down

Pic: Charnchai / iStock / Getty Images Plus via Getty Images

The North American cannabis industry continued to experience a gradual decline last week, after undergoing an impressive sector-wide share price rally earlier this month which saw many pot stocks catapult to new heights.

This upturn was initially the result of increased enthusiasm around the cannabis sector, as many investors believe that the newly empowered Democratic Senate will push through cannabis legalisation measures that were previously blocked by the Republicans.

However, share prices began entering the stratosphere once the 9.3 million raging bulls of r/wallstreetbets turned their attention towards the cannabis market, which led to a reddit-fuelled buying frenzy.

“This is beyond a bubble, I don’t even think bubble is the accurate is the right word for it. It’s almost like we’re in simulation territory. [A stock] could change 30 per cent and it wouldn’t be surprising anymore,” Merida Capital Partners managing director Mitch Baruchowitz said.

During this period Aurora Cannabis (TSX:ACB) recorded an impressive 97% month-on-month increase to its share price, while Canopy Growth (NYSE:CGC) and HEXO Corp (NYSE:HEXO) saw their stock climb by 98% and 154% respectively, although these gains were quick to evaporate.

This trend was also broadly reflected in the wider market, as the performance of the ‘Horizons Marijuana Life Sciences Index ETF’ (HMMJ) continued to spiral downward.

Although the HMMJ is currently showing an impressive 91% increase when compared to the month prior, this represents a significant decline from the ETF’s position earlier in February, when it achieved an 183% gain at the peak of the retail investor stampede.

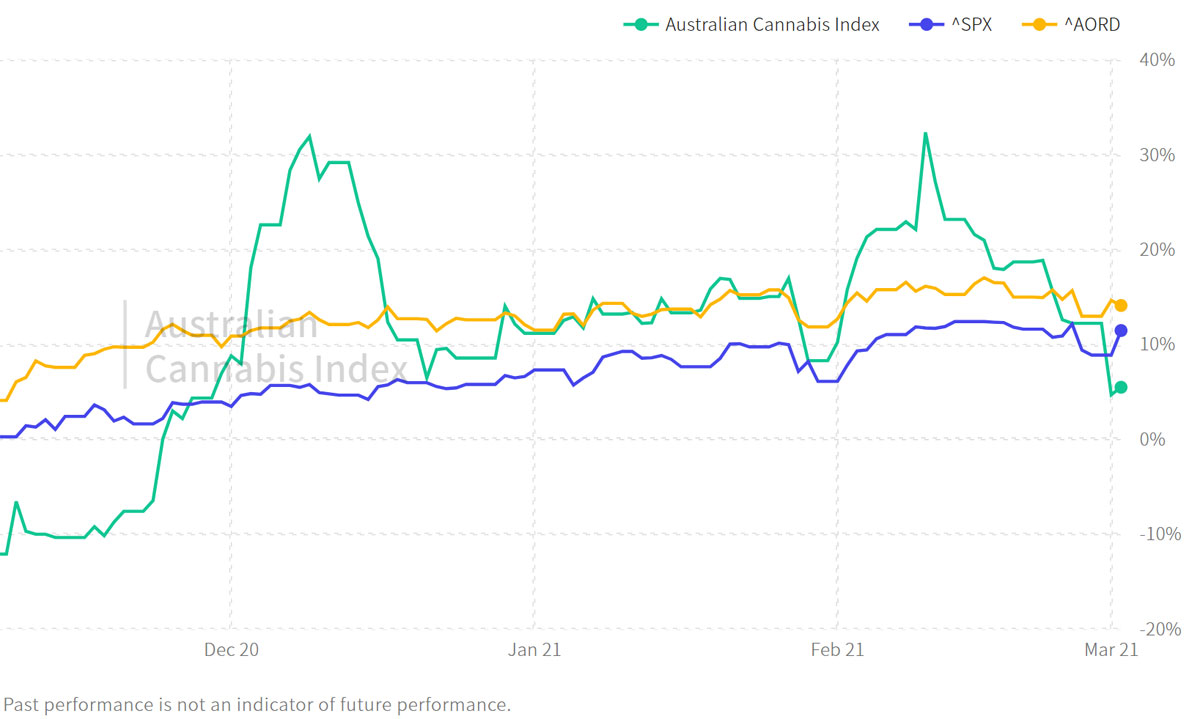

The Australian Cannabis Index also went into a slight decline last week before eventually approaching parity with the S&P 500 and Australia’s All Ordinaries, while the latter two indices remained relatively stable despite experiencing minor fluctuations.

The biotech developer MGC Pharmaceuticals (ASX:MXC) continued to be one of the best performers in the Australian market this month, after following its listing on the London Stock Exchange (LSE) and associated share placement with the release of an earnings report which showed considerably reduced losses.

According to a statement from the company, this means that MGC Pharma is now in “a strong financial position to pursue identified growth initiatives.”

“The Group is focused on and dedicated to delivering on its growth ambitions by progressing its key clinical research programs, continuing to expand its manufacturing capabilities, broadening its product range and expanding into new and existing key markets,” said Roby Zomer, the chief executive and managing director of MGC.

The Green Fund’s Australian Cannabis Index allows investors to benchmark top players in the Aussie cannabis space against the S&P500, the AORD, and HMMJ, giving them an overview of the health of the industry Down Under.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.