Never looked better: Volpara Q3 cash receipts up, ARR beats record, powerful on key metrics

Medtech Volpara has delivered another strong quarter of growth as it continues to advance its position in the growing personalised medicine sector. Image: Getty

Medtech Volpara has delivered another strong quarter of growth as it continues to advance its position in the growing personalised medicine sector.

Healthcare technology company Volpara (ASX:VHT) has reported quarterly cash receipts of NZ$7 million for Q3 FY22, up ~50% year on year or ~56% on a currency-adjusted basis.

Subscription based receipts in Q3 FY22 were more than NZ$6.7m, up ~51% compared to Q3 FY21 for the company, which is spearheading advancement in the early detection of breast cancer worldwide.

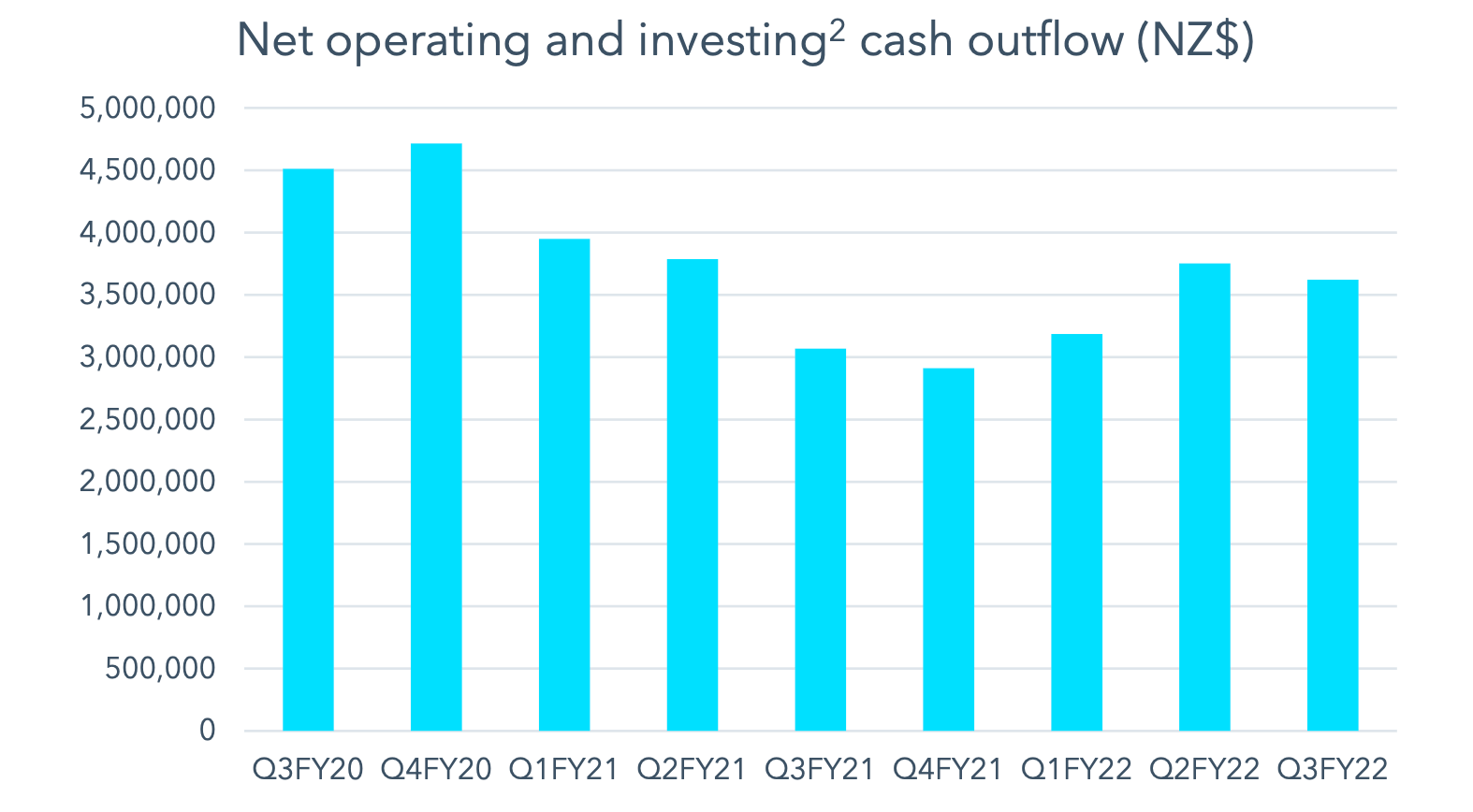

Among other impressive results for the quarter, net operating cash flow improved and was NZ$3.6m, down NZ$200k in Q2 FY22.

Importantly, Volpara had NZ$21.3m in the bank at the end of Q3 FY22 and is on track to meet revenue guidance for the year of NZ$25m.

ARR beats Q3 record

Volpara’s reported a record Q3 for annual recurring revenue (ARR) at ~US$21.5M (~NZ$30.4M2), up almost US$1.1M on the prior quarter (Q2FY22). ARR was up more than 34% on the previous best Q3.

Contracts were signed across Volpara’s full product suite as both platform deals and standalone sales for software such as Volpara® Risk Pathways™ (formerly CRA Risk), Volpara® Analytics™, and Volpara® Patient Hub™.

Several expansions within the existing installed base were also upsold.

The ratio of net new ARR contributed by entirely new customers versus expansions within the existing installed base is approximately two-thirds to one-third.

Average Revenue Per User (ARPU) over the installed base of US$1.47 was reported at the end of Q3 FY 2022. Average ARPU for deals in Q3 was US$1.65, ranging from US$1.05 to US$6.68.

Software as a Service (SaaS) churn remains low for the company.

Screening rates improves

Volpara focuses on the early detection of breast cancer by improving the quality of screening using artificial intelligence.

The medtech’s Risk Pathways and Volpara® Scorecard™, which underscores the value of the Volpara® Breast Health Platform™, is regarded as the most clinically validated density software to measure breast density, which is considered a key risk factor for cancer.

The company has been working to build out a strong position in the US breast cancer screening market. It now boasts coverage of over 35% of US women being screened, up from the prior quarter of ~34%.

Consumer-facing breast density microsite goes live

Volpara continued to boost its profile as a leader in personalised medicine for early breast cancer detection during the quarter.

To mark Breast Cancer Awareness Month in October, Volpara launched special consumer-facing webpages to provide a wider understanding about the importance of breast density.

The company also progressed towards the formal release of Project Thumb, which puts images directly into patient letters to better inform women about breast density for sites that have both Volpara Scorecard and Volpara Patient Hub.

Volpara said Project Thumb is an important step toward having women demand Volpara- level care and provides a more compelling reason for people to buy multiple products.

Biggest deal yet

In October, Volpara entered a five-year US$2.15 million contract with a leading US imaging provider.

The deal represented Volpara’s largest to date in terms of annual recurring revenue (ARR). It will bring in US$430K ARR.

The company will install its integrated breast screening platform across the customer’s extensive network imaging centres located across 11 states, to provide a standardised patient tracking platform that incorporates Volpara Risk and Scorecard.

Public screening boost

Volpara achieved a significant milestone in the quarter to have its screening technology adopted by public health services.

After significant delays due to the COVID-19 pandemic, BreastScreen Queensland went live with Volpara Analytics across the entire state in December. Volpara Analytics examines every single image to provide enterprise-wide quality assurance.

The adoption of the technology by BreastScreen Queensland is a major step forward with public screening services for Volpara. The company said it will be carefully watched around the world as screening services look for more ways to optimize their services.

Radiological Society of North America (RSNA) annual meeting

In November Volpara showcased its breast care platform to more than 23,000 decision-makers at the RSNA show in Chicago.

The RSNA is considered the single-most important exhibition in the radiology industry. Represented by key members of Volpara’s US sales and marketing team, the company generated several high-quality customer and business development leads to continue its growth trajectory.

Furthermore, RSNA saw continued discussions with Volpara’s lung partners as the company positions itself to play a bigger part in the lucrative US$750 million market for lung cancer screening.

While it remains primarily focused on using its AI for the early detection of breast cancer, Volpara has entered strategic partnerships in the space, including with US-based lung AI company Reveal-Dx.

Building on momentum

Volpara Group CEO Dr Ralph Highnam said he was pleased with the Q3 FY22 results and that the company was well on track for the guidance it gave the market of NZ$25M in revenue for FY22.

“We have plenty of cash in the bank, and our aim now is to maintain our strong growth while driving down net operating and investing cash outflow and utilizing the data we’re collecting to create ever more impact for women globally,” he said.

Broker Morgans are bullish on Volpara, recently retaining an add rating and $1.94 price target on the company’s shares.

This article was developed in collaboration with Volpara, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.