MedAdvisor shares surge 45pc after healthcare giant invests $9.5m

Pic: REB Images / Tetra images via Getty Images

Healthcare giant EBOS Group has invested $9.5 million in MedAdvisor and will help accelerate the rollout of its digital medication management platform in hospitals, pharmacies and GPs.

MedAdvisor (ASX:MDR) surged as much as 45 per cent on the news to 5.2c. Its shares close Tuesday at 5c, up 39 per cent.

The deal with EBOS — the $2.6 billion owner of Australia’s biggest pharmacy brands such as Terry White Chemmart — would “turbo-charge” MedAdvisor’s patient acquisition and international expansion plans, chief executive Robert Read said.

EBOS paid 5.75c a share — a significant premium to MedAdvisor’s Monday closing price of 3.6c and a 44 per cent premium on its last capital raising a year ago.

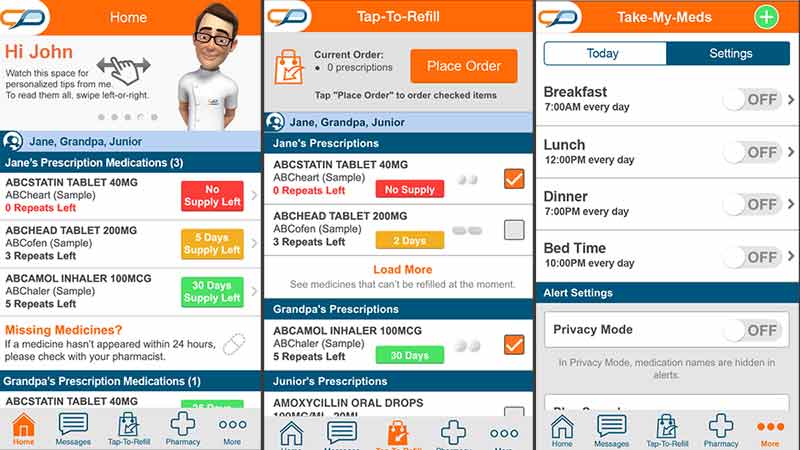

MedAdvisor markets an app that tracks medications and scripts for patients and connects to doctors and pharmacists without the hassle of juggling paper scripts.

Only about half of patients with chronic diseases such as diabetes and high blood pressure take treatments as prescribed, according to a World Health Organisation study.

MedAdvisor is designed to help solve that problem by reminding patients to re-fill scripts, make doctor appointments and take their meds.

Increasing the effectiveness of “adherence interventions” could have a far greater impact on health than improvements in specific medical treatments, according to WHO.

MedAdvisor had boosted medication adherence by 20 per cent among its 900,000-plus users, Mr Read said.

“Quite often a pharmaceutical company knows the barriers to medicine adherence but has had a tough time educating patients because the only levers they have had are through a doctor or pharmacist.

“MedAdvisor opens a digital channel to reach the right patient at the right time with exactly the right information.”

Customer expectations for service and convenience had increased dramatically in sectors such as retail and banking — but the healthcare market had struggled to keep up, Mr Read said.

“Innovation in customer engagement has been slow. MedAdvisor can have a hugely positive impact on the health system because it provides immediate convenience benefits and ultimately huge health benefits.”

“The software is the most complete and integrated medication management program globally with huge engagement from connected patients.

MedAdvisor users can pre-order scripts to skip the queue at participating pharmacies or ask their doctor to re-order scripts without visiting a surgery every time.

The app also provides information such as how-to guides and advice on medication issues.

The platform also helped automate customer engagement and drive up revenue for pharmacies.

Australian and international expansion

Under the new partnership, MedAdvisor has signed a three-year exclusive deal with EBOS (ASX:EBO) subsidiary TerryWhite Chemmart.

MedAdvisor also has a memorandum of understanding with institutional healthcare providers HPS and Zest.

MedAdvisor plans to expand patient acquisition through HPS’s hospital pharmacies. Zest will use MedAdvisor as a digital distribution channel for its healthcare and pharmaceutical manufacturer programs.

The investment from EBOS is also expected to accelerate the company’s entrance into new overseas markets including the UK and the US.

“We already have advisors for the UK and US to help us understand those markets and make sure we enter in the right way,” Mr Read said.

This special report is brought to you by MedAdvisor.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.