How Australia is missing a multi-billion-dollar hemp opportunity

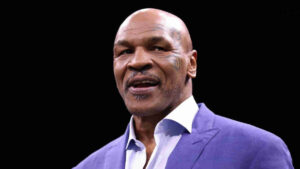

Picture: Getty Images

Australian governments are taking steps to open up the medical marijuana and hemp markets, but one expert says it’s not enough to stop the country missing out on “one almighty boom”.

The federal government recently made promises to cut red tape and speed up the granting of licences for Australia’s medical cannabis players.

At the same time, the Northern Territory government has gone as far as passing a Hemp Industry Bill, which introduces a licensing system for possession, cultivation, supply, processing and research of industrial hemp.

Two main opportunities are expected to arise from the passing of this new bill — both a fibre and seed industry (THC levels under 1 per cent).

The government says the Northern Territory will have a competitive advantage, with the potential to supply a viable seed industry to other Australian jurisdictions via a dry season crop, supplying viable seed to the rest of Australia for summer planting.

Hemp grain currently fetches a farm-gate price of around $3,000 per tonne.

Other uses for industrial hemp fibre include line, rope, clothing, sunscreen, shampoo, lotions, soap, biofuels, stock feed, paper, building materials, and as a highly nutritious food source.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

But Alex Keach, the boss of newly listed hemp play ECS Botanics (ASX:ECS), says it’s pretty piecemeal by comparison to what the US is doing.

“There needs to be more unified progress,” he said. “We’re still well behind what’s happening in North America.

“Australia is missing out on one almighty boom.”

ECS is an agribusiness and hemp food company (wholesale and retail) that backdoor listed into tech shell Axxis Technology.

The company has Tasmanian licences to grow, supply and manufacture industrial hemp for non-therapeutic commercial purposes and research, and a grower licence in Queensland.

It’s also applied for cultivation and manufacturing medical cannabis licences.

ECS is positioning to become a diversified cannabis company with a core focus on Tasmania as the largest and most highest yielding hemp production state.

Industrial hemp contains low levels of tetrahydrocannabinol (THC), the psychoactive element of cannabis and slightly higher levels of cannabidiol (CDB).

https://twitter.com/Jaxarooney/status/1158837379945455616

The US legalised it in mid-December last year when the government passed the 2018 Farm Bill.

This removed hemp, including its extracts, from the list of Schedule 1 controlled substances and made it an ordinary agricultural commodity.

“This has created one almighty boom in the US, where the outdoor grow hemp extracts market (or CBD market) is forecast to reach between $US20-25 billion by 2025,” Keach said.

But in Australia, while hemp foods were made legal for human consumption in November 2017, extracts from the remainder of the plant (i.e. leaf/flower) are still considered a controlled substance.

“You’re very limited in what you can do with the hemp plant in Australia, and it’s all state-based legislation as well,” Keach explained.

“There’s no overarching legislation at a federal level.”

So why is Australia missing out on this multi-billion-dollar opportunity?

It is because hemp (excluding seed and fibre) is still subject to guidance of the United Nations Single Convention on Narcotic Drugs, according to Keach.

“The US and Canada are also signatories to this treaty of 1961, however the US and Canada have proceeded to deregulate their hemp industries and, in the process, created a new boom, jobs and growth,” he said.

“Should favourable legislative change come down the pipe with regard to hemp, naturally ECS is well positioned to be a first mover in this space. It’s something we are watching very closely.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.