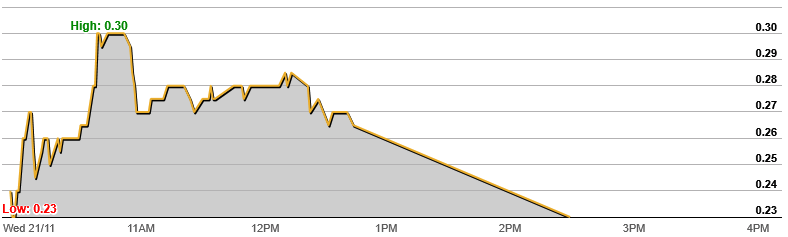

MMJ’s share price plunged 30pc yesterday – when it was meant to be suspended

Pic: Luis Alvarez / DigitalVision via Getty Images

MMJ Group’s rebirth as a listed investment company has stumbled at the first hurdle, with the company’s shares accidentally spending a couple of hours trading thanks to an ASX error.

Global cannabis investor MMJ Group (ASX:MMJ) owns minority stakes in 10 businesses, and has been in trading suspension since October 5 as it transitioned from medical cannabis company MMJ Phytotech to cannabis investment company MMJ Group.

With that transition now complete, MMJ Group told investors on Tuesday that it would recommence trading on Thursday, November 22.

So shareholders were surprised to find they could freely trade the company’s shares for a couple of hours on Wednesday.

From the time the market opened until MMJ shares were finally suspended again at 2:34pm, the company’s shares dove 30 per cent to 23c, after they closed at 33c on October 4.

The ASX released a note saying MMJ’s shares were “reinstated to the official quotation today in error”.

“All trades today in the securities of MMJ will be cancelled and the order book purged,” the statement read. “Trading in the securities of MMJ will resume from the commencement of trading tomorrow.”

Prior to the kerfuffle, MMJ released an investor presentation detailing the company’s rebirth, showing off 10 minority investments in cannabis companies in Canada, the US and Australia.

It has been a rollercoaster of a year for MMJ. In June the company, then known as MMJ Phytotech, sold the Phytotech Therapeutics business for $8 million to focus on building a portfolio of minority marijuana investments.

That was after the two companies had merged in 2015 due to “complementary strategies and asset portfolios that would yield significant synergies”.

- Subscribe to our daily newsletter

- Bookmark this link forsmall cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

In its annual report, MMJ said its board was “disappointed” by MMJ’s share price performance in 2018, but “we are very excited by the outlook of the company as all of its investments, most of which were made in the past six months, are well positioned to participate in the significant growth expected in each of their market segments”.

Chief Jason Conroy told Stockhead earlier this year that he wanted to professionalise the business, “clean up the story” and attract institutional money.

MMJ has been contacted for comment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.