Kazia wants to cure the disease that delivered the Trump presidency

Former US vicepresident and son Beau who sccumbed to Glioblastoma. Pic: Getty

All diseases need a poster child to raise awareness — and research funding.

In the case of glioblastoma it’s former US presidential Republican candidate and war hero John McCain.

In a bipartisan vein, the common and aggressive form of brain cancer also killed Ted Kennedy and Beau Biden, son of former Democrat Veep Joe Biden. (Biden’s death was widely cited as a reason his popular father didn’t run for president in 2016 — the election that delivered POTUS Trump).

They’re not alone.

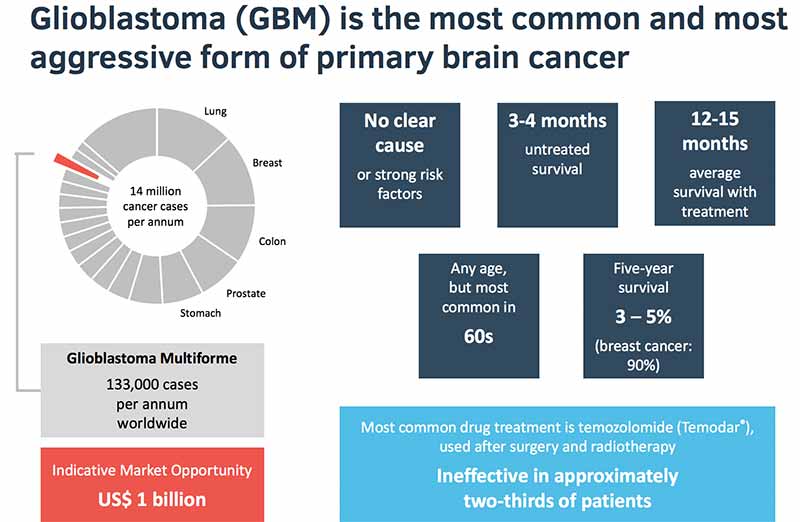

In the US, 12,500 new patients are diagnosed annually and about 1600 here. Untreated, sufferers have an average four-month life expectancy, rising to 12-to-15 months with treatment.

The good news is that there is an existing standard of care drug, called temozolomide. Or at least good news for some because the drug (administered after surgery or radiotherapy) is effective in only one-third of cases.

When this columnist was at school that was a big fat fail. Now, of course, it’s a participation certificate.

Formerly Novogen, Kazia Therapeutics (ASX:KZA) is taking a new approach with a brain cancer therapeutic called GDC-0084, which Novogen bought from Glioblast in October 2016.

Glioblast licensed the compound from Roche’s Genentech.

Who is Glioblast? I’m glad you asked — and goodness, it’s a very small biotech world.

The Sydney company was owned by Viralytics chairman Paul Hopper (Genentech’s former program leader for GDC-0084) and Leslie Chong, now Imugene’s CEO.

Viralytics is subject to a $500m buyout offer and Imugene hopes to be … one day.

Enough history

The molecule inhibits a signalling pathway called P13K, which is expressed in 85 per cent to 90 per cent of glioblastoma tumours.

Kazia chief Dr James Garner says there’s been little progress in treating brain cancers for the last 15-to-20 years. One reason is that other drugs (such as for breast and lung cancer) have been re-purposed for glioblastoma.

“GDC-0084 was designed specifically as a treatment for brain cancer so it has been carefully optimised in the disease area,” Dr Garner says.

Silver medal for longevity

Kazia is based on the shell of Novogen, the second-oldest ASX-listed biotech (Circadian, now Opthea, takes out the gold medal).

Also Nasdaq listed, Novogen changed its name to Kazia in November last year, which could mean “cinnamon tree” in Hebrew or “commands peace” in Polish, but the company was simply looking for a name that wasn’t Novogen and settled for one that sounded like a 1980s keyboard.

Founded by Dr Graham Kelly, Novogen listed on the ASX in 1994 and then on the Nasdaq in 1998.

In its tortured history Novogen had many guises, including a developer of veterinary products and women’s natural health supplements, not to mention red clover leaf derivatives for cancer.

Dr Kelly left the company in 2005 after a strategic difference of opinion with the board, only to return as CEO in 2012.

During his absence, Dr Kelly was a regular critic of Novogen on his personal website — which made for interesting reading to say the least.

He departed (again) in 2015 to found Noxopharm.

Novogen’s board recruited Dr Garner in 2016 to take the company along a more commercially-focused path, rather than dabbling in early stage stuff that never went anywhere.

Novogen then engaged in a legal spat with Noxopharm over intellectual property.

In a settlement late last year, Novogen/Kazia agreed to renounce any rights to Noxopharm’s intellectual property, in return for Noxopharm stock and options worth $7.8 million and $165,000 of cash.

Kazia retains a second program for ovarian cancer, Cantrixil, a third-generation benzopyran molecule that has shown activity against cancer stem cells.

Other preclinical assets were hived off to Heaton-Brown Life Sciences, founded by former Novogen CEO Dr Andrew Heaton and erstwhile chief scientific officer Dr David Brown.

Kazia retains 10 per cent equity in Heaton-Brown, plus milestone payment entitlements.

What Kazia does

The GDC-0084 program came to Novogen via a deal with Roche’s drug development arm Genentech in late 2016.

The global licensing deal involved Novogen buying the program for $US5 million up front, plus royalties in line with industry standards and a performance payment component “linked to regulatory and commercial outcomes”.

“The Genentech transaction bought a technology more recognisable to clinicians and investors,” Dr Garner says.

“It was something easier to talk about.”

So if the prospects were so good, why did Genentech give it up?

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

“Genentech produces more drugs than they have the resources to take forward,” he says. “It’s not uncommon for a drug to go [to] three or four owners before it becomes a product.”

GDC-0084 tackles glioblastoma multiforme, which sounds like a vitamin tablet but is the most common form of glioblastoma accounting for 15 per cent of all brain cancers.

Kazia last month won orphan drug status from the US Food and Drug Administration.

A 47-patient, phase I trial run by Genentech showed safety and some signs of efficacy.

Kazia is now recruiting for a 228-patient phase II trial, initially at the University of Oklahoma’s Stephenson Cancer Centre and then at other US centres.

While most clinical trials enrol difficult-to-treat patients that have failed other treatments, this trial gives the opportunity to target a first-line therapy compared with the (ineffective) temozolomide.

The chosen primary end-point of progression-free survival rather than overall survival should enable quicker data readouts.

Kazia is targeting full recruitment in 12-to-18 months, with first data 12 months thereafter.

Dr Garner says the trial has been designed in view of accelerated approval, “but there are no guarantees”.

Prospects and financials

While a rare cancer, glioblastoma was a $US1 billion a year market for Merck before its temozolomide drug Temodar went off-patent.

Dr Garner notes that three drugs support a form of lung cancer suffered by only two per cent of lung cancer patients.

“Increasingly we are seeing cancer as a group of many smaller diseases,” he says.

Novogen shares have traded as high as $13.70 (in May 2008) and as low as 33c (in December last year).

In its Kazia reincarnation the stock has more than doubled.

Including cash, receivables and pending Federal Research and Development Tax Incentives, the company has $14.8 million of current assets — enough to fund the trial and other costs until the end of 2019.

“But we will need some additional funding to see us through to completion of the study,” Dr Garner says.

Flattering comparisons

Globally, other biotechs in the P13K field are attracting juicy valuations.

The Nasdaq-listed, phase I Infinity Pharmaceuticals is valued at $US130 million. TG Therapeutics, which also graces the Nasdaq and is in phase II/III stage, is worth a cool $US1.2 billion.

Locally, Kazia shares DNA with the preclinical stage Patrys (ASX:PAB), which is also targeting glioblastomas.

Attentive readers will know we covered that stock a couple of weeks back.

Dr Boreham’s diagnosis

Currently, two P13K inhibitors have been approved for blood cancers: Bayer’s Aliqopa (copanlisib) and Gilead’s Zydelig (idelalisib).

So the science is accepted, generally speaking.

Kazia doesn’t look like the sort of play for short-term investors, given we’ll have to wait some time for the GDC-0084 clinical results.

However initial data from the phase I Cantrixil program is expected in the current quarter.

With a compact $35 million market cap backed by $6 million of cash Kazia, like peace, deserves a chance.

As chairman Iain Ross told the company’s AGM last year: “We feel that (the company) deserves to be judged on its own merits and not on the strengths of weaknesses of the distant past”.

This column first appeared in Biotech Daily.

Disclosure: Dr Boreham is not a qualified medical practitioner and does not possess a doctorate of any sort. But he has won many participation certificates.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions. The content of this article was not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.