Investing in cannabis: who’s growing the good stuff and how to get some

There’s cannabis for pets, cannabis for autism, cannabis for melanoma and even cannabis nutritional supplements.

Since Australia opened the market for scientific and medical marijuana cultivation in February last year — and for medicinal consumption in November — a myriad of ASX-listed businesses have jumped on the pot band wagon.

There are at least 17 ASX-listed marijuana companies. Another, CannPal, expects to list in October. Chapmans (ASX:CHP) and EVE Investments (ASX:EVE) have investments in the space.

Despite the hype around medical cannabis, share price performance has been mixed.

Without doubt, the top of the table has been on fire. At least seven pot stocks are up more than 70 per cent this year.

One, Cann Group, has risen 345 per cent to $1.32 since listing at 30c on May 4. Creso Pharma and Zelda Therapeutics have more than doubled since the start of the year.

Others such as Chapmans and BOD Australia have not fared as well. (See table below).

One of the more unusual entrants is failed cosmetics supplier Bronson Group (ASX:BGR) which went into administration last year.

Bronson reformed as a cannabis play by buying a Lesotho pharmaceutical company and gaining a licence. Last month it hired Israeli corporate cannabis expert Amit Edri.

Another, Capital Mining (ASX:CMY), is yet to tell the market how its second punt at becoming a pot stock is turning out.

Its shares have been in suspension since August 10 and it’s promising all will become clear soon.

| Code | Name | Price Jan 3 | Price Oct 6 | % change 2017 | Market Cap | 52Wk High | 52Wk Low |

|---|---|---|---|---|---|---|---|

| AEB | ALGAE.TEC | 0.0294 | 0.025 | -0.1497 | 17157204 | 0.061 | 0.0225 |

| CAN | CANN GROUP * | 0.30 | 1.335 | 3.4500 | 136525200 | 1.49 | 0.45 |

| RGI | ROTO-GRO INTERNATIONAL * | 0.20 | 0.35 | 0.7500 | 27942852 | 0.565 | 0.16 |

| ZLD | ZELDA THERAPEUTICS | 0.038 | 0.079 | 1.0789 | 58877672 | 0.1425 | 0.022 |

| ATP | ATLAS PEARLS AND PERFUMES | 0.043 | 0.029 | -0.3256 | 12408281 | 0.05 | 0.025 |

| MMJ | MMJ PHYTOTECH | 0.215 | 0.375 | 0.7442 | 70327256 | 0.835 | 0.175 |

| MXC | MGC PHARMACEUTICALS | 0.043 | 0.042 | -0.0233 | 42767740 | 0.12 | 0.035 |

| ESE | ESENSE LAB | 0.25 | 0 | 15851134 | 0.57 | 0.145 | |

| MDC | MEDLAB CLINICAL | 0.84 | 0.7 | -0.1667 | 119732352 | 0.96 | 0.445 |

| CPH | CRESO PHARMA | 0.23 | 0.56 | 1.4348 | 47031660 | 0.93 | 0.19 |

| AC8 | AUSCANN GROUP HOLDINGS | 0.24 | 0.465 | 0.9375 | 120760880 | 0.945 | 0.18 |

| CHP | CHAPMANS | 0.02 | 0.005 | -0.75 | 4075000.25 | 0.033 | 0.004 |

| THC | THE HYDROPONICS CO * | 0.20 | 0.265 | 0.325 | 28107000 | 0.425 | 0.24 |

| BOT | BOTANIX PHARMACEUTICALS | 0.044 | 0.046 | 0.0455 | 23353786 | 0.075 | 0.038 |

| BDA | BOD AUSTRALIA | 0.195 | 0.1 | -0.4872 | 4833360 | 0.35 | 0.09 |

| EVE | EVE INVESTMENTS | 0.008 | 0.005 | -0.375 | 6674494.5 | 0.01 | 0.0035 |

| SCU | STEMCELL UNITED | 0.014 | 0.026 | 0.8571 | 10036979 | 1.085 | 0.013 |

| CMY | CAPITAL MINING | 0.01 | 0 | 4050004.5 | 0.04 | 0.004 |

* Roto-Gro listed Feb 8; The Hydroponics Company and Cann Group listed May 4

Cannabis frenzy still has legs

The Australian cannabis market is fragmented because it’s so new. Despite a period of share price decline between March and May, ASX analysts still have faith that the cannabis frenzy has a while to run.

Pac Partners’ Sean Kennedy says there are a few ways the industry can go, from raw material exports to R&D companies selling their technology for royalties.

“Because the market has just opened up it’s probably an agri-play [for investors] right now,” Mr Kennedy told Stockhead.

There’s a “land grab” for market share because the industry is so new, but Australia is in an excellent position as an exporter given it already supplies half of the world’s legal poppy feedstock for opioid manufacturing, he said.

Canada alone is expected to burn through 600,000 kg of cannabis a year if it legalises recreational marijuana — an issue that’s been pushed back to 2018. That amount of pot exceeds the country’s total growing capacity, estimates Deloitte.

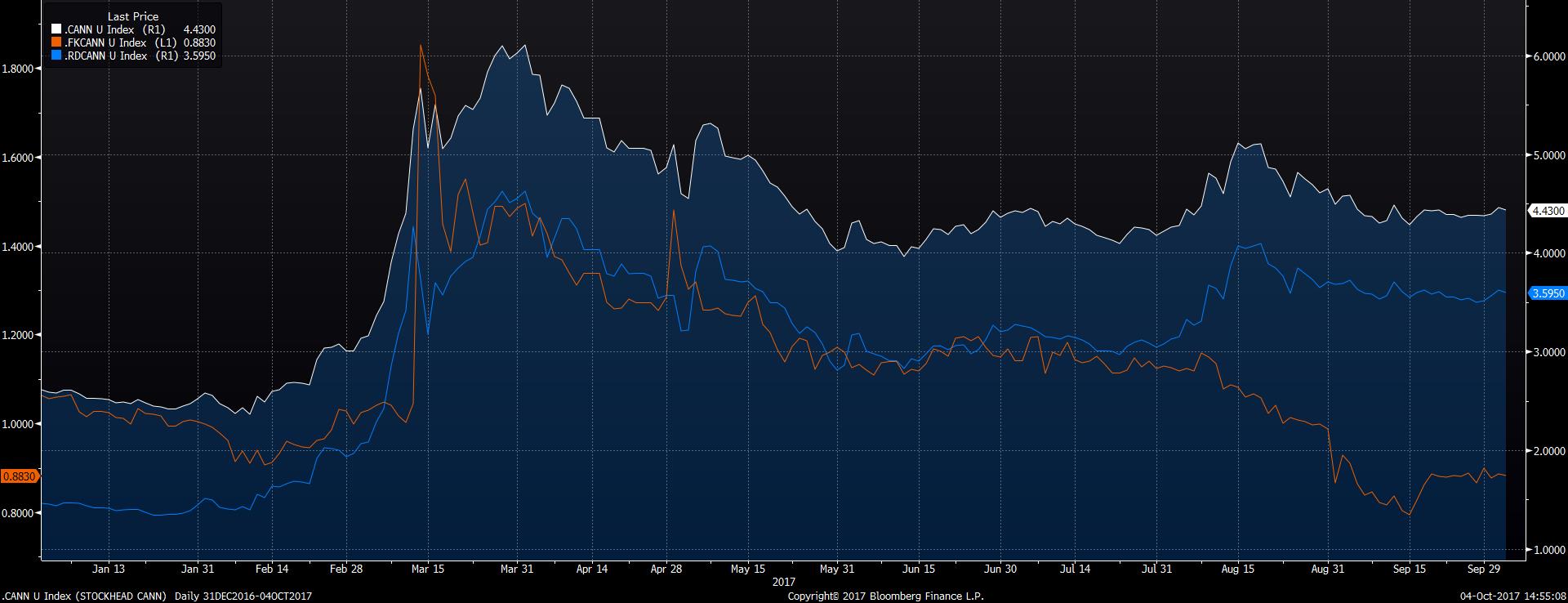

The ASX cannabis frenzy started in February (see the graph below), driven initially by seven companies making cannabis investments (represented by the orange line below).

Another 10 pot stocks (the blue line) that were ‘born’ as cannabis plays have seen less share price variation and weathered recent months much better than their hybrid peers.

Getting into the green

ASX-listed pot stocks are largely targeting the medicinal and therapeutics sectors.

Six of the 17 listed companies have commercial growing operations but only AusCann (ASX: AC8) and Cann Group (ASX:CAN) are set up as commercial growers in Australia.

The other four get around Australia’s strict manufacturing rules by growing, or working with partners who grow, their own stuff overseas. They are Creso Pharma (ASX:CPH), Algae.Tec (ASX:AEB) which has a partner in Uruguay, MMJ Phytotech (ASX: MMJ) and allegedly Bronson Group after its Lesotho foray.

Canada’s Roto-Gro International (ASX:RGI) supplies the equipment, while Singaporean Stemcell United (ASX:SCU) is a researcher.

Five are working on medicinal applications – that’s MMJ Phytotech, MCG Pharmaceuticals (ASX:MXC), Zelda (ASX:ALD), Medlab Clinical (ASX:MDC) and The Hydroponics Company.

Five are working on therapeutic compounds or applications – that’s Creso, Botanix Pharmaceuticals (ASX:BOT), eSense Lab (ASX:ESE), BOD Australia (ASX:BDA) and pearl grower Atlas Pearls (ASX:ATP).

Jo Patterson, chief of BOD Australia, sees consolidation coming in the market.

But given the breadth of opportunities in Australia at this stage she doesn’t see major competitors in her space of manipulating the natural, non-THC cannabinoid chemicals. Only eSense Labs is doing something similar.

A critical element for cannabis operations in Australia is licensing.

It’s reasonably simple to get a medicinal or R&D licence from the Office of Drug Control, but manufacturer’s permits are more difficult to come by.

The ODC wants to make sure none of the medical cannabis grown in Australia ‘disappears’.

It has has issued eight licences for the cultivation and production of medicinal cannabis, five licences for cultivation and production for research purposes, and four licences to manufacture cannabis products.

Two of the manufacturing and two of the medicinal licences went to market heavyweights AusCann and Cann Group.

Two of the research licences went to them as well, and one to The Hydroponics Company – which also managed to get what is no doubt the coveted ASX ticker THC.

MMJ Phytotech, Medlab Clinical, and Creso Pharma have import licences, and Bod Australia is expecting theirs any day now.

High risk

The risks for investors are high, although the market in Australia is blue sky right now.

Many of the ASX-listed pot stocks haven’t yet recovered from share price falls in April, and this could make capital raising difficult without attractive offerings, such as revenue or market potential.

Perhaps the biggest unknown is North America.

None of the US cannabis companies that have sprung up in weed-favouring US States can list or borrow money from banks — because they’re still illegal federally.

Canadian analysts think it’ll take at least a few more presidential administrations before marijuana is legalised for any use at a federal level.

But when that happens, all bets are off.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.